Top 10 Bookkeeping Outsourcing Companies You Can Trust in 2025

- Why Choose a Bookkeeping Outsourcing Company in 2025?

- Key Criteria to Evaluate a Bookkeeping Outsourcing Company

- Top 10 Bookkeeping Outsourcing Companies for 2025

- How to Choose the Right Bookkeeping Outsourcing Partner for Your Practice

- Frequently Asked Questions (FAQ)

- Final Thoughts – Is Outsourcing Bookkeeping Right for You?

There is no need to stress how important bookkeeping responsibility is for your accounting practice. However, you cannot deny that it is time-consuming work that diverts your attention from other important matters. No wonder bookkeeping outsourcing companies are gaining a lot of trust to do the heavy lifting. An expected annual growth rate of 9.1% from 2024 to 2030, indicates a strong and sustained demand for outsourced bookkeeping services, according to Grand View Research.

Outsourcing bookkeeping is a brilliant way to keep costs low, streamline operations, and improve your services. Through a professional bookkeeping outsourcing company, you can handle day-to-day accounting and VAT submissions, allowing you to focus on high-value advisory services.

In this blog, we will focus on why outsourcing is gaining traction, how to choose one and some of the top ones to look out for. Let’s begin.

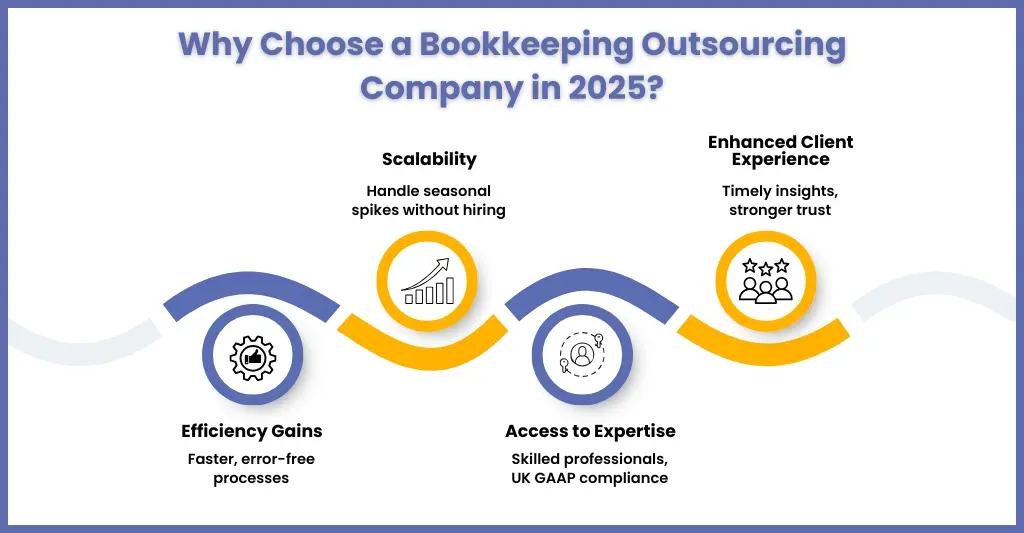

Why Choose a Bookkeeping Outsourcing Company in 2025?

Yes, cost saving is a major factor why practices prefer bookkeeping outsourcing, but that’s not all. Moving towards bookkeeping outsourcing is a strategic move that opens countless opportunities. By partnering with a Bookkeeping Outsourcing Company, you can unlock multiple advantages that directly impact efficiency, client satisfaction, and business growth.

Let’s go through a few:

Efficiency Gains

A professional outsourcing provider gives you access to automation tools, cloud-based systems, and standardised processes to ensure faster, more accurate completion of bookkeeping tasks. With the reduction in data entry and reconciliation mistakes, your practice can attain the goal of quick turnaround for your clients and free up your teams for high-value advisory work.

Scalability

Outsourcing will provide you with the flexibility to scale your bookkeeping up or down according to your workload. These ups and downs in workload are due to seasonal spikes, growth in client business, or the sudden addition of large projects. With the help of your reliable outsourcing partner, you can adapt quickly without having to hire or train additional staff.

Access to Expertise

A professional outsourcing provider will give you access to highly skilled professionals who have experience with multiple industries and UK accounting standards. Such expertise ensures that you are compliant with UK regulations, thus reducing the risk of errors and penalties.

Enhanced Client Experience

Accurate and on-time bookkeeping enables you to provide your clients with timely insights and updates, which in turn impact their financial performance. When all records are well-maintained, you can focus on proactive advisory services, strengthening client trust and satisfaction.

Key Criteria to Evaluate a Bookkeeping Outsourcing Company

To gain the maximum benefit from a bookkeeping outsourcing company, you will need to select the right one. It is crucial for ensuring accuracy, efficiency, and long-term value for your accounting practice. Here are the key factors you should consider:

Industry Experience

A service provider with experience in serving accounting practices will understand the unique requirements of workflows, reporting requirements, and compliance obligations. Therefore, you should look for a provider that has experience in meeting your requirements, offering relevant advice, and delivering consistent, high-quality results.

Security & Compliance

Handling client financial data requires strict adherence to data protection regulations. Therefore, ensure that the provider you select complies with GDPR, maintains secure data storage, and follows UK accounting principles like UK GAAP or IFRS. Select a partner that conducts regular audits, encryption practices, and documented compliance processes are key indicators of a reliable partner.

Technology & Automation

Technology reduces errors, increases speed, and saves time, allowing advisors to focus on their advisory services. So, opt for a service partner that has experience in cloud-based accounting platforms, AI-enabled reconciliation tools, and automated reporting systems. Additionally, verify whether they can integrate with your existing software, including real-time dashboards and automated VAT calculations, to ensure smooth operations.

Customisation & Flexibility

Every accounting practice has unique client requirements to fulfil, and a cut-and-paste approach will not resolve your client’s problems. That’s why you must choose a partner that meets your workflow requirements and has good communication.

Support & Communication

Effective communication ensures that issues are addressed quickly. Hence, evaluate your partner’s response time. Verify that you receive a dedicated account manager, clear escalation paths, and regular progress updates.

Top 10 Bookkeeping Outsourcing Companies for 2025

The key to streamlining operations, reducing administrative burden, and improving client service is to partner with a professional and experienced bookkeeping outsourcing company. The problem is that the UK accounting market is flooded with many of them, but we have taken the liberty of listing ten companies that will be perfect for you.

These 10 companies are:

1. Corient

Established in 2011, Corient has gained a reputation among UK accounting practices as a leader in outsourcing bookkeeping. It has achieved mastery in combining AI with bookkeeping, VAT support, and year-end preparation. The GDPR and ISO 27001 compliant accounting solutions designed by Corient’s experts are ideal for accounting practices of all sizes and are flexible in meeting unique and future accounting demands.

Corient has always stayed ahead of the curve through its tailored accounting services and has helped firms through its advisory services, saving many from future regulatory hassles. Discover how Corient has transformed bookkeeping for a client, eliminating backlogs and enabling real-time financial reporting.

Accounting services offered by Corient are:

- Year-End Accounts Outsourcing

- Bookkeeping Outsourcing

- Payroll Outsourcing

- Management Accounts Outsourcing

- Corporation Tax Outsourcing

- VAT Outsourcing

2. LedgerLine Solutions

LedgerLine has focused its energy on cloud-based bookkeeping and automation for small and mid-sized practices. They are efficient in data entry, reconciliations, and reporting, making it useful for practices that do not want to expand their headcount.

3. FinAcc Outsourcing

FinAcc has tailored its bookkeeping services with a focus on accuracy and compliance. Its team is experienced in UK accounting standards, thus helping practices in record maintenance and VAT compliance.

4. ClearBooks Support

ClearBooks Support offers seamless integration with multiple accounting software, ensuring consistency for busy practices that cannot afford downtime.

5. Optima Accounting Services

With specialisation in outsourced bookkeeping and cash flow management, Optima has provided valuable support to practices in areas such as payroll, reconciliations, and VAT submissions. It has allowed practices to focus on high-value advisory services and client growth.

6. BrightLedger

BrightLedger combines automation and oversight in its bookkeeping services. Their services are ideal for practices that want only reliable services without long-term commitments.

7. Precision Bookkeeping Solutions

Precision Bookkeeping Solutions offers cloud bookkeeping and real-time reporting dashboards. Their services make monitoring easy and spotting issues early, leading to improved efficiency.

8. SmartBooks UK

SmartBooks UK can handle VAT, reconciliations, and client reporting along with scalable bookkeeping solutions. Their services make them ideal for quality services during peak periods.

9. Accura Outsourcing

It has dedicated its expertise toward GDPR compliance and multi-platform integration. They also offer reliable bookkeeping services with a focus on security and integration. This makes it ideal for practice handling sensitive client data.

10. NextGen Finance Partners

NextGen Finance Partners combines technology-driven bookkeeping with advisory-ready reports, enabling firms to offer insights beyond standard accounting. Their services are ideal for practices seeking to strengthen client relationships and offer strategic guidance.

How to Choose the Right Bookkeeping Outsourcing Partner for Your Practice

Selecting the right partner depends on:

- Compatibility: Ensure the company understands your workflow and integrates with your existing systems.

- Service Breadth: Evaluate whether they offer payroll, VAT, and year-end support, in addition to bookkeeping.

- Pricing Model: Look for transparent pricing, whether per hour, per client, or subscription-based.

- References & Reviews: Check testimonials and case studies from other accounting practices.

Frequently Asked Questions (FAQ)

The cost of outsourcing bookkeeping varies depending on the scope of services, client volume, and the complexity of accounts. Many bookkeeping outsourcing companies offer flexible packages, enabling practices to select a level of support that suits their budget and client workload.

Outsourced bookkeeping is when a practice hires an external individual to handle its clients’ bookkeeping and prepare financial statements, such as balance sheets and profit and loss statements.

Yes, it is possible to transition from an in-house bookkeeper to an outsourcing company at any point during the year. Professional providers will:

a. Review Existing Records

b. Integrate with Your Systems

c. Provide Ongoing Support

Switching mid-year can actually help streamline operations, especially if your in-house team is overloaded or if you need additional expertise to handle complex accounts.

Absolutely, outsourcing accounting services is a fantastic idea for many practices. It offers numerous benefits, including cost efficiency, access to expertise, increased focus on core activities, scalability, and risk reduction.

Outsourcing bookkeeping will give you the freedom to scale your services up or down as needed. Whether your business is expanding rapidly or growing slowly, outsourcing will ensure you have the support you need at a fixed cost.

A professional outsourced bookkeeping service will work like an extended arm of your bookkeeping team and proactively align with your goals. Here’s what you should expect:

a. Accurate, timely bookkeeping every month

b. Full compliance with UK accounting standards

c. A dedicated bookkeeper at your service

d. Use of latest accounting software and tech tools

e. Strong data security

f. Clear processes and audit trail

g. Transparent price

h. Scalable

i. Support during accounting issues

For accounting firms based in the UK, Corient offers a perfect balance between cost, compliance, flexibility, and expertise.

a. You will get access to highly qualified bookkeeping experts without bearing the cost of an in-house UK accountant.

b. Bookkeeping services will be flexible based on work volume, meaning you pay only when you need.

c. You reduce operational risk, compliance exposure, and error potential through structured processes, automation, and professional standards.

d. Reducing routine bookkeeping workload on your accountants so that they can focus on high-value activities such as advisory and client relationships.

Final Thoughts – Is Outsourcing Bookkeeping Right for You?

Outsourced bookkeeping is more than a cost-saving exercise; it provides access to expertise, advanced tech, and scalable processes. These benefits have enabled practices to enhance their efficiency and improve the client experience. To maximise the benefits of outsourcing bookkeeping, it is essential to select the right outsourcing partner, and Corient should be the ideal choice.

Our confidence comes from the fact that Corient has mastered AI-enabled bookkeeping services that are compliant with the latest UK accounting standards and regulations. Our proactiveness in staying ahead of the curve has made us reliable among accounting practices and streamlined bookkeeping work for many.

Do you need to streamline your bookkeeping or other accounting services? Connect with us and get a free trial, and take the call.