The UK pension reform is set to bring significant changes for employers, accountants, and payroll teams nationwide. With the focus on employee retirement security, these reforms will impact not only pension contributions but also financial planning, payroll processes, and compliance.

For accounting practices, these reforms serve as a warning to stay ahead of the curve and avoid non-compliance and penalties. In this blog, we will explore what the new UK Pension Reform means for accountants, how payroll outsourcing can help, and what practical steps your firm should take now to prepare.

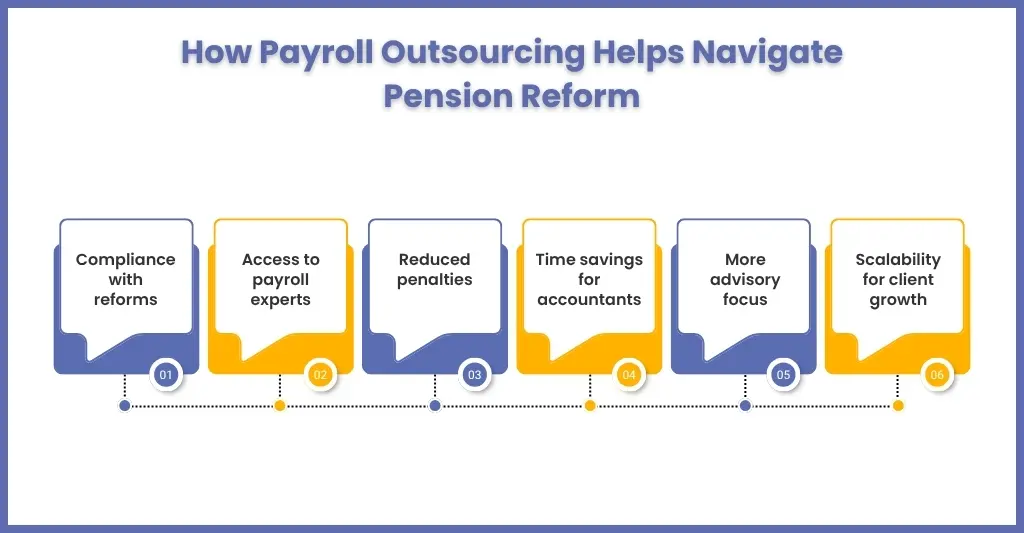

How Payroll Outsourcing Helps Navigate the 2025/26 UK Pension Reforms

These upcoming reforms will likely make payroll management more complex, particularly with adjustments to contribution thresholds, reporting requirements, and compliance deadlines. Managing these complexities via in-house payroll can also overwhelm your accounting team. The only practical or smart option left is outsourcing.

With a reliable outsourced payroll services partner, you can:

- Remain compliant with the latest pension rules without burdening your in-house accounting team.

- Get access to the payroll experts who will explain the UK pension reform in detail and help in its accurate implementation.

- Reduce the risk of penalties by submitting correct and accurate information.

- Free up accountants’ time to focus on advisory services rather than administrative tasks.

- Save the time of your accountants, which can be focused towards high-value advisory work.

- Outsourcing will also help you in scaling your practice services, which will be valuable for your clients.

Key UK Pension Reform Highlights in 2025/26

The exact details of UK pension reform are not yet precise, but we can expect some things which we will highlight below.

Lowering the Auto-Enrolment Age

It is expected that the government will reduce the age at which employees can be enrolled in workplace pensions. This means younger employees will need to be enrolled and monitored.

For your payroll teams, it means more assessments and contributions to track each pay period. Your accountants, who manage multiple payrolls, will need to ensure that your clients’ systems are updated to capture young employees without error accurately.

Changes to Qualifying Earnings

There will be changes in contributions for both employers and employees. Even a small adjustment requires significant recalculations across payroll systems. It means you will need to review client data, update payroll software, and check that contribution percentages apply correctly across all levels of staff income.

Tighter Compliance Reporting

HMRC is expected to enforce these changes more stringently, especially the real-time data requirements. It means employers must submit enrolment and contribution data more accurately and on tighter deadlines. This reform will ensure greater transparency by reducing errors and improving accuracy. You will need to ensure that your client’s payroll system can integrate with pension providers seamlessly to avoid compliance breaches.

Penalties for Non-Compliance

HMRC will enforce strict fines for late payments, inaccurate reporting, or failing to auto-enrol eligible staff. While handling payroll, the risk of small errors is always present, which can lead to penalties. By outsourcing to a specialist provider, you can reduce the risk of non-compliance through enhanced quality checks and robust compliance controls.

What UK Practices Should Do Next

For your practice to be prepared and one step ahead for UK Pension Reform, you will need to do the following things:

- Audit current payroll systems and identify gaps in compliance and reporting.

- Train your payroll teams on the UK pension reforms to ensure your in-house staff are updated.

- Give serious thought to payroll outsourcing, which is a better long-term solution.

- Proactively update your clients about reform and its impacts on their workforce.

It is advisable to act fast and implement these points quickly to ensure a smoother transition.

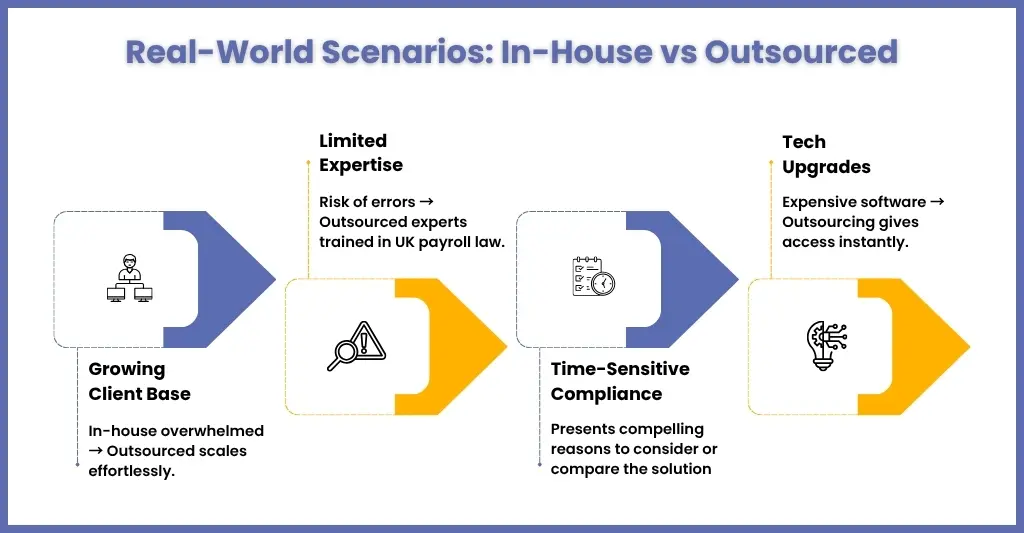

Real-World Scenarios – When to Choose Payroll Outsourcing Over In-House

Multiple scenarios will prompt a shift from in-house to payroll outsourcing, and the 2025/26 UK Pension Reform will only exacerbate these complexities. Here are some expanded real-world scenarios where outsourcing can provide clear advantages:

Growing Client Base

As your client base increases, so will the number of payrolls you will process. Each new client will have different pension arrangements, employee categories, and contribution levels. In-house handling will surely overwhelm your staff. However, with outsourcing, you can scale up and meet growing and complex payroll requirements.

Limited In-House Expertise

You will not have all the expertise to deal with the pension reforms. The 2025/26 UK pension reform includes new rules on enrolment, qualifying earnings, and real-time reporting, which require specialised knowledge. Outsourcing will give you access to payroll experts who will avoid costly mistakes, while giving your client peace of mind that their payroll is managed accurately.

Time-Sensitive Compliance

HMRC will continue to enforce deadlines strictly. Any missed deadlines during the enrolment window or the submission of contribution data will result in financial penalties. Your accountant will likely already be overwhelmed with bookkeeping, VAT returns, and audits, making it challenging to meet deadlines.

However, by outsourcing, you can ensure these time-sensitive tasks are handled with precision, thus protecting your reputation and clients from penalties.

Technology Upgrades

Payroll outsourcing providers usually use advanced cloud-based payroll software to automate pension assessments. They integrate directly with HMRC and pension schemes, and provide real-time compliance monitoring. You will gain access to this technology without the cost of purchasing, implementing, and maintaining it.

How Corient Supports UK Accountants During Pension Reforms

Corient had developed expertise in helping accounting practices adapt smoothly to changes in payroll and pensions. The 2025/26 UK pension reform is complex, but with our help, your practice can transition smoothly.

Here’s how we will help you:

Accurate Payroll and Pension Alignment

Our payroll specialist ensures that every payroll run is compliant with the latest pension reform requirements. From contribution calculations to deductions, we minimise the risk of costly errors.

Comprehensive Enrolment Management

We will handle the entire process, which includes auto-enrolments, re-enrolments, and ongoing workforce assessments. Now, you will not have to worry about monitoring enrollment dates and eligibility.

Real-time Compliance and Reporting

Under UK Pension Reform, there will be strict reporting requirements; we will do timely updates, compliance monitoring, and seamless reporting to HMRC. This will keep your clients and you compliant without extra burden.

Technology-driven Efficiency

Our systems are designed to integrate with pension schemes and HMRC, which your in-house system may not offer. This will ensure smooth compliance even when regulations change.

Freeing Accountants For Higher-Value Services

By outsourcing pension tasks to professional providers like Corient, you will free your accountants from this time-consuming work, allowing them to focus on advisory and strategic services for clients.

Scalable Solutions For Growing Practices

For a professional service provider, it doesn’t matter whether you handle a handful of clients or hundreds; our solutions will scale according to your needs. Such flexibility will ensure you can expand without worrying about bottlenecks.

In short, Corient acts as an extension of your practice, combining compliance expertise, advanced technology, and practical support. To check our achievements, see our success story in payroll outsourcing.

People Also Ask

1. How does pension reform affect payroll calculations?

Pension reforms, such as changes to auto-enrolment thresholds or contribution rates, directly impact payroll calculations. Employers must:

a. Calculate employee and employer contributions accurately based on updated thresholds.

b. Ensure deductions are correctly applied each pay period.

c. Update payroll software to reflect new pension rules.

Failing to account for pension reforms can lead to errors in payslips, underpayments, or regulatory non-compliance, which can result in fines from The Pensions Regulator (TPR).

2. Will outsourcing payroll help my firm avoid penalties under new reforms?

Yes. Outsourcing payroll to a specialist provider ensures:

a. Compliance with Latest Regulations: Outsourced teams stay up to date with changes in pension rules, tax legislation, and payroll regulations.

b. Accurate Calculations: Automated systems and expert oversight reduce the risk of errors in contributions, deductions, and submissions.

c. Timely Filing and Reporting: Payroll providers handle all HMRC submissions and pension scheme reporting on schedule.

By outsourcing payroll, your firm minimises the risk of fines, penalties, and compliance breaches while freeing internal staff to focus on strategic work.

3. What will the UK state pension be in 2025-26?

For 2025/26, the basic State Pension and new State Pension will increase by 4.1% in line with earnings growth.

4. What are the changes to the pension in 2025?

The government has announced changes to Age Pension payments from 20 September 2025, including a lift on the previously frozen deeming rates by 0.5%

Conclusion

One thing is for sure: the 2025/26 UK pension reform will change the way payroll and pensions are managed across the UK. For practices, this reform brings in challenges and opportunities. Handling the challenges in-house is not possible; that’s why you will need the assistance of payroll outsourcing, which will reduce compliance risks, save time, and enhance your client service.

At Corient, we’re here to support UK accountants through every stage of these changes. From accurate payroll calculations to seamless pension compliance, our team ensures you stay ahead of the reforms with confidence. Are you in need for streamlining your payroll operations? Connect with us and get a free trial to experience our services.

Don’t risk penalties under the 2025/26 reforms. Book a free payroll outsourcing consultation with Corient and stay compliant with confidence.