P11D Guide for UK Employers: Reporting, Deadlines, and Avoiding Penalties in 2025

Are you aware of a simple guide in place to answer the questions posed by your employer clients regarding P11D? Such a guide will be particularly convenient now, as we are in the midst of tax year 2025. You must have noticed that your UK client employers are already concerned about their increased obligations, and none is more critical than submitting the P11D form. These forms, which account for employee benefits and expenses, often become an unseen compliance risk for businesses.

A P11D form is used by UK employers to report benefits and expenses provided to employees, such as company cars or medical insurance. The guide prepared by us will make it easy for your clients to understand how to file P11D and P11D(b) forms for the current tax year, key deadlines, penalties, and how to stay compliant with HMRC.

What Is a P11D?

The P11D is a form used for reporting benefits provided by employers to their employees. This form must be completed for each employee who receives certain taxable benefits and expenses and must be submitted to HMRC on an annual basis.

The expenses that need mentioning in the P11D form are:

- Company car/fuel

- Company vans (provided for personal use)

- Private medical insurance

- Employer loans over £10,000 (where no/low interest charged)

- Professional/private memberships

- Accommodation

What Is a P11D(b)?

P11D(b) is a form that is submitted to the HMRC, and it shows the total value of benefits provided to an employee and Class 1A National Insurance Contributions (NIC) due on them. We have noticed that your clients get confused between P11D and P11D(b). You can make them understand that the P11D form details the specific benefits given to each employee. On the other hand, the P11D(b) summarises the overall employer liability for Class 1A National Insurance Contributions (NICs).

Who Needs to Submit a P11D and P11D(b)?

It is the responsibility of every UK-based employer to submit P11D for every employee who has received taxable benefits and has not been processed in payroll. Nowadays, due to work pressure, P11D filing and submission are often handled by accounting practices on behalf of their clients. If your clients provide benefits for the tax year, then P11D(b) is also required.

Step-by-Step Process to File a P11D in 2025

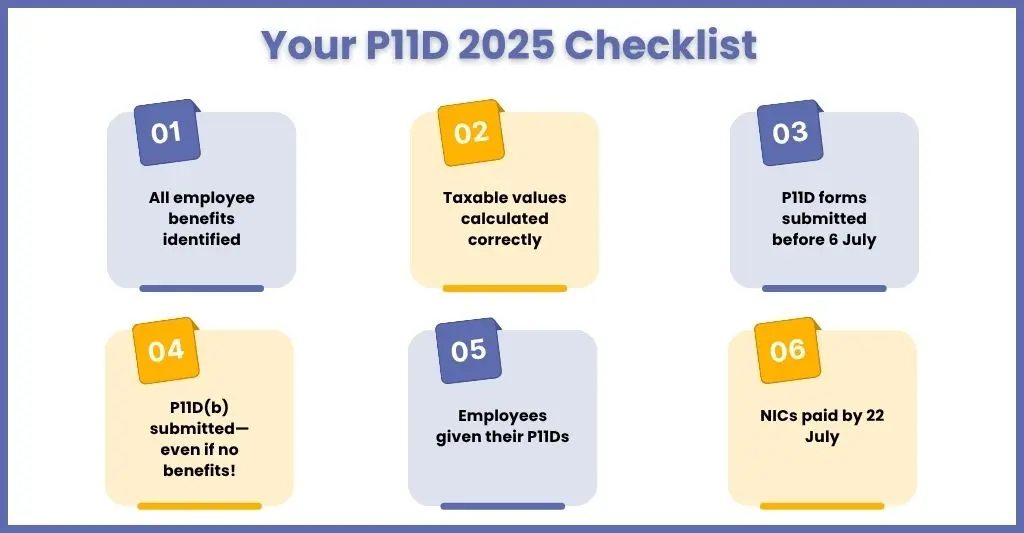

For your clients to understand P11D, they must understand the filing process. It is essential to note that preparing P11Ds is a complex and time-consuming process that involves collecting accurate data, calculating taxable values, and submitting them to HMRC. For the sake of simplification for your clients, we have broken it down into a few step-by-step processes. These steps are:

Identifying Benefits Provided

The first step is to identify all employees who are receiving benefits in addition to their salary for the current tax year. These benefits can range from one-time benefits, such as accommodation, to recurring ones, like fuel expenses. Maintain a detailed record of when benefits are issued and to whom.

Conduct Calculations of Taxable Value

Once the list of benefits is prepared, conduct the calculations on them to identify the taxable value of each. To do that, you will have to use the best payroll software that has built-in P11D functionality for ease of calculation. During calculations, follow HMRC guidance to apply correct valuation rules. Also, note that accuracy is critical here because incorrect values will lead to penalties and or additional NIC liabilities.

Fill out the P11D Form for Each Employee

For every employee who has received benefits outside their payroll, they must complete their P11D form. This form has to contain the following details:

- Employee’s name, NI number, and job title

- Type of benefit (e.g., company car, medical insurance)

- Value of the benefit

- Date the benefit started and ended, if applicable

Once the forms are completed, they must be submitted either through HMRC’s PAYE online system or using payroll software that supports P11D submission. It is worth remembering that if your client has not provided any benefits to their employees, then there is no need to submit P11Ds; however, they still need to file a P11D(b).

Prepare and Submit P11D(b) Form

P11D(b) is a summary form that contains the total value of all taxable benefits provided and Class 1A National Insurance Contributions due on those benefits. Even if your clients have paid all benefits, the P11D(b) must still be submitted to confirm NIC’s liability. The submission of P11d(b) form can be done either through HMRC online services or payroll software integrated with HMRC. If there are no benefits to report, then P11D(b) must be submitted with a nil return.

Distribution of P11D Copies to Employees

By July 6th 2025, your clients will be legally required to provide each affected employee with a copy of their P11D form.

With the P11D copies in their hand, your client’s employees will able to:

- Understand the benefits reported to HMRC

- Accurately complete their Self-Assessment (if applicable)

- You can provide the form to your client’s employees in either paper or secure digital format.

Pay Class 1A National Insurance Contributions (NICs)

Finally, calculate the Class 1A NICs based on the total value of benefits reported and pay it to HMRC.

- For the 2024–25 tax year, the Class 1A National Insurance Contribution (NIC) rate is 13.8% of the taxable benefit value, subject to confirmation from HMRC.

- Payments can be made through HMRC’s online payment portal, via BACS, Faster Payments, or direct debit.

Deadlines:

- Electronic payments must reach HMRC by July 22nd 2025

- Cheque payments must arrive by July 19th 2025

P11D Deadline 2025: Key Dates to Remember

The P11D deadline for reporting employees’ benefits and submitting forms is July 6th 2025. Additionally, a copy of these forms must be provided to the employees by July 6th. Also, it should be noted that the payment of Class 1A National Insurance (NICs) must be made by July 22nd 2025 (online).

P11D Penalties: What Happens If You Miss the Deadline?

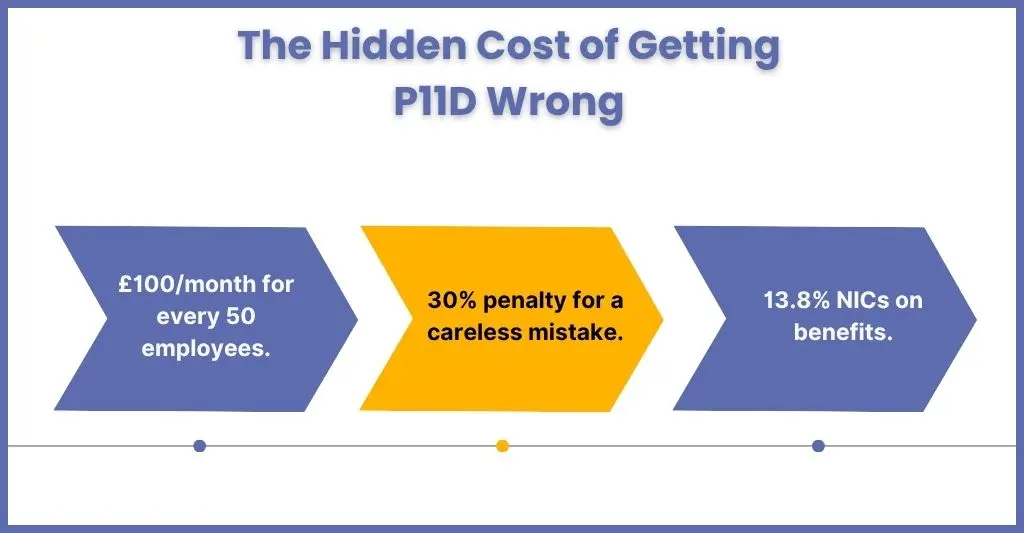

Missing the P11D or P11D(b) deadline can result in automatic penalties from HMRC even if you had no benefits to report. Penalties are applied based on the extent of the delay in submission and the number of employees affected.

Late Submission Penalties

In the case of late submissions, your clients will be subject to a £100 penalty per 50 employees for each month the P11D(b) is late.

Incorrect Information

There is a range of penalties in place for incorrect information on P11D and P11D(b) forms. Starting from 100% of the tax owed on the benefits for concealing information, 70% on deliberate but not concealing information, and 30% on careless actions.

Penalties on Late Payment

If Class 1A National Insurance Contributions are not paid by July 22nd 2025, HMRC may charge Interest or Surcharges for persistent delays

Common Mistakes in P11D Reporting and How to Avoid Them

Even the most experienced employer or practice can make mistakes when preparing P11D. Here are some common mistakes and how to avoid them.

Missing Out on Reportable Benefits

Failing to report benefits that are taxable, such as company cars, private medical insurance, or interest-free loans, is a common mistake made by multiple clients and practices. To avoid it, you must have a detailed record of all the benefits given to employees throughout the year and conduct a check before submission.

Errors in Valuation of Benefits

Wrong calculations of benefits are a common occurrence when reporting benefits. However, by utilising the latest accounting software and adhering to the current year’s tax guidelines, you can rectify this mistake.

Late Submissions

Missing the 6th July submission deadline for P11D forms is a common mistake. However, by marking the date or by utilising a payroll service provider, you can easily overcome this problem.

Errors in Employee Information

You must have encountered the issue of incorrect employee information, such as employee names, National Insurance numbers, or benefit allocations, from your clients. Hence, double-check the information provided and use payroll software for further validations.

Manual Entry

Manual entries are an invitation to make errors. Hence, consider using accounting software or outsourcing P11D preparation to a specialist provider for accuracy and peace of mind.

You must have noticed that all these mistakes occur due to a lack of expertise or a failure to meet deadlines. Hence, you must get hold of an expert to get the P11D job done perfectly, which you will find from payroll service providers.

How Payroll Outsourcing Services Can Help You Stay P11D Compliant

Gone are the days when businesses in the UK had the time to handle P11D forms by themselves; now, this critical but time-consuming responsibility is dealt with on their behalf by accounting practices.

However, practices are now facing a situation of increased complexity and workload, which is hampering their productivity and accuracy. For this reason, many practices are opting for payroll outsourcing services and entrusting their P11D responsibilities to experts.

Here is how payroll outsourcing services of a professional service provider will help your client stay compliant.

Automated Benefit Reporting to Ensure Nothing Is Missed

Professional outsourcing providers will utilise the latest and most advanced payroll software, which automatically identifies and tracks employee benefits throughout the year. Such automation will ensure that no taxable benefit, such as a medical policy or company car, is left out. Thanks to automated reporting, there will be no manual interventions during last-minute rushes.

Real-Time Compliance Tracking

UK tax regulations are constantly changing, particularly about benefit-in-kind rules and National Insurance Contributions. Professional outsourcing providers closely monitor the latest HMRC updates and implement them across their systems to ensure compliance with no issues. For instance, if HMRC updates car benefit percentages mid-year, outsourced payroll teams can apply changes proactively across all records.

Dedicated Payroll Experts to Handle P11Ds End-to-End

The best payroll outsourcing company will have a team of trained experts who are experienced in handling the P11D process, right from data collection and calculation to filing and employee communication. Such a team will ensure accuracy and less burden on your clients and your practice. When an expert is by your side, you will not have to worry about heavy lifting.

Distribution of P11D to Employees

A reputable provider doesn’t just file with HMRC they also ensure that each employee receives their P11D form by the legal deadline (July 6th 2025) in either paper or secure digital format. This reduces follow-up queries and supports employee tax self-assessments.

No reputable provider will stop at filing P11Ds with HMRC; it will ensure that each P11D it generates is distributed to every employee before the July 6, 2025, deadline. The P11Ds can be distributed in either paper or digital format, thereby reducing queries from employees. The P11Ds are crucial for employees in their employee tax self-assessments.

Timely Reminders and Compliance Calendars

Outsourced services often provide automated reminders to practices for critical dates, such as:

- P11D and P11D(b) submission deadlines

- Class 1A NIC payment due dates

- Monthly benefit reconciliation checks

This means you’re never caught off-guard, even during peak periods like year-end.

Frequently Asked Questions (FAQ)

The P11D form is used for reporting benefits given by employers, which can include company cars or vans.

The filing and submission deadline for 2025 P11D forms to HMRC is 6th July, and it is important to ensure that your clients are compliant with this deadline.

To correct an already submitted P11D form you will have to fill a new P11D form and mark it as a replacement so that it is known. Submit the form in the way as the previous one was done, that is HMRC’s PAYE portal or compatible payroll software.

By April 2026 (subject to change), P11D will be phased out and benefits-in kind will be reported in real-time.

Your client will need to register as an employer as soon as possible as without a scheme you cannot submit a P11D and there are penalties for this being late.

Wrapping Up

Armed with this guide, you will be better equipped to educate your clients about the workings of P11D. With your clients being aware of the deadlines and penalties, you can expect a reduction in errors and an increase in productivity, which will benefit both you and your clients.

Understandably, filing and submitting a P11D can be a daunting task, considering the complexities and volume involved. However, with the proper knowledge, tools, and support, such as outsourcing payroll, you can help your clients stay compliant, avoid penalties, and ensure their employees’ benefits are reported accurately. Corient can help you achieve this.

Since 2011, we have been helping multiple accounting practices streamline their payroll processing, including P11D filing and submission. If your practice or business wants stress-free P11D filing with zero penalties, Corient is ready to help. Talk to our payroll experts today to stay ahead of deadlines and HMRC. Write to us using our website contact form, and our executive will get in touch with you.