The Impact of AI on Outsourced Payroll Services in the UK

What was once a futuristic tool has now become an integral part of every accounting practice in the UK. We are talking about AI and its impact on accounting services, including outsourced payroll services. However, AI is continuously evolving at a rapid pace, which raises one question: What is the future of outsourced payroll services in the UK? AI is already transforming outsourced payroll in the UK by automating tasks, reducing errors, improving compliance, and delivering faster, cost-effective payroll processing.

In this blog, we’ll explore in detail how AI transforms payroll, the potential downsides, and what should be considered before adopting AI-driven outsourced payroll systems.

How Payroll Outsourcing is Evolving with AI

Payroll itself is a highly complex and time-consuming task that requires good technical and legal knowledge to maintain full compliance, but that’s not enough. A recent study by PayFit revealed that 37% of UK employers report manual payroll tasks as stressful for them and their teams. Accounting firms and payroll outsourcing service providers are no exception.

For this reason, Artificial Intelligence (AI) has become an integral part of accounting processes in the UK and has significantly reduced manual work. We also come to a point where AI has started impacting payroll outsourcing, and to stay relevant in the market, payroll service providers are evolving themselves. Here are some ways in which it is evolving:

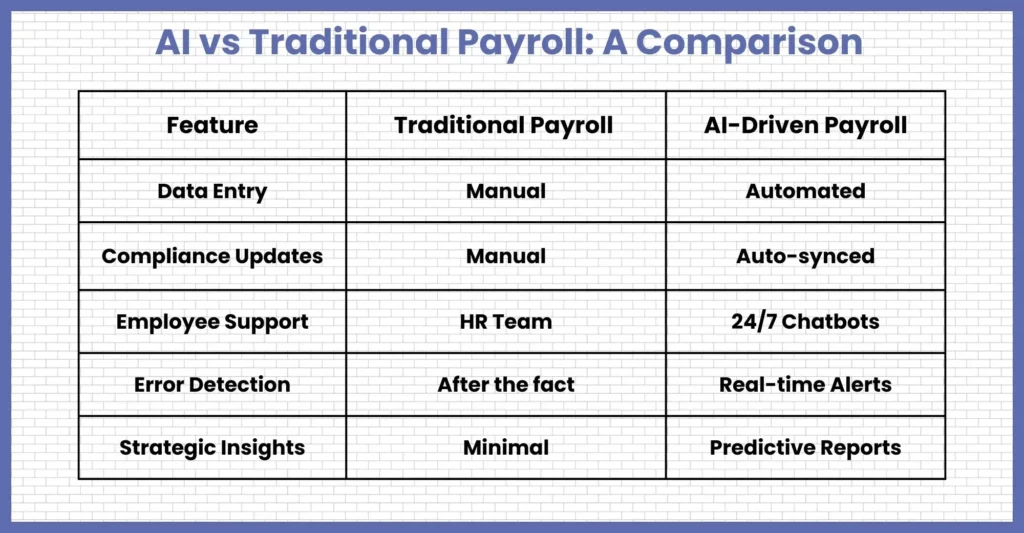

Automated Data Entry and Processing

AI-powered tools have enabled automation of the data entry process, reducing the requirement for manual input, thus reducing human errors. These AI tools can simultaneously extract information from multiple sources, such as timesheets, employee records, and tax forms, speeding up the payroll processing cycle. Through AI, payroll outsourcing service providers have prevented payroll discrepancies, enhanced forecasting, and improved budget planning.

Automation of Compliance

UK tax laws and payroll regulations change frequently, and payroll outsourcing services find it difficult to stay updated. But that’s the past. AI tools have conquered this problem by automatically updating payroll calculations as per the latest legal requirements, resulting in lower risks of non-compliance and fines. This also means fewer reworks and a less stressful environment.

Getting Employee Queries Resolved Through Chatbots

AI-powered chatbots reshape the employee experience by answering payroll queries 24/7, issuing payslips, or helping employees understand payroll deductions. This reduces the burden on HR and payroll teams while improving responsiveness.

Your clients’ employees can now expect their payroll queries to be attended to 24/7 through AI-powered chatbots. These chatbots have helped payroll outsourcing service providers disseminate payroll information and reply to queries without any human intervention.

Fraud Detection and Security

AI algorithms will detect irregularities and discrepancies in payroll data, helping to identify potential instances of fraud or data breaches. This will strengthen data security and safeguard sensitive employee information.

Strategic Role of Payroll Partners

Payroll is time-consuming and gets overwhelming when its volume increases, thus leaving less time for payroll service providers to make strategic decisions for accounting firms. With AI comes automation, which will take care of routine payroll work, thus giving providers the time to evolve into strategic advisors. By becoming a strategic advisor, a payroll outsourcing service provider will be offering value-added services such as insights on complicated payroll data, which aid in making informed decisions.

Why Accounting Firms are Choosing Payroll Outsource Solutions

It’s a fact that the accounting environment in the UK is becoming quite complex and fast-paced. Your clients will be demanding quality work in less time, which you will be under pressure to meet. The only way to reduce pressure is by outsourcing some of your recurring accounting tasks, like payroll, which was traditionally done in-house. It is a route chosen by countless accounting firms, so let’s understand why.

Saves Valuable Time

Payroll work is highly repetitive, time-consuming, and deadline-driven, and during peak times like paydays, it has the potential to overwhelm the most experienced teams. By outsourcing it, you are freeing up your teams to concentrate on high-value services that will impress your clients, such as advisory, tax planning, and client relationship management.

Compliance is Getting Complex

From RTI submissions to pensions auto-enrolment and ever-changing HMRC rules, handling compliance has become a full-time job. When you outsource payroll, you are getting access to teams that have knowledge about the latest laws, payroll deadlines, and formats, thus reducing the risk of non-compliance for you and your clients.

No Compromise on Accuracy

None of your clients will tolerate errors in their payroll that will reduce their respect among their employees and destroy the trust between client, employee, and accounting firm. To avoid such a situation, practices have started using outsourced payroll services, which have robust systems and checks, often backed by ISO certifications, to ensure precision in every run.

For instance, there is a case study where a professional service provider resolved incorrect payroll deduction allocations and ensured accurate salary payments and HMRC compliance. Such professionalism and use of tech restored employee trust and prevented future payroll issues

It’s Scalable and Flexible

No matter if you are handling the payroll of a client with 5000 employees, an outsourced payroll service provider can scale up with ease. Even onboarding new clients on an immediate basis will not be a problem.

Cost-Efficient Without Compromising Quality

One of the biggest plus points of outsourcing is its payroll outsourcing cost when compared with hiring, training, and retaining payroll staff in-house. By partnering with the right outsourcing partner, you will get access to payroll services offered by experienced talent backed by the latest tech, thus not sacrificing quality.

Access to Better Tech Without the Investment

Professional payroll outsourcing service providers proactively provide and train their accounting staff on the best payroll software. These top payroll software offer real-time data, employee portals, and AI-driven insights. Such technology requires huge investments, which an accounting firm cannot afford independently.

Challenges and Considerations in AI-Driven Payroll Outsourcing

AI is changing how accounting in the UK is done, and payroll is the first to feel its impact. With the rise of AI-driven payroll outsourcing, accounting practices are discovering new ways to streamline operations, improve accuracy, and reduce manual workload. However, with innovation comes complexity.

We have recently noticed challenges faced by accounting practices while outsourcing their payroll to an AI-driven service provider. Let’s explore these issues that UK accounting practices should address before outsourcing payroll to AI-driven providers.

Data Security and Privacy Risks

Payroll involves dealing with highly sensitive employee data, such as employee names, salaries, bank accounts, national insurance numbers, tax codes, and pension contributions. Outsourcing payroll already exposes your client’s employee details (with permission) to a service provider, but now, with AI in the mix, the exposure points have increased.

To minimise this challenge, you will have to consider the following:

- GDPR Compliance: Ensure your outsourcing partner fully complies with the latest UK data protection laws.

- Data Encryption and Access Control: Check or select a service provider that offers strong cybersecurity protocols to negate the risk of data breaches.

Integration and Compatibility Issues

AI solutions cannot work in isolation; they require integration with your existing systems. You are already using cloud-based platforms like Xero, QuickBooks, Sage, or BrightPay to perform accounting functions, and poor integration will lead to data loss, duplication, or system breakdowns.

To overcome integration and compatibility issues with the payroll service provider, you must consider the following:

- AI Integration Capabilities: Check whether the AI system used by a service provider is compatible with your current accounting and payroll software.

- Scalability: Is the AI-driven payroll system used by your service provider capable of handling high volumes of data and clients from sole traders to multi-site companies?

- Error Handling: Is there a clear process for managing exceptions and discrepancies?

Successful payroll service providers use AI to augment, not replace, their human expertise, especially when dealing with complex payroll scenarios.

Human vs. Machine Decision-Making

Yes, AI can automate most payroll tasks, such as salary calculations, tax deductions, and reporting. However, payroll is not rigid; certain aspects, such as one-off bonuses, maternity pay, or part-year calculations, require human judgment.

To overcome this predicament, you will have to consider the following things:

- Oversight Mechanisms: Check whether your payroll outsourcing team has qualified payroll accounting experts who regularly review AI-generated payroll outputs.

- Exceptional Cases: Does your payroll outsourcing service provider have an AI system in place that will detect unusual payroll activity and route it for manual review

- Client Communication: If a payroll issue arises, who will communicate— an AI bot or a trained payroll expert?

Training and Team Readiness

Adopting AI into your processes is not just incorporating a system; it’s a change in mindset. Your in-house team must have the trust and training to interpret and use AI-driven outputs.

So, what needs to be considered:

- Staff Training: Training of your staff in understanding and operating the AI interface provided by your outsourced payroll service provider. Your payroll outsourcing partner will provide some training to your staff.

- Client Education: Before outsourcing payroll to a service provider, you will have to inform and explain to your clients how their payroll will be handled and the benefits of an AI-driven payroll process for them.

Without proper onboarding and education, AI tools can lead to confusion, mistrust, or underutilisation, undermining the efficiency they promise.

The Future of Outsourced Payroll Services in the UK

The UK payroll landscape is changing rapidly, and accounting practices are under tremendous pressure to evolve from being just a number crunching firm. Your clients will demand faster, smarter, and more integrated payroll solutions. All this means that the future is bright for outsourced payroll services providers in the UK, especially those ready to embrace artificial intelligence.

Let’s explore some transformative shifts shaping the future of outsourced payroll in the UK:

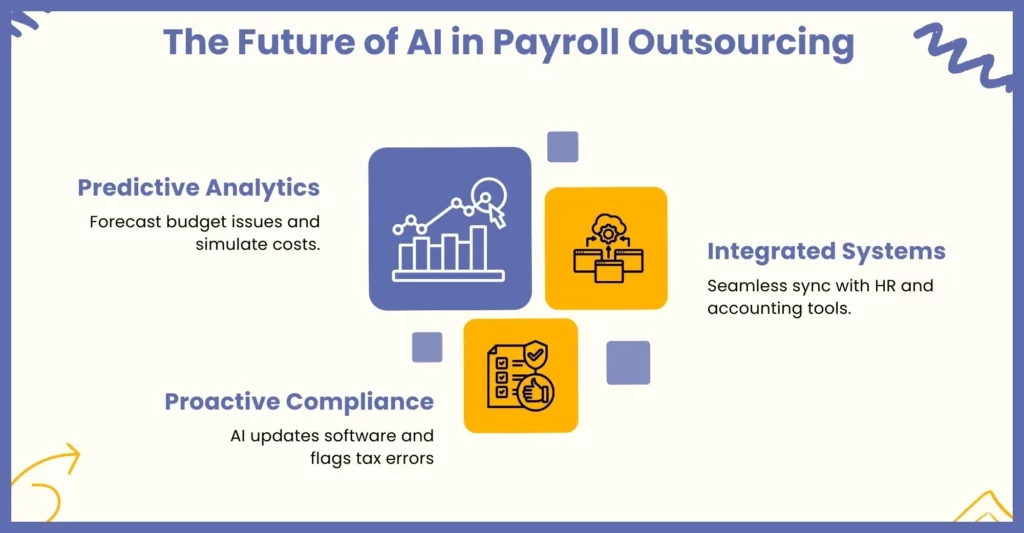

Predictive Analytics and Proactive Payroll Management

There were days when payroll meant processing payslips on time and maintaining compliance. However, now your clients demand proactive services and predictive analytics, which are provided efficiently through outsourced payroll services offered by payroll providers. Predictive analytics use historical data to forecast potential issues, such as budget overruns, tax liabilities, or employee views.

By integrating predictive analytics:

- Payroll providers can alert your clients about cost spikes before they occur.

- You can simulate payroll costs by suggesting different hiring or policy scenarios for your clients.

- With payroll outsourcing’s help, you can offer advisory-led payroll, thus increasing your client’s value and revenue.

In essence, payroll outsourcing is transitioning from a reactive function to a strategic forecasting tool, and your clients expect nothing less.

Integration with HR and Financial Systems

In today’s fast-paced climate, your clients will demand that your payroll work seamlessly with HR platforms, time tracking tools, and accounting software. Achieving such integration will be tough for your practice singlehandedly, but with the help of payroll outsourcing services, it is possible.

Only those payroll service providers that offer seamless integration will survive. By integrating payroll with:

- HR software (e.g., for tracking leaves, benefits, onboarding)

- Accounting platforms (like Xero, QuickBooks, or Sage)

- Time-tracking and expense systems

You can reduce manual inputs, eliminate duplicate data entries, and offer real-time reporting. Such deep integration enables faster reconciliations, more accurate tax filings, and stronger client retention through smoother operations.

AI & Compliance with Evolving Payroll Legislation

UK payroll legislation is constantly changing, including national insurance thresholds, sick pay, auto-enrolment updates, and the list goes on. Handling so many changes can also be overwhelming for an experienced outsourced payroll services provider without the assistance of AI tools.

Artificial Intelligence is set to play a vital role in staying compliant by:

- Automatically updating software with legislative changes

- Flagging anomalies in payslip calculations or tax deductions

- Generating alerts when deadlines or documentation are missed

More importantly, AI can learn from past errors. For accounting practices, this means fewer penalties, faster audits, and better compliance assurance for clients without the need for constant manual monitoring.

Frequently Asked Questions (FAQ)

Payroll is a time-consuming process that includes collecting payroll data and documents that require human hands. AI service providers have found ways to automate inputs, calculate wages, and validate the accuracy of the entered information. This reduces the risk of human error and can save valuable hours, thus improving the accuracy of payroll outsourcing.

That’s right. Payroll outsourcing services have widely adopted AI for predictive analysis, automated payroll processing (including data entry), and fraud prevention. Using AI, payroll service providers have eliminated repetitive tasks and improved efficiency.

AI will not replace payroll professionals, as the data still requires a human touch and unbiased interpretation.

AI helps automate repetitive and routine tasks, which is beneficial for employees as it frees them up to focus on more complex and creative work. However, it can also create concerns about job displacement and changes in the demand for certain types of jobs.

Conclusion

Payroll outsourcing services have become a strong pillar on which many accounting practices have started to rely and provide value-added services. With AI in the mix, outsourced payroll services are becoming more efficient and quicker. In this blog, we have made an effort to describe how AI is making payroll outsourcing services even better and the challenges associated with it. Through this blog, you can select a future-ready payroll outsourcing partner.

Speaking about future readiness, many payroll outsourcing service providers are focusing on incorporating AI in their process, but Corient is one step ahead. Established in 2011, Corient is a tech-savvy accounting outsourcing service provider that has always preferred to use the latest tools, including AI, to increase the efficiency of its accounting services, including payroll. For more information or to post your queries, do it on our website contact form, and our executive will connect with you shortly.

We are looking forward to a long-term and fruitful association.