Internal Audit vs External Audit: Key Differences & Business Benefits

Every business fears the word “audit”, yet it cannot survive without it. It’s fair to say without an audit, you can say goodbye to transparency and accountability. Audit is a process where an assessment is made of your client’s business, its process, and its financial documents. Through it, you can gauge the performance of your client’s business for a specific period. Audit is quite vast, but for the sake of understanding, it has been divided into two distinct types: internal and external audit.

The name suggests that internal and external audits are different; under them come various types of audits. Some common audits under them are financial statement audits, compliance audits, operational audits, and risk management audits, to name a few. There are many things uncommon between internal and external audits except one: they are time-consuming.

Yes, auditing software has made things quicker and simpler, but there is a saying, “Prepare for the worst and hope for the best.” So, let’s be prepared by understanding internal and external audits, their differences, and how your clients can benefit from them.

Let’s dive into the auditing world.

What Is Internal Auditing?

Internal auditing is the internal assessment of your client’s business operations and processes. The main goal of internal auditing is to focus on performance and give accurate insights without biases. It also focuses on the effectiveness of internal controls and ensures that business operations comply with your client’s business policies.

Internal auditing is preferred for identifying areas in business that are not performing up to the mark before they are spotted in an external audit. In other words, internal auditing helps improve clients’ performance. While internal auditing is not mandatory, it is considered one of the best practices, and your clients will surely insist on you providing this service.

Let’s take a closer look at its pros and cons

Pros

When done by an experienced and professional auditor, internal auditing can bring multiple advantages to your clients, such as:

Improving Decision Making: Internal audits can help you identify specific problem areas and provide the data to support them. The data will help your clients develop strategies to address them.

Improving Operational Efficiency: Internal audit helps find the source of the problem in a specific area of your client’s business. Such detailed identification of problems will help your clients rectify the issues quickly.

Alerts of the Risk: Internal auditing will alert your clients about potential problems that can cause future problems. Once the client is aware of the risk involved it can take preventive actions to lower or nullify the risk.

Ensuring Full Compliance: Internal audits can be mimicked to perform just like external audits to find compliance gaps. By finding these problems and making corrections, your client can avoid potential penalties or punishments.

Cons

With roses comes the thorns, and so does internal auditing. These thorns in internal auditing are:

Disrupting Operations: Internal auditing has the potential to disrupt the smooth functioning of your client’s business operation. Stoppages, especially unannounced, will cause more harm than good for your client.

Feelings of Biases Among Employees and Departments: Internal auditing is preferred for auditing specific areas of your client’s business. However, it can potentially create a view among employees and departments that they are only targeted rather than others.

Cost Involved: Internal auditing will cost your clients money, and if it is way out of their budget, they will not agree to do it. Hence, if you are facing such a problem, you can seek the help of audit outsourcing services and lower your cost.

What Is External Auditing?

External auditing independently assesses your client’s financial records and information. Such auditing is usually done by an outside accounting firm specialising in external audits. The main goal of external auditing is to assure your client’s stakeholders that the financial statements are accurate and compliant with the relevant regulations. Unlike internal audits, external audits are compulsory, and they help businesses improve their standing in the market and attract new investors.

Similar to internal auditing, the external one also has its pros and cons. Let’s take a closer look.

Pros

Through external auditing, your clients can avail of certain advantages, which are:

Improved Accuracy: An outside auditor will thoroughly scan the financial statements provided by your clients and decide their accuracy. Such external checks add a layer of transparency that stakeholders will appreciate and help attract new investors.

Investing in Stronger Controls: Your clients will focus on creating strong policies and practices that will have a positive outcome, considering the external audits. Such policies and practices will help improve your client’s company’s accounting, record-keeping, and overall efficiency.

More Credibility: Any third-party examination of your clients’ financial statements will automatically increase their credibility. The reason is simple: an external audit will negate the chances of data manipulation.

Cons

Of course, it has its share of disadvantages, which, if your clients are not prepared, can cause mayhem.

Costs: The cost of an external audit depends on the size of your client’s business and the volume of financial records to audit. Therefore, if your charges are too high for your clients, get the external auditing done through a third-party outsourcing service provider.

Negative Publicity: If the audit produces negative results, it will lead to negative publicity for your clients. Such negative publicity will drive away new investors and reduce the confidence of existing ones.

Concerns Related to Compliance: Before or during the external audit, your clients may worry whether your accounting practice has done its job properly when it comes to adding data or following accounting and industry standards.

Differences Between Internal and External Auditing

Both internal and external audits strive to provide an independent assessment of your client’s finances. However, there are some crucial differences between internal and external auditing when it comes to who conducts it, the scope, and the overall purpose.

Level of Independence

While both the auditing types are independent, the levels differ. Under internal auditing, the task is done either by your client’s in-house team or assigned to your practice, which will have certain biases. On the other hand, external auditing is done through a third-party independent auditor or an audit outsourcing service provider. This means an external auditor will be more objective in its assessment and present the true picture of your client’s performance.

Scope of the Assessment

Another major difference between external and internal audits is the scope. An external audit focuses on only certain financial information and records for a specific period, like a year. While under internal audit, your client’s overall performance will be focused on compliance, risk management, technology and systems, and human resources.

Level of Assessment

The final difference between external and internal audits is the level of detailed assessment. An external audit is much more detailed and in-depth than an internal one. Such detailed assessment presents an accurate picture regarding accuracy in numbers and compliance with HMRC rules and regulations. For this reason, stakeholders widely trust external audits, hence while selecting an audit service provider take a close look at their case studies to know their past performance. On the other hand, internal audits are more focused on specific areas to identify risk and suggest ways for improvement. Therefore, conduct an audit planning to understand what you want to know and then decide whether to go for internal or external audit.

How Businesses Can Benefit from Both Audits

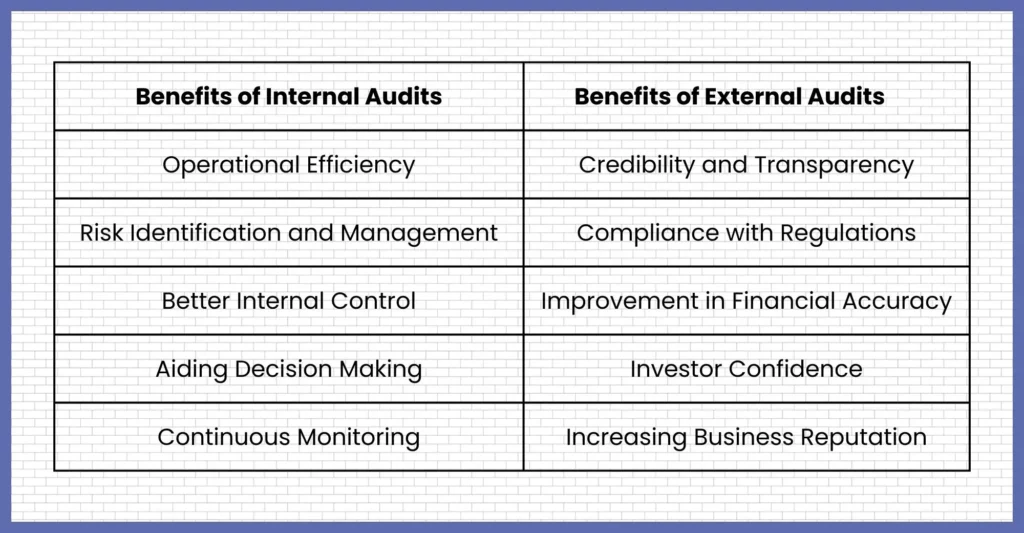

Both external and internal audits have the potential to bring countless benefits for your business clients. Both types of audits complement each other in assessing and improving business operations.

Benefits of External Audits

Credibility and Transparency

We all know that external audits are conducted by outside third-party firms, thus raising the credibility of your clients’ financial statements. Such high credibility increases trust among stakeholders, investors, and financial institutions.

Compliance with Regulations

An external audit will require your client to take the regulations and accounting standards seriously. This will help them avoid penalties and legal hassles.

Improvement in Financial Accuracy

An external audit thoroughly examines your client’s financial statements to identify discrepancies, errors, and fraud without biases. This increases the accuracy of your clients’ financial numbers, leading to reliable financial records.

Investor Confidence

There is no better way for your clients to gain the confidence of their stakeholders and investors than to conduct an external audit of their records. A positive report from the audit can help your clients secure business loans and investments.

Increasing Business Reputation

By performing well in an external audit, your clients will build an excellent business reputation. Customers, suppliers, and potential partners may feel more confident in engaging with a company that has undergone rigorous auditing.

Benefits of Internal Audits

Operational Efficiency

Internal audits help identify the effectiveness of your client’s internal business process. They identify bottlenecks, redundancies, and inefficiencies, streamlining operations, saving costs, and improving productivity.

Risk Identification and Management

Through internal audits, you can help your clients identify problematic areas such as breaches, errors, discrepancies in records, or operational inefficiencies. By identifying this risk early, you can help your clients resolve it before it gets out of hand.

Better Internal Control

As an internal auditor for your client, you can suggest checks and balances to prevent fraud or errors right at the source. These checks and balances will make your client’s business more resilient to potential risks.

Aiding Decision Making

Internal audits provide valuable insights into your clients’ business performance. These insights help them make better decisions about resource allocation, strategic planning, and operational adjustments.

Continuous Monitoring

Unlike an external audit, which is done once a year, an internal audit can be done throughout the year as demanded by your client. Through internal audits, you can give your clients constant updates on their business performance. This helps them make their business adaptable, compliant, and efficient.

By integrating external and internal audits, you can help your clients comply with regulations and improve financial reporting, optimise their operations, manage risks effectively, and support strategic growth.

Frequently Asked Questions (FAQ)

Both audits are important in maintaining the accuracy and integrity of a company’s financial information and operations. However, their scope and level of assessment will differ.

Well, there is no fixed number as to how many times internal audits can be conducted. However, if a business has an established process than it will require internal auditing once a year.

External audits give an unbiased assessment of the financial statements, thus ensuring accuracy and compliance with accounting standards. This creates transparency among stakeholders and investors.

Internal audit conducts assurance audits through a five-phase process which includes selection, planning, conducting fieldwork, reporting results, and following up on corrective action plans.

The seven audit assertions are occurrence, existence, completeness, allocation, valuation, rights and obligations, and presentation and disclosure.

These days, outsourcing service providers offer audit support services to assist accounting firms in statutory and internal audits. Under audit support services, service providers provide compiling audit-ready documentation, reconciling accounts, preparing working papers, managing audit queries, and ensuring compliance with UK GAAP and IFRS standards.

Many professional providers like Corient work in the background with accounting practices to streamline their audit process without compromising accuracy or deadlines.

Conclusion

We have concluded that both internal and external audits are equally important for maintaining the accuracy and efficiency of your client’s financial information and operations. The only thing that differs is the scope and detail of their assessment. Therefore, it is important for you to understand the difference between the two types and use it accordingly to improve your client’s financial reporting and overall operations.

We are confident of your ability to handle internal audits for your clients. However, if you need assistance in external auditing, Corient can help. Since 2011, we have focused on providing the best accounting and auditing services to accounting firms in the UK. Our auditing services have reduced the work pressure for countless accounting firms and brought speed and efficiency to their processes. Share your queries or questions on our website contact form, and we will help you out through our customer executives.

Wishing you luck and hope to hear from you soon!