Understanding the Audit Process: A Complete Guide for UK Accountants

- What Is the Audit Process?

- Step-by-Step Breakdown of the Audit Process

- What Is the Importance of Audit for UK accountants?

- What is External Audit vs Internal Audit, Key Differences

- Common Mistakes UK Accountants Make During the Audit Process

- Benefits of a Well-Managed Audit Process

- How Audit Outsourcing Can Simplify the Process for UK Accountants

- People Also Ask

- Conclusion

Have you been increasingly experiencing stress or hurdles during the audit process of your clients? You are not alone in being affected by this phenomenon. Being in an advanced accounting market like the UK, you cannot escape from the audits executed by regulators. The audit process helps ensure accuracy in financial statements, which increases reliability among your clients’ stakeholders. Hence, it is wise to have a deeper understanding of the audit process and its workings.

In this guide, we will walk through what your accountants need to know about the audit process, how to avoid common pitfalls, and why outsourcing parts of it might be your smartest move yet.

Let’s get started.

What Is the Audit Process?

The audit process is a systematic examination of financial reports, records, and statements done by independent experts known as auditors. Under the audit process, the accuracy and validity of financial information are verified, along with identifying any potential fraud or errors, and ensuring compliance with applicable laws and regulations. By conducting audits, auditors will be able to assess your client’s financial position and provide an independent opinion on the fairness of the financial statements. Such independent opinion increases confidence among stakeholders.

Audits in the UK are governed by International Standards on Auditing (UK) and monitored by the Financial Reporting Council (FRC). For accountants, understanding this process thoroughly is crucial, especially with the increasing scrutiny from regulators and stakeholders.

Step-by-Step Breakdown of the Audit Process

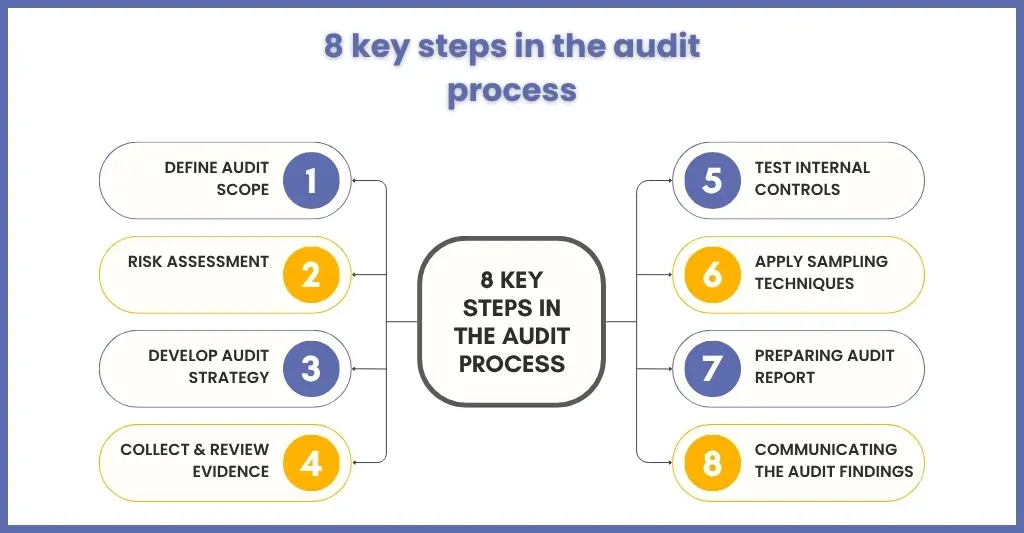

The audit process comprises multiple crucial steps, and when followed to the letter, you will obtain financial statements that are comprised of authentic numbers, providing stakeholders with complete confidence. Let’s understand each step of the audit process in detail:

Scope of the Audit

Start by identifying the specific areas that need to be audited, such as financial statements, internal controls, or compliance with laws and regulations. The scope of the audit is decided based on the industry and risks and issues that need to be identified and addressed.

Risk Assessment

Under this step, auditors will identify and evaluate the risks that may impact your clients’ financial statements. There are various techniques for conducting risk assessments, such as interviews, inquiries, and analytical procedures, which the auditor will use. The information gained from the assessment helps in planning the audit procedures and allocating resources effectively.

Creating an Audit Strategy

Based on the scope and risk assessment, the auditor will create an audit strategy tailored to your client’s specific needs. The plan developed will be the roadmap for the audit, thus ensuring that the audit work is done efficiently and systematically.

Collecting and Investigating Evidence

Collecting and investigating evidence is a crucial step in the audit process. Under it, an auditor will examine documents, observe, and confirm with third parties to gather evidence that supports the conclusions. The evidence will be analysed to determine whether the financial statements are free from material misstatements.

Checking Internal Controls

Checking the effectiveness of internal controls is an essential part of the audit process. These internal controls, which include procedures and policies, help maintain the reliability of financial reporting. This analysis helps the auditor to assess the level of risk associated with the financial statements and guides the selection of appropriate audit procedures.

Audit Sampling Techniques

Due to the volume of transactions and the limited resources available, auditors often use sampling techniques to gather evidence. Various sampling methods, such as statistical sampling or judgmental sampling, can be employed depending on the circumstances. Auditors carefully design their sampling plans to ensure that they obtain reliable and meaningful results.

Preparing Audit Report

The audit report is perhaps the most important deliverable of the audit process. It contains an independent opinion on the fairness and accuracy of the financial statements. The format and content of the report must adhere to auditing standards and guidelines.

Communicating the Audit Findings

Once the audit report is finalised, the findings must be communicated to your clients and their stakeholders. Through this step, the findings of the audit report can be explained in simple terms, thus enabling corrective actions if required to address deficiencies.

What Is the Importance of Audit for UK accountants?

The multiple reasons which make audit important for UK accountants. These reasons are:

- Helps in building credibility with investors, regulators, and lenders. Almost 89% of institutional investors value audited financial statements for decision-making, according to the PWC Global Investor Survey.

- It ensures regulatory compliance, especially under the UK GAAP, and Companies Act 2006

- Highlights operational inefficiencies or risk exposures

- Helps in improving financial accuracy and trust in reporting

- Supports advisory services by identifying areas for strategic improvement

What is External Audit vs Internal Audit, Key Differences

It is essential to note that there are two primary types of audits: internal and external. An internal audit focuses on evaluating your client’s internal controls and processes. On the other hand, an external audit is offered by independent auditors, providing an independent overview of your client’s financial statements.

When it comes to external audit vs internal audit, you will find many other key differences:

| Feature | External Audit | Internal Audit |

| Purpose | Independent validation for stakeholders | Improve internal operations and controls |

| Conducted by | Independent third-party auditors | In-house team or outsourced internal auditors |

| Frequency | Usually, annual | Ongoing or as scheduled internally |

| Reporting | To Shareholders and regulators | Management or Board |

| Legal Requirement | Often mandatory for larger companies | Optional (but highly recommended) |

Common Mistakes UK Accountants Make During the Audit Process

We have identified multiple practices that commonly lead to mistakes during the audit process. These common mistakes are:

- Poor Documentation: Missing or incomplete supporting records delay audits and trigger additional scrutiny from regulatory bodies.

- Lack of Preparation: We have noticed some accounting practices that wait until the last minute to prepare audit files or client books, which must be avoided.

- Overlooking Internal Controls: Some practices fail to regularly test the internal controls of their clients, which can potentially lead to non-compliance, miscalculations, and penalties.

- Ignoring Auditor Queries: Any delayed responses to auditors from your side can raise their suspicion and damage your relationship with your clients.

Benefits of a Well-Managed Audit Process

Audit is more than just compliance; it offers multiple direct and indirect benefits to you, your clients, and their stakeholders, provided it is done correctly. These benefits are:

- Confidence in the Financial Reports: When financial reports undergo a well-managed audit process, it gives your clients and their stakeholders confidence that they are verified and compliant, providing them with peace of mind.

- Insights: Through an audit, inaccuracies are identified before they are caught by regulators, thus allowing you to rectify them.

- Business Growth: When your client has audited financial reports in their hands, they can use them to secure funding from financial institutions for scaling operations.

- Trust of Clients: Providing your clients with audited financial reports fosters a reputation of professionalism for your practice.

How Audit Outsourcing Can Simplify the Process for UK Accountants

Yes, conducting audits is an essential responsibility for any professional accounting practice. However, this is also a fact that auditing responsibility consumes a lot of time, which could have been utilised for advisory or client support.

To address this situation, consider approaching a professional audit outsourcing services provider, such as Corient, which offers auditing outsourcing services. Here’s how it will simplify the process:

- Access to an Experienced Audit Support Team: Corient will provide you with access to trained and experienced auditors who will conduct internal testing, prepare documentation, perform reconciliations, and coordinate with clients.

- Offering Multiple Models: Whether you need us for a one-off audit season or year-round support, we have you covered.

- FRC and ISA Compliant Processes: Our audit support staff are trained to work with UK standards and regulatory requirements, ensuring your clients remain fully compliant and avoid unnecessary hassle.

- Work Like Your Partner: Our audit support team will serve as an extended arm of your team, working behind the scenes.

People Also Ask

The audit process ensures financial accuracy, strengthens internal controls, and verifies that the company is compliant with UK financial regulations. It builds trust among stakeholders and uncovers potential risks.

Technically, no. To maintain independence and avoid conflict of interest, external audits must be conducted by an independent party. A firm can assist with internal audits, but the external audit must be outsourced to an independent registered auditor.

Audits in the UK are governed by International Standards on Auditing (UK) and monitored by the Financial Reporting Council (FRC).

A statutory audit is typically required for companies that meet two or more of the following criteria:

a. Annual turnover of more than £10.2 million

b. Total assets over £5.1 million

c. More than 50 employees

Outsourcing audit tasks to a provider like Corient gives firms access to experienced auditors, improves turnaround time, and allows in-house teams to focus on client advisory and business growth.

Conclusion

The audit process may be complex, but it doesn’t have to be chaotic. For UK accountants, it’s a golden opportunity to deliver value beyond compliance. Through this guide, we aim to help you understand the importance of the audit process. When managed well, audits build trust, uncover areas for improvement, and support long-term growth.

If your capacity is far stretched to handle audits, then outsourcing service providers like Corient are there to support you. Whether you need full-cycle audit support or help with just one part of the process, Corient is here to help, so you can focus on what matters most: growing your clients’ trust and your firm. Our professional audit outsourcing services, led by our experienced staff, have enabled our clients to be audit-ready in the event of a surprise HMRC check. To know more about our services, you can connect with us through our contact form and get access to our experts.

Looking forward to seeing you soon.