P60 Guide UK: What It Is, When You Get It & Why It Matters

Even with experience, your accounting staff must have been overwhelmed with tax documents, especially those with puzzling names, such as the P60 form. As mysterious as it sounds, the P60 form is vital, especially regarding taxation related to your client’s employees.

During tax season, you will be handling multiple compliance responsibilities for your clients, including the P60. Since your clients have placed full responsibility for handling the P60, including employee queries, you will need to know the what, when, and why of the P60. This guide breaks down everything you need to know about the P60, including how to manage it efficiently, common errors to watch out for, and why it plays a vital role in payroll compliance.

What is a P60?

Every employee in the UK is entitled to a P60, which an employer issues at the end of the tax year. It is an official document that shows an employee’s total income and deductions (such as Income Tax and National Insurance) for that year. It serves as a summary of the pay and tax information already reported to HMRC throughout the year.

The form contains crucial financial details such as:

- Total pay: The P60 will show all an employee’s earnings from current and previous employment during the tax year.

- Tax deducted: This form will also show the total amount of tax deducted via the Pay As You Earn (PAYE) system.

- National Insurance contributions: Even the National Insurance contributions of an employee will be showcased in the P60 form.

- Other deductions: Payments such as student loan repayments, statutory maternity/paternity pay, and any other deductions are included.

These financial details make the form crucial in tax calculations and support several financial procedures and transactions.

When Do You Get a P60?

You must have encountered this question several times, especially from your clients’ employees, regarding when they should receive the P60 form. It’s a simple question, but as an essential answer, employers must issue the P60 form by 31st May for employees whose tax year ends on 5th April. This applies to both full-time and part-time employees and directors of limited companies who pay themselves a salary.

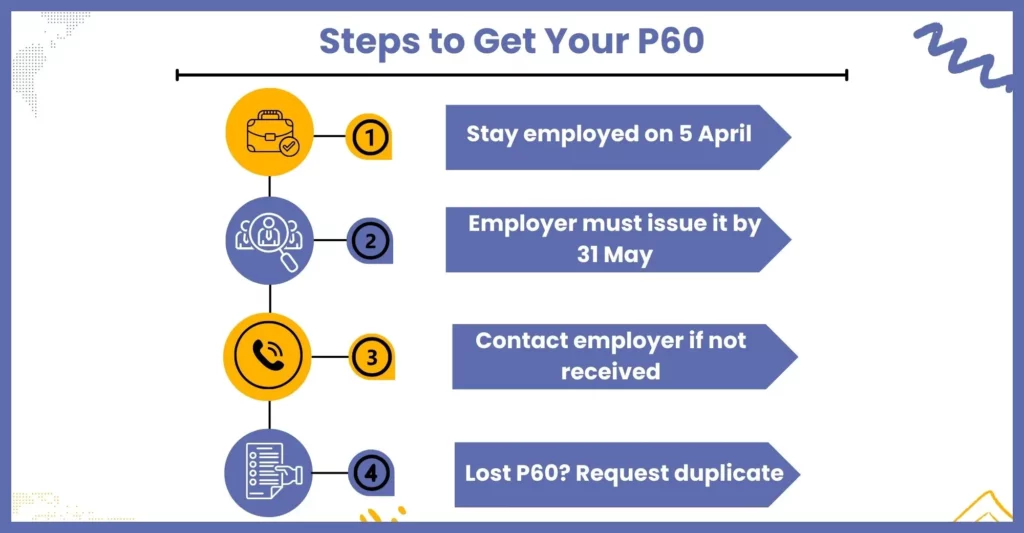

How Do I Get a P60?

Every employee has the right to get a P60 form from their current employer, and it’s a pretty straightforward process. By 31st May each year, an employee will automatically get the form, either printed or digital. If your clients are limited company directors and draw a salary, they are entitled to a P60 form.

Here is the process of steps on how to get a P60

1. Employer Will Have to Issue It: An employer must provide P60 forms to its employees by 31st May following the end of the tax year. The form must be handed over either physically or digitally via email.

2. Contact the Employer if You Haven’t Received It: If an employee has not received its P60 after 31st May then it must be communicated to the employer or its HR department immediately. It is their responsibility to issue P60 forms, and they must rectify their mistakes.

3. For Those Changing Their Jobs: Employees who leave their jobs before the end of the tax year will be entitled to P45, not P60. The P45 contains the details of an employee’s pay and tax up to the leaving date.

Yes, we understand that preparing P60 for hundreds of your client’s employees will be time-consuming and resource-draining. In such situations, you can relieve the pressure on your payroll team by outsourcing payroll services. One of the biggest benefits of outsourcing P60 tasks is handling and resolving P60 queries from employees, thus saving your time and resource expenditure.

What’s the Difference Between a P45 and a P60?

P60 and P45 sound familiar, but they are very different. Let’s check the difference.

| P45 | P60 |

| Issued when an employee leaves the job | Issued to the employee at the end of the tax year |

| It shows the earnings and tax paid up to the leaving date | It shows the earnings and tax paid for the full tax year |

| This document is provided to the employee and their next employer | Only the employee gets it from the current employer |

| Helps next employer apply correct tax code | Used for tax returns |

Why Is the P60 Important for Employees and Employers?

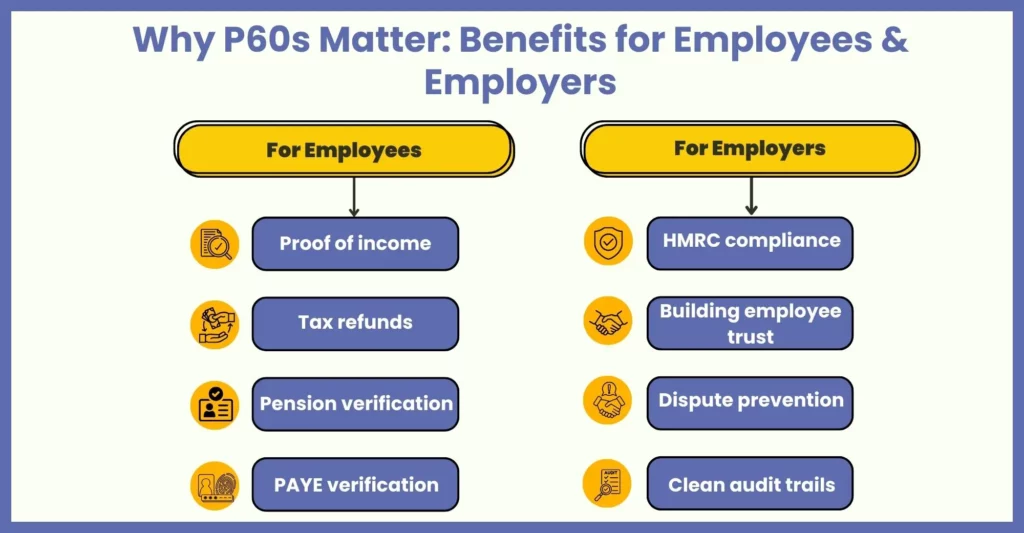

The P60 is not just a form; it’s a vital financial year record for employees, and issuing it is an important responsibility for your clients as part of payroll management. By generating accurate P60 forms, you will help your clients in keeping their reputation high among their employees and HMRC

Let’s elaborate on the importance of the P60 form for employees and employers:

For Employees

Proving Income

Through the P60 form, your client’s employees can establish their income source while applying for mortgages or loans, visas or immigration, and tenancy agreements.

Claim Tax Refunds

There can be situations where your client’s employees complain that more tax is deducted than required. In such situations, HMRC can use the employee’s P60 document to verify the claim and rectify any mistakes.

Monitor Pension Contributions

Pension contributions are equally divided between the employee and the employer, and this detail will be showcased in the P60 document. You can look at this document whenever your client or its employees are required to check the contribution accuracy.

Verify PAYE Deductions

The P60 document also helps identify and verify whether the correct income tax and national insurance were paid throughout the year.

For Employers

Demonstrates Compliance with HMRC

Your clients must issue P60s to all their employees by 31st May, especially for those on payroll as of 5th April. Any delays or misplacement of these documents will lead to heavy penalties and a loss of trust among their employees.

Supports Transparency and Trust

Employees need to have confidence in your clients’ payroll accuracy, and the best way to ensure that is by providing them with accurate P60s. Any negligence or inaccuracies will shake their confidence and lead to a brain drain.

Helps Prevent Disputes

Your clients should expect payroll queries and complaints from their employees, especially in payroll deduction errors. The P60 document becomes crucial in providing a comprehensive year-end summary.

Provides a Clean Audit Trail

P60s are important documents that contain crucial information related to financial and employment records. They are useful during inspections or financial reviews.

In short, the P60 is a cornerstone of tax reporting and employee documentation. Getting it right—on time and accurately—reflects well on the employer. Hence, to keep the P60s spot-free, accounting firms taking crucial help from payroll outsourcing services offered by service providers.

Common Mistakes in P60s and How to Avoid Them

It is an important annual document issued to each employee, plus it is an HMRC compliance requirement for every employer. Its importance can be summarised by the fact that it shows the total pay and deductions. It is also a key record for financial matters like loans, tax refunds, and pension claims.

For accounting practices, managing P60s for clients isn’t just about ticking boxes—it’s about accuracy, timing, and maintaining client trust. Small mistakes can lead to costly problems, penalties, or unnecessary employee confusion.

Here’s a breakdown of the most common mistakes—and how to avoid them to keep your clients fully compliant and protected.

Issuing P60 to the Wrong Employee

Giving P60 to an employee who has left before the end of the tax year (5th April) is a mistake that occurs frequently among accounting practices and must be avoided to maintain credibility. It must be noted that it is issued to those who are employed as of 5th April.

You will have to issue a P45 form for those employees who have left early. To simplify this task, you must get payroll software with filters that will separate current employees from resigned ones by the end of the year.

Incorrect Earnings or Tax Figures

There is always a possibility, and we have noticed inaccuracies in reporting gross pay, income tax, or national insurance contributions in the P60s. Such inaccuracies will shake the employees’ confidence in their client, affecting your reputation.

To avoid such inaccuracies, emphasis must be placed on reconciling payroll reports before starting to generate P60s. It gives accuracy in Real-Time Information submissions throughout the year and must be given importance.

Missing the 31st May Deadline

Under no circumstances can you delay issuing P60s to your client’s employees after the end of the tax year. To avoid such a big non-compliance, you must set internal targets to meet the deadline for P60 which is 31st May so that your team gets time for review and corrections. Also, preference must be given to those clients with larger payrolls so you have enough time to prevent last-minute errors.

Overlooking Statutory Deductions

Failing to record statutory payments like maternity and sick pay is a mistake that will demoralise your client’s employees and reduce their productivity. To avoid such mistakes, a complete review of employee payment histories must be done before finalising P60s.

Use the best payroll software to automatically include all statutory deductions in the year-end totals. This will save you time and resources. If getting and operating payroll software is out of your hands, you can avail yourself of payroll outsourcing services and get access to the software without buying it.

Using Outdated or Incomplete Templates

Creating P60s using outdated templates will increase the chances of non-compliance with HMRC’s directives. Hence, you must avoid making P60s manually and use HMRC-approved templates or payroll software that generates compliant P60s. Also, Double-check mandatory details like employer PAYE reference, employee NI number, and full tax year dates.

Not Keeping Copies of Issued P60s

Not keeping copies of the P60s you have generated will lead to problems for your clients in the future, especially during audits. Hence, you must securely store these records in digital format for at least three years. To achieve that, you can use the store backups of payroll software.

Resolving Corrections Properly

When errors are found after issuing a P60, failing to amend records and reissue a corrected P60 marked as “Duplicate” or “Corrected.” Hence, a formal process must be prepared to handle and record these corrections for future reference. If necessary, then inform the HMRC about these changes through accurate channels.

FAQs About P60s

Your P60 shows the tax you’ve paid on your salary in the tax year (6 April to 5 April). You get a separate P60 for each of your jobs every tax year.

If an employee loses its P60 form then it can ask for a replacement from the employer. An employee can also connect with HMRC and ask for the information that was on the P60 form.

P60 forms can be made available to employees in both printed and digital format. These days, many prefer digital format because it can be stored easily.

Employers are legally required to provide a P60 to all employees who are still working for them at the end of the tax year (5 April). The P60 must be given to you by 31 May following the end of the tax year.

There are two PAYE forms in particular that you’ll come across quite often, and you may recognise them from life as an employee. These are the P60 and P45. The P45 is used when employees change jobs and the P60 is used to summarise the employee’s tax information at the end of the tax year.

Conclusion

Handling P60 forms seems like a piece of cake, and many accounting firms are comfortable handling them in-house. However, if done wrong, it carries big consequences, including employee frustration and HMRC penalties. Hence, it is important for you to understand your capabilities and make the right decision that will have a positive impact on your client’s payroll management, accuracy, and transparency.

By putting strong checking processes in place, using reliable software, and staying ahead of deadlines, you can ensure every P60 you produce stands up to scrutiny—and strengthens your clients’ trust in your service. You can try payroll outsourcing services like Corient to achieve that speedily and cost-effectively.

Corient has established its name among accounting practices by offering up-to-date and tech-savvy accounting services, including P60 tasks that come under payroll. Our payroll outsourcing services have already delivered exceptional results for countless accounting practices and can do the same for you. State your request, questions, and requirements on our website contact form, and our executive will contact you shortly.

We are looking forward to connecting with you soon—best of luck.