10 Benefits of Outsourcing Accounting Work for UK Accountants?

In current times, businesses have understood how important accounting practices are in keeping their commerce running smoothly. From meeting tight client and regulatory deadlines, managing payroll and staying compliant with ever-changing HMRC regulations, an accounting practice handles it all. However, we have noticed strains developing among multiple accounting practices in recent years. These strains have occurred due to increasingly complex regulations, calculations, and deadlines, which are being strictly enforced.

To tackle this stress, many accounting practices have made a long-term strategic decision – outsourcing accounting work. Outsourcing! But has it worked well for others, and will it be able to maintain or enhance your service quality? We understand these questions, and many more will crop up, and we will put all your doubts to rest once and for all.

In this blog, we will explain what outsourced accounting means, the benefits of outsourcing, and why choosing it will be your smartest decision this year.

What is Outsourced Accounting?

Under accounting outsourcing, you will be delegating specific accounting responsibilities that you wish to delegate to a third-party specialist, mostly a professional accounting outsourcing service provider. This service provider will act as an extension of your team and assist you in handling everything from data entry, bank reconciliations, VAT returns, payroll, and year-end accounts to management reporting.

However, there is a misconception that outsourcing will cause you to lose control over client relationships, which is untrue. Under outsourced accounting, you must choose the services you want from the service provider and will be charged accordingly. You will only have to select an outsourcing provider that meets your criteria and then enjoy its expertise, scalability, and cost efficiency.

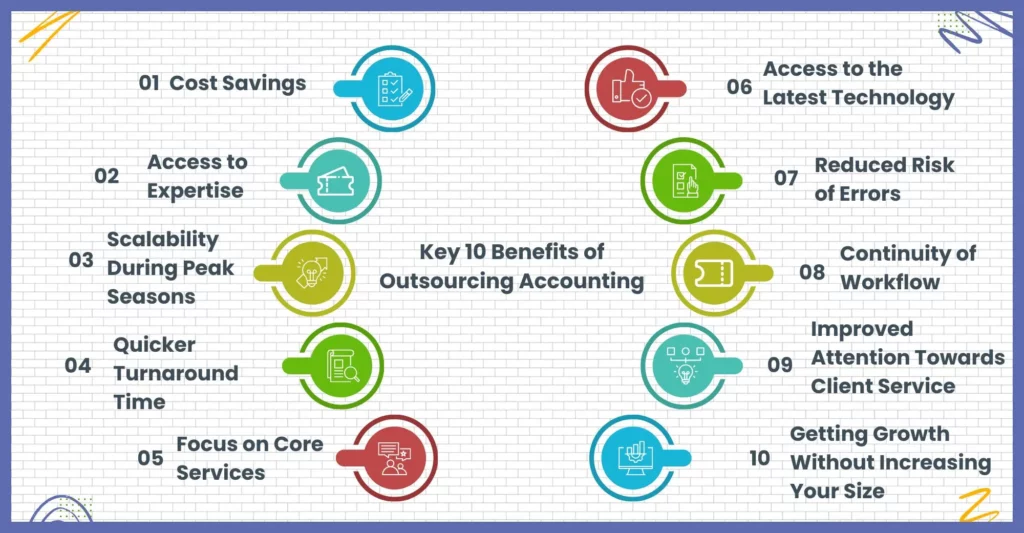

Key 10 Benefits of Outsourcing Accounting

Still confused about trusting outsourcing accounting? After going through the benefits of it, all your apprehensions will go into thin air. Here are the key benefits of outsourcing accounting that will make you get one.

Cost Savings

Forget hiring and training new employees when outsourcing accounting is an option. When you outsource your accounting to a competent service provider, you can access experienced accountants at a lower cost. The saved funds will allow you to invest in capacity enhancement and client relationship processes.

Access to Expertise

One of the primary reasons outsourcing is becoming extremely popular among accounting practices is the wealth of expertise accountants possess. A professional outsourcing service provider will always have multiple teams of experienced accountants to handle various accounting practices. These teams have the experts to handle accounting, from VAT to payroll to year-end filings. With experts on your side, you can get assurance of full-proof quality and compliance.

Scalability During Peak Seasons

Peak accounting seasons like March are when you are expected to get multiple accounting service requests from your clients. To handle so many accounting requests, you must either make your accounting team work overtime or recruit additional staff. However, both these solutions are not ideal. Overtime will cause work overload, leading to work-life imbalance. Also, hiring staff to handle peak season will lead to excess employees during the lack season, further draining your resources.

However, peak season demand can be handled efficiently through outsourcing. The service providers are flexible enough to scale up during peak seasons and scale down when the demand for accounting services goes down. This way, you can maintain efficiency and quality and prevent additional burdens on your team.

Quicker Turnaround Time

Many accounting services require a quick turnaround, especially if your clients require urgent services. In such situations, accounting service providers will provide the necessary services on demand, ensuring quicker and quality delivery and client satisfaction.

Focus on Core Services

Many accounting tasks, such as filing P11Ds for employees or VAT filing, take up considerable time. These tasks leave you with less time for other important accounting tasks. When time-consuming and complex accounting tasks are handed over to a service provider, your team will be left with enough time to focus on higher-value advisory work, client relationship building, and business development.

Access to the Latest Technology

The latest accounting software will help you speed up your accounting process without compromising quality. However, getting access to them is neither cheap nor easy to operate without proper training. Instead, you can choose the easy option of getting access to these tech and tools through an outsourcing service provider. You can boost accuracy and productivity by accessing tools like Xero, QuickBooks, Dext, and Power BI.

Reduced Risk of Errors

Certain accounting tasks, such as payroll-related ones, involve multiple complex calculations and must comply with the latest payroll regulations. However, this is where the risk of errors is the most; to overcome that, you will need expert help and a double-checking system. Only outsourcing can offer you a system and expert help to reduce your manual errors and compliance risks.

Continuity of Workflow

Your accountants have the right to sick leave and holidays. Also, there will be internal staff transitions, which have the potential to disrupt the workflow and cause trouble for your clients. However, outsourcing will provide you with sufficient buffer by maintaining a smooth workflow and reliability in the eyes of your clients.

Improved Attention Towards Client Service

By outsourcing the time-consuming tasks, your accounting team can be more responsive and attentive to client needs.

Getting Growth Without Increasing Your Size

Are you interested in growing your accounting firm without additional recruitment? Outsourcing can help you expand your capacity without increasing overheads or hiring extra staff.

Who Should Consider Outsourced Accounting Services?

There are several circumstances under which it becomes vital for accounting practices to consider outsourced accounting services. Here are the one who must consider outsourcing accounting.

- Small and mid-sized accounting firms do not have the resources to hire a full-time accounting team.

- Accounting firms or businesses that are unable to find talent with the right skill set at an affordable cost.

- If an accounting practice grows rapidly due to increased demand for accounting services, it needs to scale immediately.

- Those accounting practices that require additional assistance in increasing their capability, e.g., making year-end reports.

Any accounting practice, regardless of its size, can benefit from outsourced accounting services, depending on its circumstances. Large accounting firms usually do not require outsourced services due to their large teams and resources. Still, they can find it helpful to get impartial advice, additional assistance, and skills when required and take over repetitive accounting work so that their in-house team can focus on value-driven tasks.

Now that you understand how important outsourcing is in the smooth running of your practice, you must try it out and experience it for yourself. When it comes to choosing an outsourcing service provider, Corient is second best to none. Why? Let’s find out.

Why Choose Corient for Accounting Outsourcing in the UK?

When it comes to providing accounting outsourcing services in the UK, Corient has, within a short period, established itself as a trustable and go-to accounting service provider among accounting practices. It will be a surprise for many how we managed to gain the trust of so many practices in such a short period and in such a competitive environment. The secret to this is that we understand the on-ground challenges a practice faces and have developed solutions that will address those challenges and give you growth, accuracy, speed, and value.

Here are some specific points that will make you choose Corient’s accounting services:

Experienced Staff at Your Service

We understand your faith in your in-house accounting team’s experience and skills, but current accounting challenges are such that you will require outside help, someone whom you can trust to tackle complex accounting tasks. Corient accountants can take on this challenge. We have 100+ experienced accountants at your service who possess specialised knowledge regarding various accounting tasks, laws, and regulations, which are critical for maintaining high standards. You can take advantage of this experience and enhance the quality of your service.

Fast Turnaround Time and 100% Accuracy

You must have encountered a situation in which your clients suddenly come up with an urgent task that you cannot fulfil. However, our accountants will take care of such tasks quickly without compromising accuracy or compliance.

Cost-effective Services

Providing quality and cost-effective payroll and other accounting services is the goal of Corient, and through it, we have succeeded in gaining the trust of many accounting practices in the UK. Our process has helped many firms reduce recruitment and training costs, thus saving them time and money. Even if you need only a few accounting services, Corient has got your back and will charge you only for the services taken.

Scalable Services

Corient has invested considerably in making its accounting services easy to scale up when there is demand for more services from accounting practices. Accounting services like bookkeeping, payroll, year-end, VAT, and so on are also designed to be flexible enough to upgrade and meet future requirements. By trusting Corient, we can assure you our outsourcing services will support you through all stages of growth.

Full-Compliance

Corient has experience in all the latest regulations related to VAT, Tax laws, and HMRC, and based on this, we have designed services that will ensure the accuracy of financial data right from the start. Whether it is payroll, bookkeeping, year-end, or VAT, rest assured that we will provide services that fully comply with regulations so that you do not have to stress about non-compliance penalties.

End-to-End Accounting Support

Corient has invested heavily in offering end-to-end support, from onboarding to customer support. Our experience, which you can access in our case studies, has helped us develop a team to provide you with dedicated support. This team is always available to assist with any questions or concerns, ensuring your firm operates without disruption.

Frequently Asked Questions (FAQ)

An outsourcing provider through its experienced workforce can get the work done much more efficiently compared to recruitment an accounting team, thus proving to be more cost-effective.

There is no definite answer for this question. Only thing we can say that the prices will fluctuate depend on the number of services you avail from the service provider.

Under accounting outsourcing, accounting firm can delegate certain accounting tasks to a specialised third-party service provider. These service providers will offer services in payroll, bookkeeping, VAT, management accounts, and more.

According to a study, 50% of firms will outsource some or all of their accounting tasks by 2030.

Nearly, half of the businesses

Outsourcing accounting services in UK is a necessity for accounting firms to maintain cost-efficiency and compliance. Some of the best accounting outsourcing services in the UK are:

a. Bookkeeping outsourcing

b. Payroll outsourcing

c. Year-end accounts outsourcing

d. VAT outsourcing

e. Corporation tax outsourcing

These outsourcing services are offered by the most respected names in the accounting outsourcing world like Corient. Such service providers providing flexible staffing, seamless system integration, and dedicated teams that understand your accounting requirements.

Outsourcing accounting and bookkeeping give small businesses access to professional financial support without the cost of hiring in-house staff. The biggest benefits include:

1. Saving cost

2. Better accuracy and compliance

3. More Time to focus on business

4. Access to expertise and latest tech

5. Scalable support

6. Improved cash flow visibility

7. Reduction in fraud

Conclusion

Outsourcing your clients’ accounting work to service providers will not mean surrendering control to a third party. Instead, outsourcing will act like a backup or your extended arm, which will come in handy during high workload situations. Many accounting practices and accountants have understood the benefits and have started placing their trust in them, and it’s time for you to go with the flow.

To gain maximum benefits from outsourcing, we advise you to research and choose a service provider that meets your requirements and offers maximum benefits. Many accounting practices have trusted Corient for professional and experienced accounting services. We offer bookkeeping, payroll, VAT, corporation, and many more. Our services have brought in quality and enhanced capacity for many and can perform the same for you. Write your accounting issues or doubts on our website contact form, and our executive will contact you as soon as possible.

Wishing you success and hope to see you soon.