A Comprehensive Guide on Accounts Receivable Outsourcing

Introduction

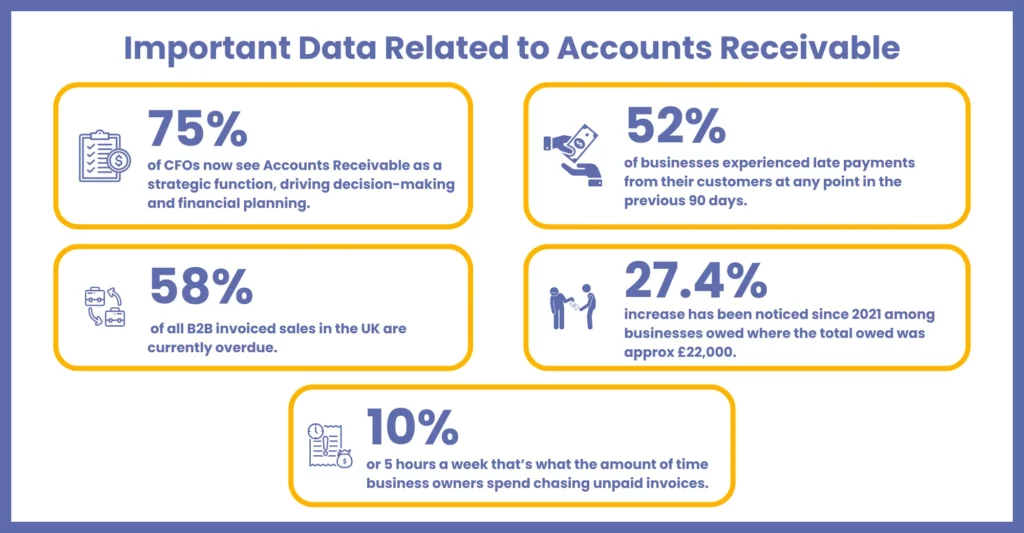

Accounts receivable is an accounting function performed by your accounting practice so that your client can do its business without any hindrance. However, it is essential to realise that accounts receivable processes are becoming more complicated in the United Kingdom. Hence, it is important to have a deeper understanding of the concept of accounts receivable and explore options such as accounts receivable outsourcing.

Gone are the days when bookkeeping was handled manually. Reasons include influences of new technologies and new rules and regulations from the HMRC. All this has made managing the accounts receivable of your clients and accounting practices difficult. However, there are many options to manage this issue such as process automation, AI-driven analytics, and so on but none has been as popular as account receivable outsourcing which comes under outsourced bookkeeping services offered by outsourcing service providers.

In this comprehensive guide, you will understand how outsourcing will help you stay relevant in the market.

Explaining the Concept of Accounts Receivable

Accounts receivable represent money considered as a current asset, providing clarity on your client’s financial status. In accrual accounting, we show accounts receivable as the value of our clients, even though they have not yet received the money.

In other words, when both parties strictly adhere to the terms of the transaction, they convert accounts receivable into bankable cash. Any delay on the side of your client’s customers to make payments will deteriorate the value of your client’s accounts receivable. The task of managing accounts receivable is usually managed by accounting practices on behalf of businesses. However, with increased complexity you will need assistance which is available through accounts receivable outsourcing offered by service providers.

The Importance of Managing Accounts Receivable Outsourcing

By choosing accounts receivable outsourcing for your clients you are actually opening the gates of multiple benefits for yourself and for your clients. But before that, you will have to take into consideration certain factors, otherwise you may not ably offer the full benefits and will lead to loss of reputation in front of your clients.

Therefore, it is important to manage the outsourcing by first avoiding the mistakes committed while outsourcing such as:

- Neglecting Data Security

- Imperfect Communication

- Priority Only On Cost-Saving

Also, focus must be placed on the trends that will impact accounts receivable outsourcing.

- AI and Automation: More outsourcing service providers are using AI tools for invoice management and predictive analysis.

- Customised Outsourcing Models: Clients are preferring bookkeeping outsourcing service models that are flexible and willing to accommodate their accounts receivable requirements.

- Blockchain Integration: Secure and transparent payment tracking using blockchain technology is gaining traction.

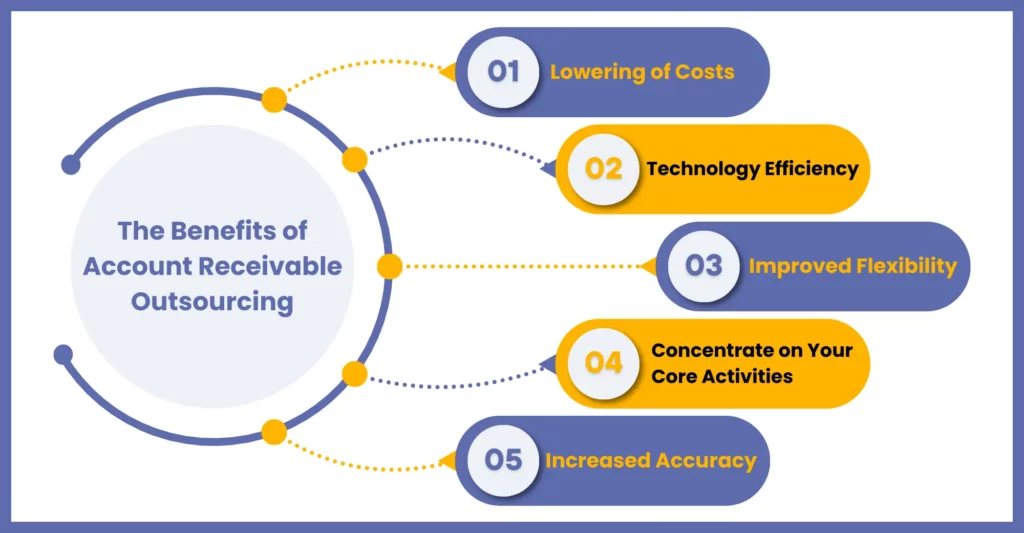

The Benefits of Account Receivable Outsourcing

Lowering of Costs

One of the main aims of accounts receivable outsourcing is to increase cost savings. You and your clients will be experts in your core tasks in the same way service providers will be experts in providing account receivable outsourcing services. By transferring the responsibilities to a service provider for the account receivable function, you will not have to invest in staff to look after it, thus saving money.

Technology Efficiency

Your clients will surely have extensive knowledge about their business; similarly, account receivable service providers have invested significantly in the latest technologies related to receivable tasks. The reason behind the investment is to overcome the challenges that come with sharing financial data between systems and platforms. Any professional service provider will invest in the integration and reporting platforms to gather and share all the information. Also, equal attention is given to service providers to automation which will not only speed up and streamline the work but also reduce the requirement of labour, thus reducing your cost.

Always select a service provider that offers it, thus giving you real-time status of your client’s financial status. Through it, you are empowering your clients to make informed and critical decisions.

Improved Flexibility

Your client’s sale cycle will not be the same throughout the year; there will be seasonal peaks or a bunch of deals that might be closed at the end of the financial year. To handle this extra account receivable workload, you must maintain different levels of workforce at different times of the year.

But if handling it internally is becoming an issue, then you can outsource it to a service provider thus reducing the need for increasing your staff levels, especially during peak times. Recruiting new staff will require investment in their training and learning will require time. Therefore, you can outsource work without hiring and incurring employee costs during a sudden spurt in work.

Concentrate on Your Core Activities

If account receivables are a non-core task for you, it is better to outsource them to an account receivable service provider. This will enable your internal staff to concentrate on core responsibilities.

Increased Accuracy

Your account receivable processes must have undergone significant changes, such as reduced manual work and increased technology use. Still, there will be significant manual intervention, which will increase the chances of human error. Even if you have invested in the latest technologies, your staff, especially the new recruits, will need more knowledge and experience to work with them. Instead, if you choose to outsource your client’s account receivables to a service provider that already uses the latest software, there will be fewer bookkeeping mistakes.

Strategies for Effective Accounts Receivable Outsourcing

Outsourcing accounts receivable will be an attractive solution to reduce your workload, especially when it comes to complex tasks. However, accounting outsourcing services is not a magic wand that using it will solve all your problems; it has its share of pros and cons. Hence, for proper implementation, you must implement specific strategies. These strategies will help you gain the maximum out of accounts receivable outsourcing. Let’s understand these strategies in detail.

Selective Outsourcing vs Full Outsourcing

You have the option of selective outsourcing, where you can outsource the responsibility of running recurring tasks while maintaining control over sensitive accounts receivable processes. This is a good way to test the capabilities of an accounting service provider before fully outsourcing.

On the other hand, when you fully outsource your account receivable responsibility, you free up the resources that go into it. These resources could then be diverted towards service upgradation and other core responsibilities. Full outsourcing is ideal if your in-house capacity is limited and you seek scalability and maximum efficiency.

Clear Data Security Measures

Make sure your outsourcing follows the latest UK GDPR and Data Protection Act 2018. After all, the safety of your clients’ sensitive and personal data is on the line.

Service Level Agreements (SLAs)

Discuss with your outsourcing partner and set clear metrics to measure your partners’ service quality.

Regular Audits and Reviews

Conduct periodic audits to check whether your outsourcing partner follows the agreed standards and improves identified areas.

Contingency Planning

Understand your outsourcing partners’ steps towards recovery and maintaining operations to always stay prepared for the worst possible scenarios, such as disruptions.

Bringing in Innovative Contracting Structure

The focus must be placed on contracts that place compensations against achieving specific outputs or benchmarks. Such a contract will motivate your outsourcing partner to deliver consistent high performance.

Also, add clauses in the contract with your outsourcing partner regarding service levels and costs. Such clauses are valuable, especially when your client’s business experiences a boom and when you demand upscaling or downscaling of services. You will not be subjected to penalties.

Lastly, design a contract that offers a clear exit way for terminating outsourcing services if they are not meeting your expectations. Also, make a contract flexible by including options this way your outsourcing partner remains aligned with your requirements, thus ensuring a long-term partnership with your partner.

Frequently Asked Questions (FAQ)

The main problem associated with accounts receivable is the risk of late or non-payment from customers. Such a problem will create cash flow challenges, and to avoid this issue, you will require effective management to minimise the impact on your clients.

The most critical aspect of managing AR is maintaining a consistent cash flow through timely collections and accurate invoicing. Utilising an accounts receivable management system can significantly enhance efficiency.

The 5 C’s—Character, Capacity, Capital, Conditions, and Collateral—help assess a customer’s creditworthiness. Only after this evaluation will you understand one’s credit worthiness and extend credit.

Under the 10 rule for accounts receivable it is suggested that your clients must aim to collect at least 10% of their outstanding receivables every month. By following it, your clients can avoid financial crises easily.

Comprehensive bookkeeping outsourcing services in the UK are available only from specialised service providers that offer all-around support, from daily transaction recording and bank reconciliations to VAT returns, payroll integration, and real-time financial reporting. These specialised service providers, including Corient, use the latest UK accounting standards and cloud platforms like Xero, QuickBooks, and Sage to ensure accuracy and compliance.

Conclusion

To sum it up, this blog aims to make you understand that when your client’s sales cycle peaks, there will be a sudden spurt in demand for your accounts receivable services, making it difficult to manage alone. Therefore, it is wise to consider the option of account receivable outsourcing through a service provider partner. In the UK, many professional service providers offer this service; and Corient is among them.

We specialise in offering tailored accounting services for accounting practices. Our teams have vast experience in providing various accounting services, from bookkeeping and payroll to audit and VAT services. Our accounts receivable services have helped countless practices transform their working style by making them more efficient and transparent. We can perform the same miracle for you, so just contact us through our website contact form and share your requirements. Our executive will get in touch with you as soon as possible.