How Many Taxes Are There in the UK? A Complete Guide for Accounting Practices

- Types of Tax in the UK – What Accounting Firms Need to Know

- What Taxes Do I Need to Pay?

- Common Tax Pitfalls and How Accounting Firms Prevent Them

- How Technology Simplifies Multi-Tax Management

- The Strategic Role of Tax Planning in Client Growth

- Conclusion

There is a set of questions that you have answered to your clients’ multiple times but will keep coming back: How many taxes are there in the UK, and do I need to pay them? Understandably, your clients will keep coming up with these questions because the UK tax system is highly layered with direct and indirect taxes. Each of these taxes has its guidelines, deadlines, and exemptions.

As an accounting practice, it is your responsibility to understand the entire UK tax landscape not only for compliance but also to give better advice to your clients and build long-lasting relationships. This guide breaks down the main types of UK taxes your firm should be aware of, how they apply, common client mistakes, and how to manage them efficiently using technology and good tax planning.

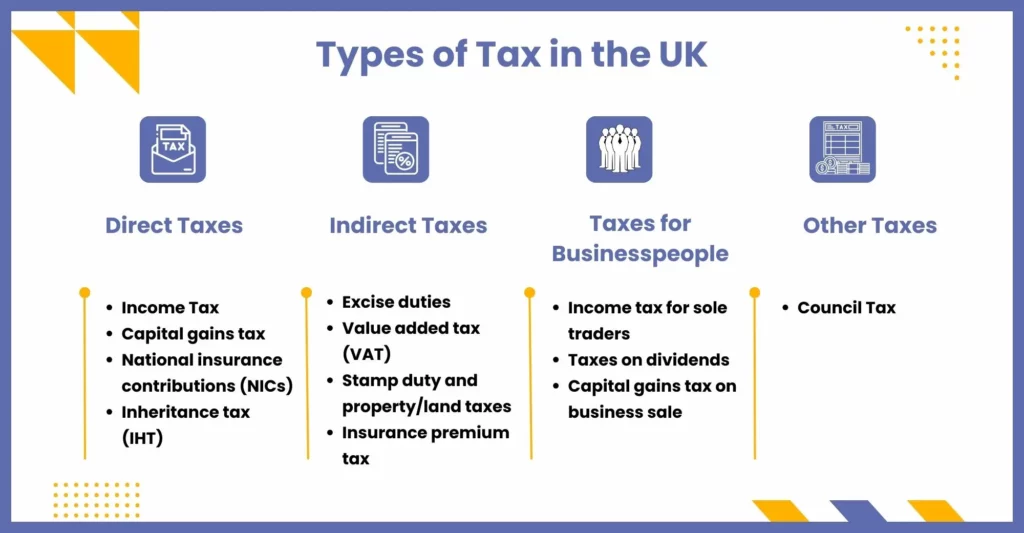

Types of Tax in the UK – What Accounting Firms Need to Know

There are approximately 15 taxes in the UK tax system, but not all of them will apply to your clients. However, looking at the changes in the accounting industry, it is important to have complete knowledge about these taxes. Let’s take a look at all of them.

What Taxes Do I Need to Pay?

Direct Taxes

Income Tax

Income tax is one of the most widely known direct taxes. It is paid on income and profits earned by an individual. While it mostly applies to salary-based income, it also applies to property income, business profits, and income from additional sources.

Capital Gain Tax

Capital gain tax (CGT) is another tax your client must pay when selling an asset. This tax applies to the profits derived from the sale of an asset that has increased in value since its purchase. CGT applies to shares and properties but not to individuals selling their homes.

National Insurance Contributions (NICs)

While it is not a tax, National Insurance Contributions (NICs) are similar. The contributions are based on a percentage of your client’s employee’s income. Your client’s employers must also pay NICs on their employees’ earnings.

Inheritance Tax (IHT)

Inheritance Tax is a tax paid on the property, money, and possessions of someone who has passed away. The UK’s standard rate of Inheritance Tax is 40% (subject to change).

Indirect Taxes & Duties

VAT

VAT is a tax on the purchase price of goods and services sold within the UK that applies to your clients.

Stamp Duty and Property/Land Taxes

This tax applies when property or land is bought at a specific price. Your clients must pay this tax when they purchase land for their business.

Excise Duties

Excise duties apply to goods the government generally wants to discourage people from buying. These products are generally harmful to public health or are imported at a high cost.

Insurance Premium Tax

As the name suggests, Insurance Premium Tax applies to UK insurance premiums. Customers pay this tax over their basic premium, and the insurance provider passes the IPT to the HMRC.

Taxes Paid by Businesspeople

Income Tax for Sole Traders

Applicable to sole traders, the income tax on sole traders is paid on profits, not income. Also, a sole trader must pay Class 2 and Class 4 National Insurance and register to pay VAT if their turnover exceeds a set figure.

Taxes on Dividends

Individuals who own shares in a company may receive dividends. Where it is the individual’s own company, extracting profits via dividends is generally more tax efficient than receiving a salary.

Capital Gains Tax on Business Sale

CGT is also applicable on business person who choose to sell their shares or part of their business at a profit.

Other Taxes

Council Tax

Local government is largely funded by Council Tax, which is paid by those living in residential property.

Common Tax Pitfalls and How Accounting Firms Prevent Them

It will be a terrifying event for your clients to fall into any tax pitfalls, causing financial losses and loss of reputation for your firm. Hence, your number one goal must be to avoid such a situation; you will have to familiarise yourself with these pitfalls. Here are some common tax pitfalls you need to be aware of.

Inaccurate Record Keeping

One of the easiest ways to make tax mistakes is through inaccurate record-keeping. Unfortunately, poor documentation and misplaced information can lead to potential issues with HMRC audits and tax filings. Hence, bookkeeping must be taken seriously and carried out carefully.

The most common tax pitfalls are inaccurate record-keeping. Accounting firms often face problems with poor documentation and wrong information, which can be an issue if HMRC conducts an audit or during tax filings.

Misclassification of Expenses

There is a constant struggle to identify your client’s allowable expenses. Such classification is essential because the HMRC will ask for a detailed explanation. Any inaccuracies in the claim will lead to paying taxes, penalties, and a loss of your firm’s reputation.

Errors in Payroll and National Insurance

Payroll is not just limited to paying accurate salaries on time; it also includes calculating National Insurance and other deductions. Any error in these calculations will result in overpayments or underpayments, leading to corrective actions and fines, thus damaging your reputation. To tackle these errors, accounting firms are resorting to payroll outsourcing services to improve accuracy and compliance.

Negligence in Corporation Tax Planning

Miscalculations in corporation tax are a potential pitfall which can cost your clients dearly. Failing to claim relevant allowances or overlooking deadlines will result in unexpected bills.

Missing Deadlines

Every tax has its deadlines and must be adhered to at all costs. However, there are many instances where the deadline has been crossed, mostly unknowingly. The reason behind missing the deadline is the handling multiple responsibilities. Such mistakes have immediate financial consequences for your clients, including late fees and penalties.

Streamlining Multi-Tax Management Through Technology

If your clients have their business spread worldwide, you must handle multiple countries’ VAT and local tax requirements. Managing numerous tax systems without compromising on time, accuracy, or control is challenging for your accounting firm. However, technology can help you streamline how you will handle multiple tax systems, so it’s worth trying out either by getting the tech in-house or through accounting outsourcing services.

Currently, your UK-based accounting firm is dealing with clients who:

- Sell products online across multiple countries

- Operate on platforms like Amazon, Shopify, and eBay

- Must adhere to local rules in various jurisdictions

Each tax jurisdiction has rules, reporting formats, deadlines, and currencies. Manually managing these variations is not only error-prone but also unsustainable.

How Technology Simplifies Multi-Tax Management

Centralised Dashboards for All Tax Jurisdictions

Select any modern tax management software, and it will have the feature to collect multiple tax information from various sources in a single view via a centralised dashboard. These dashboards help track due dates across regions, calculate real-time tax liabilities, and generate multi-jurisdictional reports immediately.

Automated Tax Calculations

Thanks to AI-powered tools that automatically select and apply the right tax rates based on the product type, origin, and customer, there is no need to manually check EU or UK VAT.

Real-Time Data Sync with Accounting Platforms

Many solutions integrate with platforms like Xero, QuickBooks, BrightPay, and Shopify, automatically pulling sales and expense data for faster reconciliation and submission.

The Strategic Role of Tax Planning in Client Growth

For any proactive accounting firm, tax planning is a tool for fueling your client’s growth. We all know the UK market is competitive, and compliance keeps changing. In such situations, tax planning can take a back seat. When you strategically plan tax, you are not just filing returns for your clients but becoming a trusted partner in their growth.

You can find relief, mitigate risks, and enable your clients to make smarter investment decisions. This will result in faster and more informed decision-making, allowing them to survive and thrive for a longer period.

Key Areas Where Tax Planning Drives Growth

Profit Retention Through Efficient Structures

It will be a value-added service when you can advise your clients whether to operate as sole traders, partnerships, or limited companies. Such advice will dramatically affect their profits. By recommending the proper structure, you will help your clients retain more profits, which will be reinvested into business expansion.

Utilising Reliefs for Innovation and Investment

You must have noticed that many of your SME clients underclaim reliefs such as R&D Tax Credits due to a lack of insights and tax planning. However, you can unlock these opportunities for your clients through strategic tax planning or outsourcing services.

M&A and Exit Planning

When your client goes through acquisitions, tax structuring becomes very important. Planning for Capital Gain Tax (CGT) implications, share schemes, or entrepreneurs’ relief early can shape the trajectory and value of a deal. Naturally, there will be a possibility that you will not be able to offer such a service on your own, but with the help of accounting outsourcing services, you can do it.

Cash Flow Optimisation

Forecasting tax liabilities and CIS deductions can help you optimise your client’s cash flow, reducing their financial strain during growth cycles.

International Expansion and Cross-Border Tax

Strategic advice on transfer pricing, double taxation, and local compliance is critical for scaling businesses expanding beyond the UK.

Conclusion

The taxes and tax system in the UK can be complex and wide without complete knowledge. For this reason, we have prepared this guide to help you better understand the taxes with which your clients will deal. After going through this blog, you will conclude that handling these taxes requires expertise, which you hire directly in-house and shell out money. However, another low-cost, high-benefit option is availing expert services through accounting outsourcing services.

Corient is among the top providers of accounting outsourcing services and professional experts to accounting firms in the UK. Our services and expert advice have improved the quality and professionalism of multiple accounting firms when it comes to tax filing, calculations, and related services. You can state your requests or queries on our website contact form, and our executive will contact you as soon as possible.

Best of luck in your future endeavours, and hope to connect with you soon.