Top Accounts Payable Outsourcing Companies in the UK (2026 Guide)

Are accounts payable eating up your profits? It’s not that accounts payable is at fault; it’s just that running the process has become tough, and things will get worse in 2026. As an accounting practice, you are expected to handle the payable process by handling invoices for clients in high volumes. However, with unresolved bottlenecks, your accountants will spend considerable time chasing purchase orders instead of advising clients.

2026 will be a challenging year of practices due to:

- Rising employment costs

- Ongoing talent shortages

- Increased HMRC scrutiny

- Growing client expectations around speed and accuracy

Multiple industry surveys have pointed out that over 40% of accounting practices in the UK are overloaded with back-office work and are unable to expand into advisory services. No wonder many are searching for Top Accounts Payable Outsourcing Companies to enhance capacity and stay competitive.

This guide breaks down what accounts payable outsourcing really is, why it matters in 2026, and which UK providers accounting practices are trusting with this critical function.

What Is Accounts Payable Outsourcing?

Accounts payable means what your client owes to their suppliers for the goods and services purchased from them on credit. On the other hand, accounts payable outsourcing is the practice of delegating the accounts payable tasks to a professional and experienced service provider who will manage the process on your behalf.

These tasks typically include:

- Invoice processing and validation

- PO and receipt matching

- Approval workflow management

- Supplier reconciliations

- Payment preparation and scheduling

- Reporting and audit support

Through the outsourcing of accounts payable via bookkeeping outsourcing services, your accounting team will be spared from repetitive processing work and can start focusing on advisory and client relationships.

Why You Should Outsource Accounts Payable in 2026

Outsourcing accounts payable is not a one-size-fits-all solution, yet many practices have already started outsourcing it. There are factors in 2026 that are pushing many more towards outsourcing.

Let’s understand those factors that are pushing practices towards outsourcing:

Staffing Costs Keep Rising

In 2025, the employer’s national insurance had risen from 13.8% to 15%, and to top it all, the recruitment fees had also skyrocketed. All this makes hiring internally for managing the accounts payable process least attractive.

Lack of Talented Accounting Professionals

Finding the right talent for handling the process is becoming a difficult task due to the lack of accountants in the UK market. Even if you get hold of a professional, it’s not going to be easy on your pockets.

HMRC Expectations Aren’t Slowing

HMRC is keeping up with its reform agenda, whether it is expanding Making Tax Digital from VAT to income tax or enforcing tighter compliance checks. Using your accounts payable processes will increase the risk of:

- VAT errors

- Audit risk

- Rework and client dissatisfaction

Clients Expect Faster Turnaround

With business becoming fast-paced, your clients will expect real-time reporting and accurate numbers without fail. Practices that are unable to do that must consider themselves out of the competition.

Only outsourcing can help you overcome these challenges. The accounts payable outsourcing cost is reasonable and its delivers faster without burning out teams.

What Does Accounts Payable Outsourcing Actually Include?

Accounts payable outsourcing is a process where a third-party service provider will handle all your accounts payable workflow. It means instead of your internal accounting team handling every invoice, vendor payment, and related paperwork, your outsourcing partner will take care of these responsibilities on your behalf.

Here’s what it typically includes:

1. Invoice Processing & Data Capture

It’s the foundation. Under it includes:

- Receiving invoices via email, portals, EDI, or supplier uploads

- Extracting invoice data (manual or automated OCR)

- Coding invoices to the correct GL accounts

- Validating tax/VAT treatment

Instead of your accountants handling it manually, you get access to structured workflows through outsourcing, thus reducing errors and speeding up turnaround.

2. Three-Way Matching (PO, GRN, Invoice)

It’s a critical verification step, which includes:

- Matching invoice to Purchase Order (PO)

- Verifying Goods Receipt Note (GRN)

- Flagging discrepancies for resolution

This prevents:

- Duplicate payments

- Overbilling

- Fraudulent invoices

Strong matching is especially important for growing businesses with high transaction volumes.

3. Approval Workflow Management

Forget about payments until the invoices get approved. The job of your outsourcing partner is to:

- Route invoices to the correct approvers

- Track approval timelines

- Send automated reminders

- Escalate bottlenecks

This will shorten your invoice cycle time.

4. Vendor Management

Under accounts payable outsourcing comes the work of supplier coordination. These work are:

- Vendor onboarding and KYC checks

- Maintaining vendor master data

- Handling vendor queries

- Updating bank details securely

When clean vendor data is in your hands, payment errors and fraud risk are reduced.

5. Payment Processing & Scheduling

This is where cash discipline is required, and for that, your outsourcing partner will do the following:

- Schedule payments based on terms and cash flow

- Managing ACH, BACS, wire, or cheque payments

- Early payment discount management

- Avoiding late fees

6. Reconciliation & GL Posting

Behind every paid invoice is proper accounting, which includes:

- Posting AP entries to the general ledger

- Reconciling AP sub-ledger to control accounts

- Identifying unmatched or aged items

- Supporting the month-end close

This connects directly with your record-to-report process and strengthens financial reporting accuracy.

7. Compliance & Audit Support

For accounting practice, this may include:

- VAT treatment accuracy

- Digital audit trails

- Documentation for HMRC reviews

A structured AP outsourcing model reduces audit risk and improves traceability.

8. Reporting & Analytics

This is where outsourcing moves from operational to strategic.

Providers typically deliver:

- Aged payables reports

- Vendor spend analysis

- Payment cycle metrics

- Cash flow forecasts

Instead of reacting to overdue invoices, you will gain visibility into trends and risks and alert your clients about them.

Top Accounts Payable Outsourcing Companies in the UK

Here are some of the Top Accounts Payable Outsourcing Companies serving UK accounting practices in 2026, based on capability, scalability, and UK compliance expertise.

Corient

Since 2011, Corient has built a strong reputation and ground presence among accounting practices for its excellent accounting outsourcing services. It has a team of professional accountants who are ACCA-approved and are fully compliant with ISO 27001 for data security.

Why do practices prefer the services of Corient?

- UK-trained accountants with deep accounts payable experience

- Strong controls aligned with UK VAT and HMRC MTD requirements

- Scalable delivery for growing practices

- Seamless integration with client systems

- Focus on acting as a back-office extension, not a black box

- Experts in the use of Sage, Xero, QuickBooks, TaxCalc, and many other accounting software

Along with accounts payable, Corient works with accountants to provide assistance in bookkeeping, payroll, consulting, analytics, admin, and back-office support. This is done through its MTD-compliant services, such as:

- Bookkeeping outsourcing services

- Payroll outsourcing services

- Year End Accounts Outsourcing

- Corporation Tax Outsourcing

- VAT Outsourcing

- Personal Tax Outsourcing

- Audit Services

Stellaripe

Stellaripe’s outsourced accounts payable services assist accountants in managing incoming invoices and supporting documentation, no matter how they’re received.

Advantages:

- All-round accounting services

- Emphasis on maintaining a stellar cash flow.

AcoBloom

AcoBloom offers tailored solutions focusing not just on streamlining cash flow but also on minimising the risk and optimising operational efficiency.

Advantages:

- Strong internal controls and regulatory compliance

- Experienced in QuickBooks, Xero, Sage Desktop/Cloud, Kashflow

Finex Outsourcing

Leading in accounts payable outsourcing, Finex is renowned for offering all-around AP services through its experienced accountants, including invoice verification, payment processing, vendor reconciliation, and monthly reporting.

Advantage:

- Access to experienced finance professionals

- Freeing up internal resources for advisory roles

Integra Global Solutions

They offer accounts payable outsourcing services customised to meet your requirements and reduce your operational burden.

Advantages:

- Up to 50% cost savings compared to in-house accounts payable

- Reduce processing time and increase efficiency

QX Accounting Services

QX is a well-known name in accounting outsourcing, offering accounts payable as part of a broader finance function.

Advantages

- Strong expertise in Xero, Sage, QuickBooks, IRIS, and more

- Scales easily during busy periods without permanent hires

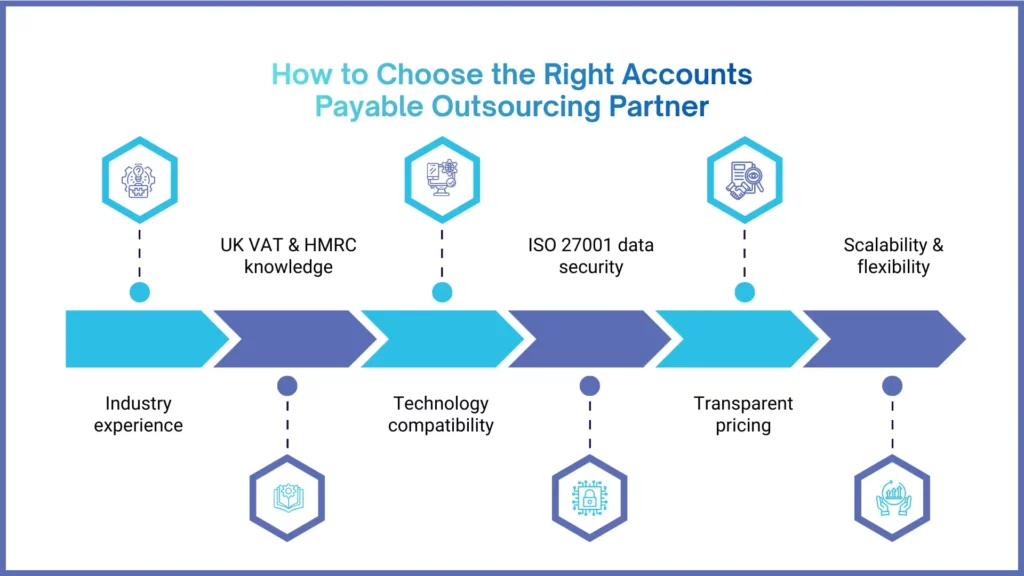

How to Choose the Right Accounts Payable Provider

The UK accounting market is saturated with accounting outsourcing service providers, but it is up to you to select the right one. For that, you will need to evaluate multiple factors apart from price. The service provider you select will be your strategic partner in your financial operations.

Industry Experience and Track Record

Check their experience, industry expertise, preferably through client testimonials, case studies, and so on. This will help you in making an informed selection.

Technology Capabilities

Identify which tools the service provider uses to offer their services and ensure they integrate well with your system. Always request a demonstration of their automation capabilities, real-time reporting, and API integration methods.

Data Security Standards

Prefer only those providers that offer ISO 27001 certifications, follow encryption protocols and access control.

Pricing Structure

Understand the going rates of outsourcing services before you set out to select an outsourcing partner. Ideally, we suggest you go for a high-priced service if the volume of invoices you are dealing with is high. This will strike a balance between your profits and expenses.

Customer Support Quality

Handling queries is an important benchmark during the selection process. Therefore, look for the average query response time, support hours, availability of a dedicated accountant, portals, and escalation options, before selection.

Scalability and Flexibility

Consider the ability to quickly increase capacity, contract flexibility, seasonal scaling options, and multi-location support.

Simple Steps to Start Outsourcing

Starting the outsourcing process can get complex only if you choose to make it. Hence, if you are starting to outsource your accounts payable tasks, ensure that you follow the steps below and make it a simple process.

Define the Scope

Accounts payable contains multiple tasks; therefore, decide on which task must be outsourced first.

Standardise Workflows

Work towards creating a standardised workflow, which enables the creation of clean inputs, preventing future issues.

Pilot with One Client or Segment

Always start the outsourcing with a pilot project on one of your clients. This will enable you to identify teething issues, which can be resolved before full-scale outsourcing.

Set Review Checkpoints and SLAs

Discuss with you outsourcing partner about setting up review checkpoints before full-scale outsourcing starts. This will help you in getting inputs and monitoring.

Scale Gradually

Once all the above points are fulfilled, you will be ready for a gradual scaling of accounts payable outsourcing.

People Also Ask

Yes, accounts payable can be outsourced and it is one of the most common functions to be outsourced.

Costs vary by volume and complexity, but most UK providers charge on a per-invoice, per-hour, or monthly retainer basis. Outsourcing is typically 30–50% cheaper than hiring internally when overheads are considered.

Accounts payable outsourcing focuses specifically on supplier invoices, payments, and AP controls. Bookkeeping outsourcing covers broader ledger work, including journals, bank reconciliations, and month-end reporting.

Yes. A strong AP provider ensures correct VAT treatment, supplier validation, and audit trails, reducing the risk of VAT errors and HMRC queries.

Conclusion

Taking the challenges associated with handling accounts payable in-house, deciding on outsourcing accounts payable work will be a good and major decision to make in 2026. The decision makes sense when you face a lack of talent and high talent cost.

However, selecting the right accounts payable outsourcing partner is even more important to improve efficiency. A perfect outsourcing partner will work toward reducing errors, accelerating processing, improving vendor relationships, and freeing teams for strategic work.

We mentioned Corient among the top, because it works like an extended arm of your teams in delivering reliable, review-ready outsourcing services without risking your growth, sacrificing control or compliance.

Is accounts payable becoming a straitjacket for your practice? Connect with us and see the difference in your process. Still, the ultimate outsourcing partner choice depends on you and your requirements; choose wisely!