The Future of Accounting for UK Businesses: Scalable, Digital, and Outsourced

- How UK Businesses Are Rethinking Their Accounting Strategy

- AI Accounting: Smarter Decisions, Less Manual Work

- Cloud-Based Accounting: Anytime, Anywhere Access

- AI + Cloud = Scalable, Efficient, Future-Ready Accounting

- Outsourced Accounting: Why More UK Firms Are Going Offsite

- Choosing the Right Digital Accounting Partner

- What is the Future of Accounting in the UK?

- Frequently Asked Questions (FAQ)

- Conclusion

The future of accounting is changing rapidly for UK businesses. With AI, cloud systems, and outsourcing taking over traditional processes, firms must adapt to stay relevant. These new regulations, evolving technology, and shifting business requirements significantly impact the accounting industry. These forces are reshaping how accountants deliver services and create value.

So, will the life of your clients become tough? Not if you are one step ahead and start working on managing those influences that affect the future of accounting. In this blog, we will be focusing on multiple solutions, including outsourcing, through which you and your clients will be future-ready.

Let’s delve into it.

How UK Businesses Are Rethinking Their Accounting Strategy

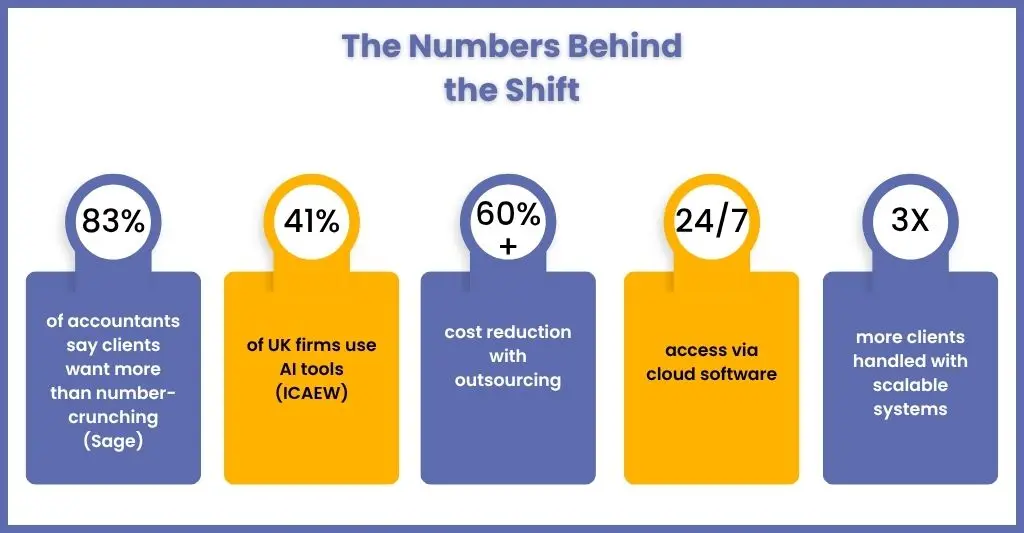

These days, your clients will not be satisfied with just year-end support, and it’s not just us saying this. According to Sage’s 2024 Practice of Now report, 83% of accountants say clients expect more than just number-crunching. With changing times, expectations and competition have increased, and your clients need real-time insights, cash flow visibility, and proactive advice to stay competitive.

These requirements from your clients have placed additional pressure on your practice to move beyond compliance and offer value-added services using technology and new procedures.

Currently, to keep up, businesses are:

- Moving away from manual, spreadsheet-heavy workflows

- Looking for ways to scale without hiring endlessly

- Embracing technology and outsourcing for core accounting tasks

The message is clear: adaptability isn’t optional. It’s essential. Accounting practices can fulfil the above-listed points only if they update themselves with new technology and methods.

AI Accounting: Smarter Decisions, Less Manual Work

Speaking of technologies that are impacting accounting, AI is one of them that is having a significant impact. We are not alone in this opinion; according to the 2023 ICAEW survey, around 41% of UK firms already use AI-powered tools, and this percentage is expected to rise further. Thanks to AI and related tools, accounting practices have been able to reduce manual efforts, boost productivity and reduce costs, which has positively impacted clients, including businesses.

Benefits of AI in accounting:

- Faster data entry and reconciliation through intelligent document processing.

- Error detection and fraud prevention using irregularity detection.

- Forecasting and decision support with real-time trend analysis.

Cloud-Based Accounting: Anytime, Anywhere Access

Many professional accounting practices have begun using top accounting software, such as Xero, QuickBooks, and FreeAgent, among others. This is because these software solutions offer cloud-based capabilities that have completely transformed how accountants perform their work. These tools have provided real-time access to ledgers, payroll, and tax data, thereby speeding up the entire accounting process.

Through cloud accounting:

- Your teams can collaborate in real-time across locations.

- Clients can upload documents and can view reports 24/7.

- Data backups and updates happen automatically.

- HMRC’s MTD compliance is built-in.

By switching to cloud-based systems, you will reduce overheads, scale up services faster, and deliver a seamless client experience.

AI + Cloud = Scalable, Efficient, Future-Ready Accounting

Both AI and cloud are essential for the future of accounting, and the best way to use them is by combining AI automation with cloud accessibility. Such a combination of AI and cloud will create a strong ecosystem and help you tackle multiple challenges for your clients.

An AI/Cloud combo system will help you in:

- Handling more clients without increasing headcount

- Delivering real-time insights and reporting

- Minimising human error and compliance risks

- Focus on advisory roles instead of data entry

This blend supports scalability and client satisfaction, making your practice future-ready. The only issue is combining AI and the cloud requires a special type of skill set and experience, which neither your clients nor you possess. Only through outsourcing can you enjoy the benefits of both AI and cloud solutions.

Outsourced Accounting: Why More UK Firms Are Going Offsite

Outsourcing accounting is the future of accounting, and it’s gaining popularity among practices. It has not only combined the benefits of cloud and AI, it has achieved that without costing too much. Such is the trust level among accounting practices that many have started relying on professional outsourced providers to handle all accounting functions, from bookkeeping and payroll to management accounts.

Not just that outsourcing offers many more benefits:

- Scalability: With an outsourcing partner by your side, you will be capable of handling extra work from your clients and onboarding new clients without expanding your staff.

- Saving on Costs: Outsourcing saves you from recruiting extra staff to cover additional workloads, thus saving costs on recruitment, training, equipment, salaries, and more.

- Attention to Value-Adding Services: While your outsourcing partner handles the day-to-day accounting activities, your team can focus on providing advisory and client relations services.

Select the right outsourcing partner to enjoy faster turnaround times and reduced processing costs.

Choosing the Right Digital Accounting Partner

To help your clients stay relevant in the UK’s competitive business environment, you will need to find an outsourcing partner that not only handles your accounting work but is also tech-savvy and compliant with the latest HMRC regulatory compliance.

Hence, look for a provider that offers:

- API integrations with Xero, QuickBooks, and Sage.

- AI-powered automation tools and dashboards.

- UK GAAP and MTD-compliant processes.

- Dedicated support teams aligned to your SLAs.

Your outsourcing partner must work like an extended team, thus making the lives of your clients and team members easier.

What is the Future of Accounting in the UK?

The future of accounting will be about delivering more value with less effort, which is also the expectation from your clients. Your clients will expect more from you in terms of speed, transparency, and input sharing. Therefore, if you are still stuck with manual accounting or your in-house team handles all accounting work, then it’s time to reassess.

To help your clients stay relevant in the modern business environment, you will have to offer them the latest accounting services by combining cloud accounting software and AI-powered tools. The best way to achieve that is through accounting outsourcing services, which will be flexible for you and your team.

Frequently Asked Questions (FAQ)

Digital transformation in accounting is transforming the financial sector, enabling practices to embrace efficiency, accuracy, and transparency.

No, but it will transform their role. AI will automate tasks, but accountants will remain important for oversight, evaluation, and strategy.

Businesses and accounting practices outsource their accounting for various reasons, such as cost reduction, increased efficiency, or simply to gain access to specialised professionals in the field.

Cloud accounting is a system that allows multi-user access and safe online or remote server storage. Users can send all their data to cloud providers where the same data is processed and safely stored, and returned.

Yes, outsourced accounting is secure for UK businesses only if you choose the best service provider. These days many businesses are relying on outsourcing partners who follow regulations strictly like UK GDPR, Data Protection Act 2018, and ISO 27001 standards for information security.

The main difference between cloud-based and desktop accounting lies in how and where the accounting data is stored. Under cloud-based accounting, you will get access to accounting data from anywhere and it is stored in strong data base. In desktop accounting, data is stored in a single computer thus accessible locally. While its faster offline, data updates, backups, and collaboration must be done manually.

No, AI will never replace accountants instead it will reduce the workload and add value to accountants by making them more efficient, accurate, and insightful.

Conclusion

The UK accounting industry has already set its course for the future, it is becoming digital, data-driven, and advisory-focused. Advanced technologies, such as AI and cloud accounting platforms, are actively reshaping how accountants deliver their services. That’s why outsourcing is proving to be an effective and attractive option, where experts utilise advanced technology to provide cost-effective and compliant services.

As the influence of advanced technology on accounting increases, your clients will demand more strategic advisory services. That’s why outsourcing accounting is no longer just a cost-saving measure; it’s a strategic tool that can drive growth, compliance, and efficiency.

At Corient, we understand the challenges you face in offering value-added services to your clients. By partnering with us, you will receive compliant and tech-savvy outsourced accounting services provided by our experts. The time to future-proof your accounting practice is now. Go digital, go scalable, and explore the power of outsourcing. Your future-ready practice starts today. Get a free session from our accounting experts today.