March is around the corner, and you must have noticed that your business clients are already getting tense about VAT returns, and they have a good reason for that. Businesses liable for VAT must submit VAT returns and pay on time. But that’s easier said than done. Frequent updates in VAT forms and processes by the HMRC and lack of time have made it necessary to hand over the VAT return responsibility to accounting firms. However, the story does not end here.

These days, accounting firms are managing a considerable VAT return workload on behalf of their business clients. However, VAT regulation complexities are taking a toll on the efficiency of their VAT performance. Among the multiple aspects that require focus, the VAT return deadline needs the most. Understanding the difficulties accounting firms face in the market, we have taken the initiative to make life easier by preparing a guide on the VAT return deadline, its penalties, key dates, and how to avoid penalties.

Let’s explore it.

What is VAT Return?

A VAT Return is a tax report that businesses registered for Value Added Tax (VAT) in the UK must submit to HMRC (His Majesty’s Revenue and Customs). It summarises a business’s VAT transactions over a specific period, typically quarterly. The VAT return form contains calculations related to total sales and purchases (including VAT), VAT owed to HMRC (on sales), VAT reclaimed from HMRC (on business purchases), and total VAT payable or refundable.

VAT returns are compulsory for businesses with taxable turnovers above £90,000. However, the threshold number fluctuates, so please visit the gov.uk website for exact numbers.

What Is the Deadline for Submitting VAT Return?

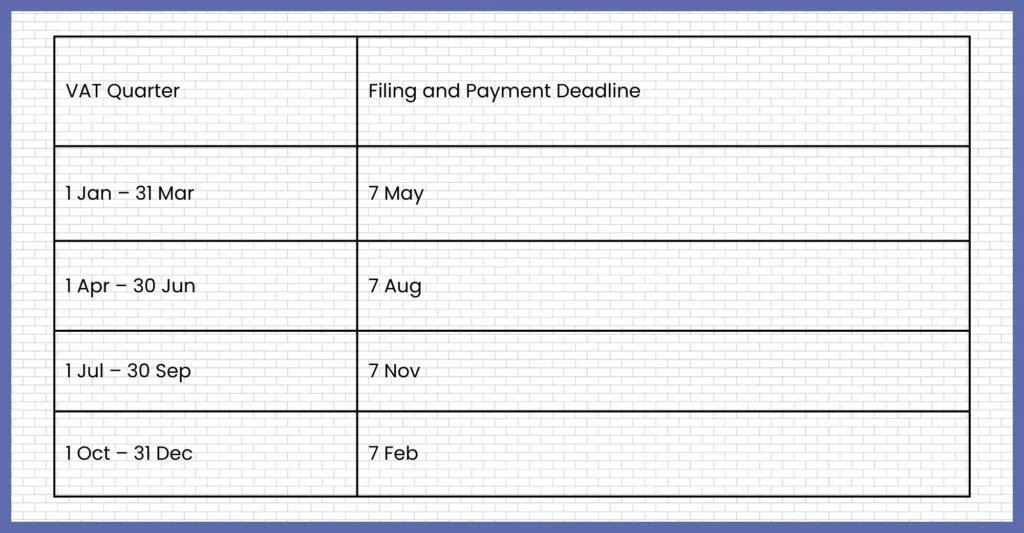

The deadline for submitting the VAT return and making payments is one month and seven days after the end of the VAT period. For example, if the VAT quarter ends on March 31, 2025, the return must be submitted by May 7, 2025. It is important to note that the deadline for submitting the VAT return also includes the time taken for the payments to reach the HMRC; hence, make sure you make payments for your clients as soon as possible.

VAT Payable Dates: When Should You Pay VAT?

Many accounting firms make the mistake of thinking that the deadlines for VAT payment and VAT return submission are the same, but that’s not true. Yes, the dates often overlap each other, but just scratch the surface, and you will find some important differences.

The VAT return submission and payment deadline is one month and seven days after the VAT period, but the payment method determines the exact timing. For example, if the VAT period ends on 31st March, you must file the return by 7th May. You must also make the VAT payment by May 7, unless your client uses Direct Debit, which requires extra processing time.

Therefore, it is essential to give adequate attention to the payment mode; if your clients choose the direct debit payment mode, then the HMRC is expected to receive the payment 3 to 5 days after the deadline, which means your client’s actual payment might not be processed on the VAT return deadline. This will increase the chances of penalties. Hence, other payment methods, such as bank transfers and card payments, must be explored to help clients make payments on or before the deadline.

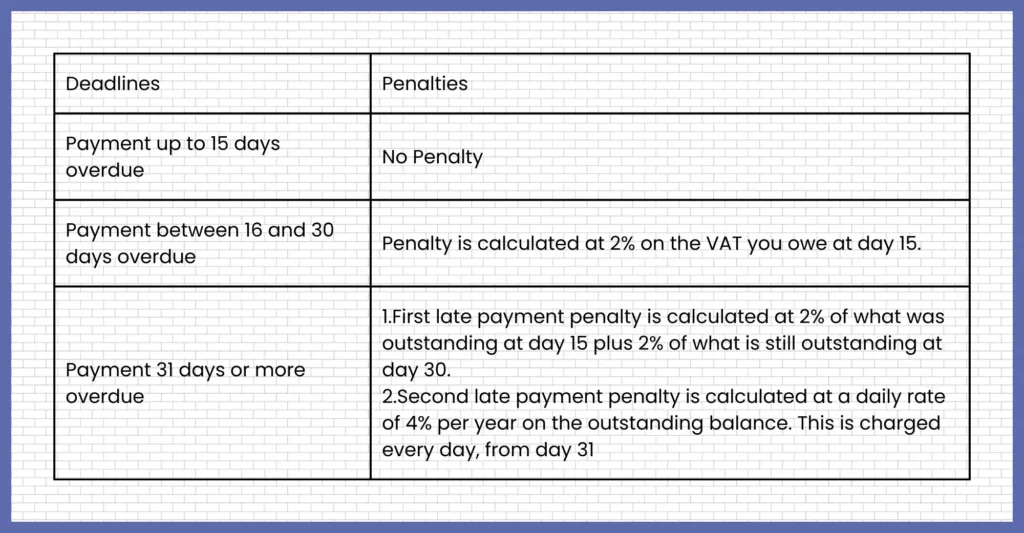

VAT Fine for Late Payment: Penalties and Consequences

If there is any delay in the VAT payment, the HMRC will record that your client is defaulting. HMRC will charge late payment interest from the first day of your payment overdue until it is fully paid. Hence, if your clients find it difficult to pay the VAT before the deadline, it must be communicated to the HMRC. This may stop more penalty charges from being added to the VAT owed. You can ask for a flexible payment plan such as Time to Pay Arrangement, which can accommodate a client’s specific financial circumstances. If HMRC agrees to it, then there will be no late penalties.

For the first 15 days, your client will not be liable for any payment penalties, but on day 15, the penalty will be 2% of the VAT your client owes. On day 30, a 2% penalty will be applied on the outstanding on day 15 plus 2% of what is outstanding on day 30. After day 31, a daily penalty rate of 4% will be applicable until the full outstanding balance is paid.

Complying with all the VAT Returns and payment deadlines is already quite complex and time-consuming. Adding to the complexity is the high volume of VAT-related tasks you will be handling for your clients. Such a situation will only create confusion, and we are saying this based on our experience with your competitors.

To avoid such a situation from aggravating towards penalties, you must explore the path taken by your competitors, i.e., VAT Outsourcing Services offered by accounting outsourcing service providers, but more of the latter. For now, let’s concentrate on how to submit a VAT return and how to avoid VAT late payment penalties.

How to Submit Your VAT Return on Time?

Submitting your client’s VAT return on time with the HMRC is crucial to avoid penalties or interest charges. For that, you will have to follow the below-listed steps:

Identify the VAT Period and Deadline

Your client’s VAT period can be annually or quarterly and ends on a specific date. The deadline for the VAT return is always one month and seven days after the end of the VAT period. For example, if your VAT period ends on March 31, the return is due by May 7.

Use Accounting Software or Tools

Manually calculating VAT is out of the question, choose VAT-compliant accounting software that will make your VAT calculations on sales and purchases easier. Many of these tools can be integrated, making the submission of returns through MTD easy.

Keep the Records of Your Client Accurate and in Order

Before you submit your client’s VAT return, ensure that your client’s invoices for the period are accurate and recorded and double-check for corrections or adjustments.

Review Your VAT Return

Conduct a thorough review of the VAT return before submission to avoid delays or costly penalties. Ensure the following:

- Sales VAT collected is accurately recorded

- Purchases VAT paid can be reclaimed (where applicable)

- All figures match your accounting records

Submit Your VAT Return Online (MTD)

There is no exception for any accounting firm to submit the VAT returns using the Making Tax Digital (MTD) system. Do it flawlessly by following the below steps:

- HMRC’s Online Portal: Login to your HMRC account and submit the VAT return directly.

- VAT-compliant accounting software: Submit through integrated systems directly linking to HMRC, ensuring compliance and faster filing.

Go for Automatic Payments If Required

If you are using Direct Debit, then it will be wise to set up your client’s bank details with HMRC to automatically pay any VAT owed before the deadline. By ensuring automatic payment, you will eliminate the chances of missing payments and potential penalties for delayed payments for your clients.

Set Reminders for Future VAT Returns

To avoid future missing of deadlines, you can set some calendar alerts when VAT returns are due. The good news is that many accounting software tools have built-in reminder features, so investing in something new is unnecessary. You can buy accounting software with such in-built features or access it through VAT outsourcing services offered by accounting outsourcing services.

Best Practices to Avoid VAT Late Payment Penalties

Businesses in the UK are increasingly finding it difficult to singlehandedly manage VAT compliance, so they are depending on the experience of accounting practices like yours to handle it well. It will be your responsibility to handle the VAT payments. Any delays on your part will lead to penalties and interest charges on your client, which will affect your reputation and client relations.

However, these days even you are finding it difficult to handle VAT-related tasks and payments due to complex VAT regulations. You can get valuable assistance from accounting outsourcing service providers offering bookkeeping, VAT, and payroll outsourcing services. However, before that, we recommend you incorporate some best practices to reduce or eliminate the chances of late VAT payments. Let’s get into it.

Know the VAT Payment Deadlines

Each of your clients has a specific VAT deadline based on the VAT return cycle, which can be monthly, quarterly, or yearly. It is your duty to make your clients aware of it and set up the payment mechanism.

Focus on Automated Reminders and Alerts

Setting up automated reminders has made a considerable difference for many practices and businesses. Hence, you will not need any specialised tools. Accounting software like Xero, QuickBooks, or Sage has built-in reminder features that will help you track deadlines and send notifications to your clients for timely submissions.

Guide Your Clients in Setting Up a Direct Debit

Direct debit allows VAT payments to be made automatically on the due date, thus reducing the risk of missing deadlines. Make your clients aware of this hassle-free payment option.

Plan for VAT Liabilities in Advance

We advise you to inform your client to maintain a reserve VAT account for collecting VAT from sales. These funds will be crucial for paying dues and avoiding last-minute cash flow issues.

Monitor HMRC Updates and VAT Regulations

VAT regulations in the UK change frequently, impacting deadlines and penalties. To avoid confusion, you must monitor the latest HMRC updates to maintain compliance, and must promptly inform your clients of the changes.

Ensure Accurate VAT Calculations

Use the latest accounting software tools to avoid errors in VAT calculations. These tools have VAT compliance features to ensure accurate reporting and check VAT return figures before submission.

Submit VAT Returns on Time

It is important to submit the returns on time to avoid penalties, so ensure that your clients know it and make a point to make timely submissions.

Create Awareness About Time-to-Pay (TTP) Arrangements

If your clients cannot pay VAT on time, they can opt for time-to-pay arrangements with HMRC. This beneficial option will allow HMRC to collect the payment cost-effectively by spreading over a few months, thus reducing their financial strain.

Regular VAT Compliance

By conducting compliance audits on VAT for your clients, you will identify and preempt potential risks. This way, you prevent your clients from being saved from future penalties.

Educate Clients on VAT Compliance

Most VAT penalties occur due to a lack of awareness, so it is important for you to communicate updates on new payment methods, VAT obligations, and best practices to ensure full compliance.

Consider Hiring a Professional Accountant

We understand that managing VAT returns can be time-consuming and overwhelming. Such situations will increase the frequency of missing out on specific calculations or errors. You can outsource the VAT return processing to an accounting outsourcing provider and get access to the expertise of professional accountants.

A professional outsourcing provider offers more than just VAT and bookkeeping services. It also handles payroll and other accounting tasks, giving you an added advantage.

Frequently Asked Questions (FAQ)

How do I check my VAT return due date?

An accounting period is 12 months, so your clients’ VAT Return is due twice a year, two months after the end of your accounting period.

What happens if I miss the VAT return deadline?

If you miss a VAT return deadline, HMRC will record a default in your client account. The default will make your client liable for a surcharge, which means your client will have to pay extra on top of the VAT they owe.

Does HMRC offer payment plans for overdue VAT?

If your clients are unable to pay VAT on time, they can opt for a time-to-pay arrangement with HMRC. This beneficial option will allow HMRC to collect the payment cost-effectively by spreading it over a few months, thus reducing their financial strain.

Can you submit a VAT return on the 7th?

The due date for submitting your client’s VAT return and making any payment is one month and seven days after the end of the VAT period. Which means the return must be submitted and payment made by 7 May.

Which firms offer taxation and VAT outsourcing in UK?

Several firms in the UK specialise in taxation and VAT outsourcing for accounting practices. Under these services, professional outsourcing service providers cover VAT registration, return preparation, MTD compliance, and corporation tax filings. Trusted providers, like Corient, combine technical knowledge with AI automation and compliance-driven processes, thus helping practices stay ahead of ever-changing HMRC requirements.

Conclusion

We have experienced accounting firms crumbling under the pressure of completing VAT returns accurately and within the deadline. To reduce this pressure, we have tried to guide you on VAT return deadlines, penalties, and best practices to avoid delays in VAT returns and payments in elaborate ways. Our guide on VAT return penalties and submission dates will ensure the smooth running of the whole process and that there is no last-minute panic on your side.

Following the above-mentioned guidelines requires considerable investment in workforce, training, and technology, which you might not find feasible. In such a case, you can seek the help of an outsourcing service provider, just like many of your competitors. Many service providers are competing to offer their professional services, but Corient is catching quite some eyeballs, especially among accounting practices and accountants.

Established in 2011, Corient is an accounting outsourcing service provider offering all-around and tech-savvy accounting services to practices in the UK. From bookkeeping and payroll to VAT, audit, and corporation tax service, we have got it all covered. Our professional services are very much sought after by accounting practices due to the positive results achieved, and we can achieve the same for you. Share your problems or queries on our website contact form, and our executive will get in touch with you as soon as possible.

Looking forward to an exciting partnership. Best of luck.