Payroll Outsourcing: A Complete Guide to Benefits, Costs and Providers in the UK

- What is Payroll Outsourcing?

- How Does Payroll Outsourcing Work?

- Outsourced Payroll That Ticks Every Box – Key Benefits

- Key Benefits of Payroll Outsourcing for Accounting Firms

- Outsource Your Payroll – Step-by-Step Guide to a Smooth Transition

- Pros and Cons of Outsourcing Payroll

- Best Outsourced Payroll Providers UK – How to Find the Right Fit

- Payroll Services Cost: How Much Should You Pay?

- What Should You Consider When Comparing Payroll Costs Across Different Companies?

- The Future of Payroll Outsourcing – What’s Next?

- Corient’s USP: Why Choose Us for Payroll Outsourcing?

- Payroll Outsourcing FAQs

- Conclusions

Accuracy, compliance, and efficiency are the qualities associated with payroll outsourcing. But what is payroll outsourcing, and why is it gaining such importance in the accounting circle? And the most important question: Is it worth your attention? We believe it is, and we will cover all aspects of payroll outsourcing in this guide.

Payroll in the UK has become so complex that neither businesses nor accounting practices handling the accounts on their behalf are able to handle it without expert help. This situation has given rise to payroll outsourcing, which has eased work stress for countless accounting firms. In this guide, we will cover everything from the pros and cons of outsourcing to finding the perfect provider.

Let’s scroll down.

What is Payroll Outsourcing?

In simple terms, for an accounting firm, payroll outsourcing means handing over the responsibility of payroll to a third-party accounting service provider. A payroll service provider completes the tasks for you through its team of payroll experts, thus completing complex tasks without fear of beginner errors.

Payroll isn’t just about paying people; it’s about building trust and reliability in your workforce.

How Does Payroll Outsourcing Work?

Payroll outsourcing works by transferring some or all payroll responsibilities from your accounting practice to a specialist payroll provider. The process typically starts with onboarding and data sharing, followed by payroll setup, parallel test runs, and a controlled go-live.

Once live, the provider manages payroll calculations, RTI submissions, statutory filings, reporting, and ongoing compliance, while your practice retains visibility and oversight through regular reports and communication.

Outsourced Payroll That Ticks Every Box – Key Benefits

Outsourced payroll has managed to tick all the boxes when offering benefits for accounting firms. These benefits are as follows:

Key Benefits of Payroll Outsourcing for Accounting Firms

There are some significant advantages associated with payroll outsourcing for accounting firms. These benefits are as follows:

Payroll Accuracy

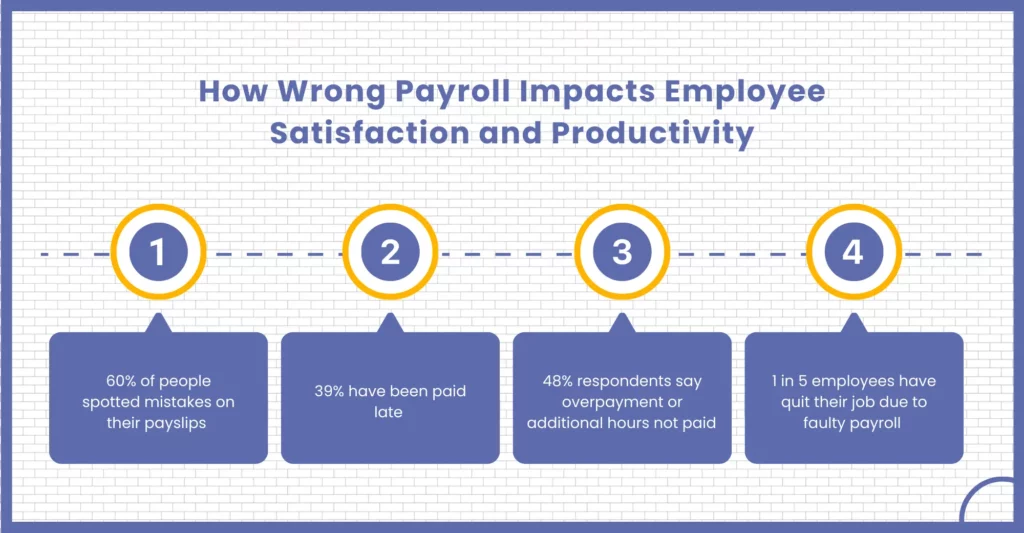

One of the major benefits of payroll outsourcing is getting your payroll tasks done through payroll experts who know how to do the job. These professionals are well aware of the latest payroll standards and accounting regulations. Also, reputed payroll service providers train their payroll experts on the latest technology and software. Hence, the combination of experience in accounting standards and software will lead to improved payroll accuracy.

Improved Reporting

No need to panic when HMRC ask for specific information, especially when a payroll service provider is by your side. The service provider will provide all the necessary data and reports in clear format. These reports will provide a detailed breakdown of your payroll, thus ensuring that your reporting duties are met.

Flexibility

Unlike your in-house payroll team, a provider will adapt their payroll services to meet your requirements according to your growth, client requirements, or changes in accounting standards. For example, if your client is on a recruitment drive, you will have to include many new employees in the payroll system within a short time. This task will be challenging for your in-house payroll team but not for your payroll outsourcing service provider. The provider will take on this task without compromising on accuracy and efficiency.

Access to Payroll Expertise

When you choose to outsource payroll, you will have a dedicated team or a dedicated payroll expert assigned to handle only your payroll tasks. The team of experts is highly trained and experienced in handling multiple payroll-related software and is well aware of the latest accounting and payroll standards, so you do not need to learn about it.

Another important benefit of payroll outsourcing is the experience of the payroll experts in handling complex payroll responsibilities, such as payroll calculations and complex processes. Therefore, using their expertise, you will be in a position to handle complex payroll issues without any additional investments.

Good payroll management isn’t a cost; it’s an investment in employee satisfaction and retention.

Data Security

A professional payroll service provider will never compromise on data security; after all, it will damage its reputation and relationship with its client. The data handled by a payroll service provider is usually sensitive information related to employees. To handle these sensitive payroll data, payroll providers have invested heavily in security systems and software, thus guaranteeing data security.

Full Compliance

One of the major benefits of payroll outsourcing is maintaining full compliance even when legislation changes. Such 100% compliance is possible because of the top-level payroll experts. They will monitor any changes in payroll legislation or standards and implement the necessary changes immediately, depending on your requirements.

Lower Costs

Your provider will absorb all the costs associated with running payroll services, including payroll staff salaries. You will only have to negotiate and pay a fixed fee for the services you avail from your provider, making it much better than recruiting an entire payroll department. Through payroll outsourcing, you can save considerable costs associated with recruitment, training, salaries, benefits, and office infrastructure.

Peace of Mind

One of the biggest benefits of payroll outsourcing is the peace of mind that comes with knowing that salary calculations, payroll analysis, reporting, and compliance are all in the hands of a dedicated team whose sole focus is to get the job done efficiently, effectively, and thoroughly.

Outsource Your Payroll – Step-by-Step Guide to a Smooth Transition

You cannot wake up one morning and decide to outsource your payroll. We understand that the benefits will make you eager to do it, but you must follow a step-by-step guide; otherwise, it will create future problems. To execute a smooth transition from your in-house team to a payroll outsourcing services team, you will need to follow the following process.

Step 1: Evaluate Your Payroll Needs

Before you even think of searching for a payroll provider, understand what your payroll needs are. Consider the following factors:

- The number of employees you are serving

- Frequency of payroll runs

- Tax and compliance requirements for your clients

- Software you will need for integration

Step 2: Communicate with Your Clients

Switching to outsourcing will affect your clients, business owners and employees. Hence, it is important to communicate about this switch to them, especially to those business owners who use your system on a day-to-day basis. To gain their trust, you will have to explain to them in detail why you are switching and the benefits associated with it.

Step 3: Choose a Reliable Payroll Provider

Once you have your payroll needs set, start searching for a reliable payroll provider that will fulfil your needs. Hence, we would advise you to look for a provider that offers:

- Compliance with UK payroll regulations

- Automated calculations and real-time reporting

- Integration with accounting and HR systems

- Secure data handling and GDPR compliance

Step 4: Collecting Relevant Data for the Transition

Yes, the service provider will handle most of the work. Still, you must set aside time to collect relevant and accurate data on your client’s employees. The employee data collected will be passed on to the service provider, who will use it effectively. The data you will need to collect are as follows:

- Employee records (name, NI number, tax codes)

- Salary structures and benefits

- Pension contributions

- Holiday and sick leave records

Step 5: Select the Right Timing

It is very important to get the timing right for the payroll transition. After all, you would not want your payroll transition to be done during the end-of-month pay period. Hence, consult with clients and choose a transition period that does not affect them.

Many of your clients would prefer to move to a new service provider at the end of their financial year or tax year to keep their admin neat, but you can change to a new payroll provider anytime.

Step 6: Conducting Parallel Dummy Pay Run

Many professional payroll service providers do dummy pay runs parallel to yours to check the calculations coming up and ensure there are no errors while going live. These parallel payroll runs are done multiple times and will be necessary when your clients have a large employee base.

Step 7: Go Live and Monitor Performance

Once live, regularly review the payroll process to ensure smooth operation. Keep communication open with the payroll provider for ongoing improvements.

So, are you ready to make the switch?

Pros and Cons of Outsourcing Payroll

There is an endless discussion in the accounting circle about whether outsourcing payroll is beneficial or not. While some are for it and some are against it, we have come up with a solution: listing out the pros and cons of outsourcing payroll. Shall we?

| Pros | Cons |

| Cost savings when it comes to salaries, benefits, and office related infrastructure. The cost saved can be reinvested somewhere else. | You might not get access to the payroll providers software as a when required for checking or adding anything. |

| You will save time which was invested in payroll tasks, thus allowing to focus on other important accounting work. | There might be delays in getting your queries resolved by your payroll contact but that depends on the professionalism of your payroll provider. |

| Staying compliant with the latest PAYE regulations, tax obligations, and legislation will not be an issue. | Once the transition is done you might have to let go some of your payroll staff which is profitable but a difficult decision to make due to loss of experience and trained staff. |

| Complete elimination of human error. | Losing control over sensitive and confidential payroll information of your clients. Hence it is important to select a provider that is GDPR compliant. |

| Expert knowledge of the latest payroll legislations. | |

| Dedicated team of payroll experts at your service instead of a single staff, thus reducing the changes of data entry errors. | |

| Reducing the requirement of constant training for your in-house payroll team. | |

| Choose a payroll provider offering their services using the best payroll software. |

Companies using payroll automation reduce errors by 67% and improve efficiency.

Looks like the Pros are winning the battle!

Best Outsourced Payroll Providers UK – How to Find the Right Fit

When choosing the best outsourcing payroll providers in the UK, there are so many options. Only an online search for “payroll provider UK” will throw up multiple worthy options. But who has the time to check all of them? Therefore, it is important to narrow them down to a select few. For that, you will need to ask a few questions.

What is and is not working in your current payroll process? Can a payroll service provider help in resolving those issues?

- Does the provider have experience in handling payrolls for accounting practices?

- What is the payroll capacity of a payroll provider?

- Ask for their experience and expertise in payroll.

- Does their software automatically update with the changing payroll regulations and legislation?

- What level of data security does their software offer?

- Is their payroll software easy to use? This is an important question with long-term consequences, so take a demo of the software in use.

- What do the reports look like? And what insights will you need from the analytics available?

- What other software will you need to integrate in your payroll processes?

Once these questions are answered, you will get an idea of what you want, thus aiding you in searching and narrowing down to a few payroll providers. Now, you can follow the steps listed below to help you find the right one among them.

Conduct Research

Start with a simple Google search and ask around for recommendations and brochures of the payroll service provider. Also, take a look at the reviews and past clients’ experiences with these service providers. They will give you an idea about their work culture, achievements, and client services.

Choose 3 Payroll Providers

After thorough research, you will narrow down to three payroll providers who meet your and your client’s requirements.

Conduct a Demo

Ask each payroll service provider to demonstrate how their payroll works. Yes, the provider may ask questions related to how to personalise their software to meet your requirements. Hence, your focus must be on understanding their onboarding process and how each provider will ensure a smooth transition.

Check the Data Security Credentials

Do not compromise on security aspects, especially data security. Hence, look for relevant accreditations and certifications, including the ISO accreditation.

Ask the Opinion of the Right People

Rope in your payroll staff and ask for their feedback on the software demo or features to help inform your final decision.

Payroll Services Cost: How Much Should You Pay?

While setting up with a payroll service provider you should not be worried only about the payroll processing fee. There are many more payroll services cost associated with payroll outsourcing and while choosing a service provider you will have to take it into consideration.

Setup Costs

The setup costs will be structured on a per-employee basis. If you are handling 50 employees and a payroll provider charges, for instance, £10 per employee as their setup fee, you’ll be looking at a £500 setup fee. Some might waive this initial cost for the sake of promotion, but that’s very rare.

Setup requires time and resources, which will cost your payroll provider. There is also a cost associated with parallel runs, which are all included in the setup costs.

Payslip Processing

These days, payroll providers offer apps through which staff can log in and access their payslips in a digital format. But if you are still keen on giving hard copies to the employees, that will cost you. We advise switching to digital and saving money and the environment.

Auto-Enrolment

It is another cost associated with payroll processing that might be charged separately or lumped in with the payroll processing fee. If there is an additional auto-enrolment cost, it will cost you a few pounds per employee. Some providers also offer a full auto-enrolment service with alerts, but it will cost you dearly.

Add-ons/bolt-ons

If you want additional add-ons, like HR software integration, which are quite beneficial, they will cost you extra. Likewise, you may wish to bolt on timesheets and expenses or opt for Faster Payments. Thus, it costs you a bit more.

Other Costs

Payroll providers will also charge some initial costs for things like parallel payroll runs and system training during the implementation. There might also be costs associated with other areas of payroll, such as creating P11Ds.

What Should You Consider When Comparing Payroll Costs Across Different Companies?

When comparing payroll costs across providers, accounting firms should look beyond headline fees and evaluate the overall value delivered. Start by checking pricing transparency, ensure there are no hidden charges for setup, parallel runs, reporting, or year-end submissions.

Next, assess the level of HMRC compliance support, including RTI filings, auto-enrolment handling, and responsiveness to regulatory changes. Finally, consider scalability and flexibility, a reliable provider should support growing payroll volumes, multiple pay frequencies, and software integrations without disrupting service quality.

The Future of Payroll Outsourcing – What’s Next?

We are confident that the complexity of UK payroll regulations, legislation, and calculations will remain for the foreseeable future. So, the future of payroll outsourcing is very bright, and many accounting firms are making the strategic choice to outsource.

However, what’s next for payroll outsourcing? Yes, it has established its importance among accounting firms, but there are factors that influence its existence every day. Let’s go through some of those major factors.

1 in 3 businesses in the UK faces payroll compliance penalties every year.

Technological Advancements

Technological advancements are increasingly influencing payroll outsourcing through AI, machine learning, and automation. Accounting software such as Xero, QuickBooks, and Sage are also playing an important role in automating routine tasks, which has helped improve accuracy and efficiency. These technologies have helped professionals access real-time data and work closely with clients to help them manage their data. Therefore, investments in this tech and regular training will keep you in sync with the latest updates.

Data Security and Compliance

GDPR is currently influencing payroll outsourcing in a major way, especially regarding data security and privacy. Any negligence by payroll providers in following the latest GDPR will lead to a data breach, which will result in financial loss and damage to reputation. Therefore, data security and compliance programs must be updated accordingly. Focus on best practices such as encryption protocols, multi-factor authentication audits, continuing cybersecurity awareness programs, and employee training.

Remote Collaborations

Remote collaborations have become a reality, especially after the COVID-19 pandemic. They have opened the possibility of accessing worldwide talent and cutting overhead expenses. Video conferencing, project management tools, and cloud-based communication technologies have made it easier for every virtual team member to keep in touch and coordinate with others. This has significantly impacted how payroll outsourcing is done and how interactions occur between accounting practices and payroll outsourcing providers.

Focus on Environment, Social, and Governance Reporting

As people become more environmentally and socially conscious, they will expect their payroll providers to become more environmentally and socially friendly. They will expect providers to offer them ESG reports, bringing more transparency and accountability. ESG reporting will also help attract new clients interested in working with a sustainable and responsible payroll service provider.

Corient’s USP: Why Choose Us for Payroll Outsourcing?

Are you confused as to which service provider to choose for payroll outsourcing? We understand your difficulty. After all, there are numerous payroll providers in the market vying for your business. However, you should choose the one that meets your requirements. For example, Corient has become a trusted outsourcing partner for multiple accounting firms when it comes to handling PAYE RTI, Auto-enrolment, P45, P32, P30, and P11D. Therefore, choosing Corient for payroll outsourcing services will be wise and help you be productive, efficient, alert, and responsive.

Our USP are:

- Compliance Assurance

- Scalability

- Innovative Solutions with Our In-House Software, Payroll Manager

- Qualified and Trained Staff

- Resource Optimisation

- Time-Saving

- Access to Latest Technology and Tools

Take a thorough look at our case studies and learn more about our achievements in tackling payroll errors.

Payroll Outsourcing FAQs

Ensuring payroll compliance and accurate tax filing is crucial for your accounting firm—but it’s also complex and time-consuming. Payroll outsourcing will help you stay compliant with HMRC regulations, avoid penalties, and streamline payroll tax filing.

Here’s how

1. Ensures Compliance with HMRC Regulations

2. Reduces the Risk of Errors and Penalties

3. Streamlines Payroll Tax Filings

4. Manages Pension Auto-Enrolment & Compliance

5. Ensures GDPR and Data Security Compliance

6. Keeps Up with Changing Tax Laws and Regulations

7. Provides HMRC Support and Audit Assistance

An ideal payroll outsourcing package features a range of services that are needed to ensure smooth payroll processing, full compliance, and employee satisfaction. Here is what is included in the payroll outsourcing package:

1. Core payroll processing (payroll calculations, payslip generation, and tax and national insurance (NI) deductions

2. Compliance and tax filing (real-time PAYE Submission, pensions auto-enrolment, P32, P60, P45, and P11D preparation)

3. Employee and HR Support, which includes a self-service employee portal and addressing payroll queries

4. Record-keeping and reporting

5. Payment processing for salary and benefits

There are three payroll outsourcing models under which you can outsource your payroll to a third-party provider.

1. Fully Managed Payroll Outsourcing

2. Partially Managed Payroll Outsourcing

3. Co-Sourced Payroll Model

Payroll outsourcing is when businesses delegate their payroll management to a third-party provider. This allows companies—especially accounting firms—to streamline payroll processing, ensure compliance, and reduce administrative burdens.

Under the payroll outsourcing model, you can delegate your payroll management to a third-party payroll service provider. This will streamline payroll processing, ensure compliance, and reduce administrative burdens.

Payroll service providers who offer accurate, compliant, and timely payroll processing tailored to HMRC standards can be considered reliable. Top professional service providers ensure the secure handling of employee data, automate RTI submissions, and offer dedicated support for PAYE, pension contributions, and statutory payments.

Accounting practices are trusting service providers like Corient, which offers scalable solutions backed by technology and robust internal controls.

Yes. Corient Business Solutions is GDPR compliant and ISO 27001 certified, ensuring secure handling of payroll data, robust information security controls, and full adherence to UK data protection standards for payroll outsourcing.

A reliable payroll service should offer full HMRC compliance, accurate and timely payroll processing, and strong GDPR-compliant data security. Accounting firms should also look for consistent service delivery, clear reporting, responsive support, and the ability to scale payroll services as client requirements grow.

Conclusions

In conclusion, payroll outsourcing has become integral to managing payroll for many accounting firms. Rather than resisting it for its cons, it will be better to accept and benefit from it than to resist it for its cons. Through payroll outsourcing, you are bound to get access to expertise and the latest technologies, save time and improve accuracy. Hope that this guide has helped address all your doubts about payroll outsourcing.

However, if you want to take the next step in growing your accounting practice whilst saving resources, it could be a strategic move for you to use Corient’s services. We have been offering services since 2011, and we are an accounting outsourcing service provider catering to the accounting needs of practices in the UK. Along with payroll, we also offer outsourcing services in bookkeeping, year end, management accounts to VAT and corporation tax. Our services have significantly impacted many accounting practices, and we can do the same for you. Share your queries and doubts on our website contact form, and our executive will contact you as soon as possible.

All the best in your future endeavours, and we are looking forward to meeting you soon.