Payroll Plans in the UK: Why April Is the Best Time to Make the Right Move

- Introduction

- What Does Payroll Mean and Why Is It Critical for Businesses?

- Why April Is the Best Time to Review Payroll Plans

- Key Benefits of Updating Payroll Plans in April

- Payroll Compliance and Legal Updates for 2025

- Payroll UK Solutions: In-House vs. Outsourced Plans

- Why Choose Corient for Payroll Outsourcing in the UK

- 100% Compliance with UK Legislation

- Reduced Turnaround Time (TAT)

- Experienced Payroll Experts and Latest Technology

- Accurate Payslips, RTI Submissions, and Year-End Reporting

- Scalable Services Tailored to Each Client’s Needs

- No Hiring, No Training, and No Hassle

- Business Continuity and Holiday/Sickness Cover

- Expert Support and Consultancy

- Enhanced Employee Experience

- Start Your Payroll Planning Journey Today

- Frequently Asked Questions(FAQ)

- Conclusion

Introduction

Gone are the days when payroll was just about processing monthly employee salaries. These days, payroll processing is expected to ensure efficiency, compliance and operational efficiency. We are saying this because we have noticed many clients (entrepreneurs) of accounting practices demanding payroll plans and requests for multiple add-ons. If you are facing similar demands then you need to tell your clients to wait until April. Why? Because it’s the start of the UK tax year.

With the UK tax year resetting every April, this month presents a prime opportunity to review and refine payroll strategies for your clients. In this blog, we’ll explore why April is the ideal time for payroll planning, how it affects compliance, and why accounting practices should consider streamlining or outsourcing payroll services for long-term value.

What Does Payroll Mean and Why Is It Critical for Businesses?

For those who need to know, payroll is a process of calculating and then distributing wages. Along with calculating wages, payroll also handles tax deductions, contributions to National Insurance, pension auto-enrolment, and other employee benefits. Under payroll also comes the responsibility of addressing queries and errors related to payroll as quickly as possible.

An inefficient payroll will make your clients (business owners) employees dissatisfied with constant errors, delayed payments, incorrect tax deductions, and lack of support for correcting mistakes. Such employee dissatisfaction will lead to the loss of talented and trained employees, demotivation, and frequent expenses on training new recruits.

When loss of talent and demotivation hit a critical mass, it will severely impact your client’s smooth operation. All this makes payroll very important to prevent such a situation for your clients.

To answer your question about what payroll means for your clients, it means employee satisfaction, HMRC compliance, and overall financial health. Therefore, it is important for you to offer the best payroll services and support for your clients to gain their trust and run their operations smoothly.

Why April Is the Best Time to Review Payroll Plans

For accounting practices and businesses in the UK, April is not an ordinary month. It is a month that can bring both happiness and stress. The reason is that it is the beginning of the new tax year and HMRC uses this opportunity to implement new schemes, tax rates, and so on. That’s why it is the best time for you to revisit, revise, and refresh payroll strategies for clients.

Let’s see its benefits in detail.

The UK Tax Year and Its Impact on Payroll Strategy

April is the start of the UK tax year, and it is the month when all the decisions taken by HMRC and other regulatory agencies come into effect. Regulators have recognised that instead of implementing new income tax thresholds, National Insurance rates, and employment legislation immediately, it is beneficial to implement them at the start of the UK tax year, that is, in April.

These new implementations have a direct impact on payroll; hence, it is wise to review your clients’ payroll at the start of April. Such reviews will allow you to implement new legislation and update your clients to new tax codes accurately, thus making your clients compliant and saving them from penalties.

Benefits of Resetting Payroll in April: Clean Data, Smooth Transitions

Updating employee records, correcting records or integrating new cloud based payroll accounting software during the tax year will create more confusion, thus causing more harm than good. Such resetting in payroll must be done only in April, which is the start of the UK tax year and offers you a clean slate to make any changes. You can also start a partnership with your payroll outsourcing partner without creating mid-year complications.

Aligning Financial Planning and Reporting with Payroll Cycles

To make life easier for your clients, you must ensure their payroll year is in sync with the tax year. By aligning your client’s payroll with the tax year, you are helping to create and maintain consistency across all financial reports, thus making it easier to forecast labour costs, manage cash flow, and prepare year-end accounts.

Hence, whenever you get a chance to advise your clients, make sure to educate them about the importance of synching their payroll from April.

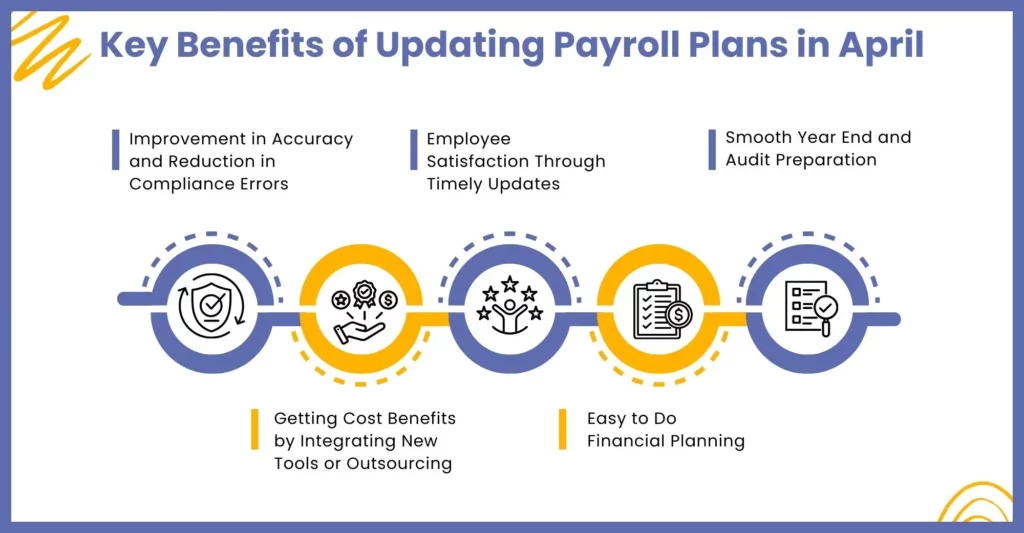

Key Benefits of Updating Payroll Plans in April

Always choose to update your client’s payroll in April and enjoy benefits that are not limited to compliance. By following the April period for updating payroll, you enhance efficiency, accuracy, and client satisfaction.

Let’s go through some of those benefits.

Improvement in Accuracy and Reduction in Compliance Errors

Always expect April to be the month of new tax codes, regulations, and statutory rates. That’s why it is important to update your client’s payroll strategies beforehand to reduce the chances of incorrect tax deductions and compliance penalties. Starting the payroll for your clients in April will give you a fresh start, thus ensuring error-free submissions of Real-Time Information (RTI) and year-end reports.

Getting Cost Benefits by Integrating New Tools or Outsourcing

If you are considering integrating new cloud based payroll software or switching to outsourcing payroll, the best time to do so is in April. Switching to outsourcing or getting an advanced payroll software will undoubtedly give you long-term benefits but will lead to disruptions you cannot afford in the middle of the year.

Hence, choose the April period to implement the strategic decision of outsourcing payroll and free your internal team’s time for more important work. Also, through outsourcing, your client will get the benefits of the latest technology and scalability without enduring any cost for recruitment and tech.

Employee Satisfaction Through Timely Updates

There are some simple ways to satisfy an employee:

- Accuracy in payslips

- Tax codes reflect new thresholds

- All benefits are processed without any problems

To maintain that accuracy, you will have to keep your payroll process in synch with the latest payroll regulations and tax codes set by the HMRC. The best time to incorporate all these updates is in April, when all the salary reviews, bonus and entitlement updates are incorporated at the start of the tax year, thus promoting transparency and trust.

Easy to Do Financial Planning

When you update your client’s payroll plan in April, you help in improving the

- Forecasting of Cash Flow

- Budgeting

- Management Reporting

These three points presents a clear picture to your clients of their labour costs and allows you to give them strategic financial advice along with regular payroll functions.

Smooth Year End and Audit Preparation

When you start the tax year with accurate and error-free payroll data, the year-end process will be equally smoother. It will also reduce your time on banking reconciliation and client audit preparation.

Payroll Compliance and Legal Updates for 2025

As of April 2025, your clients must know key payroll compliance and legal updates. These legal and compliance updates are as follows:

- Increased in minimum wages: Your payroll software must automatically incorporate the new wage calculations to reflect the changes.

- Updates in National Insurance: The NIC rates applicable from 6th April 2025 to 5th April 2026 will be 15%, an increase from 13.8% on employees’ earnings above £9,100 a year.

- New Reporting Requirements for HMRC: Stricter real-time reporting obligations have made integrated payroll software essential for seamless tax and compliance reporting.

- Updates in Holiday Pay Calculations: Changes in holiday pay will require your payroll accounting software to calculate the entitlements for employees with irregular hours accurately.

- Auto-Enrolment Pension Expansion: Many employees will be eligible for auto-enrolment, thus increasing your client’s contribution. Your payroll accounting software must accurately track eligibility and ensure compliance.

Payroll UK Solutions: In-House vs. Outsourced Plans

Every accounting practice is in a dilemma regarding the best way to handle payroll, in-house or outsourcing payroll through a dedicated service provider. Both have their strengths and weaknesses, but only one will suit your needs based on your client’s business size and budget. Let’s break it down.

Pros of in-house

- Full control of the client’s data

- Tailoring services as per requirement

- Data security in your hands

Cons of In-house

- Time-consuming

- Risk of non-compliance

- Limits in Expertise

Pros of outsourced payroll

- Access to expertise

- Cost-effective for large clients

- Saves your in-house team’s time

- Access to advanced tools and software

- Reduced risks of non-compliance

Cons of outsourced payroll

- Less control over the process

- Sharing of sensitive payroll data to outsider

The current trends in the accounting world and the above points tip the favour towards outsourcing payroll for accounting practices. But we will leave this decision to you and on factors like the client’s business size, priorities, and complexities.

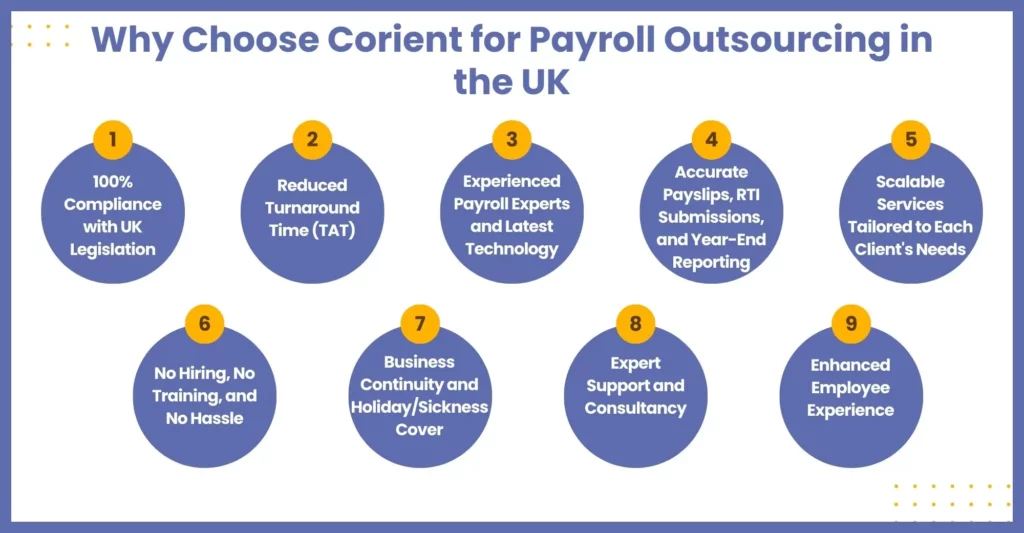

Why Choose Corient for Payroll Outsourcing in the UK

Accuracy, efficiency, and full compliance in payroll are non-negotiable, and while there are many ways to achieve that, none is as good as outsourcing payroll. When it comes to payroll outsourcing, you must place your trust in Corient, which has successfully gained the trust of other accounting firms.

Corient has built its name by offering cutting-edge solutions through its expert team of accountants and a commitment to seamless service. Here’s why you must choose Corient as your payroll outsourcing partner.

100% Compliance with UK Legislation

Constantly monitoring changes in payroll legislation is challenging for your in-house accounting team. However, when you outsource payroll to Corient, the payroll team will handle your payroll and keep it updated with the latest HMRC regulations, including tax codes, NICs, minimum wages, etc. We will manage all your compliance and prevent all costly penalties.

Reduced Turnaround Time (TAT)

Your clients will never appreciate any delays in payroll. After all, it damages their reputation in front of their employees. To reduce the time taken in payroll management, you can choose Corient, which has the experience and reliability to offer payroll processing that meets deadlines without compromising accuracy. Our time-tested process and experienced team will help reduce the turnaround time, thus ensuring your clients’ employees receive their salaries, payslips, and tax submissions on time.

Experienced Payroll Experts and Latest Technology

Our team of payroll professionals is highly trained and are kept updated on the latest happenings in the payroll world. We also train them on the best payroll software, especially the ones that integrate easily with other business tools to streamline payroll processing. This perfect balance of human expertise and technology has enabled us to run payroll smoothly for numerous clients every time.

Accurate Payslips, RTI Submissions, and Year-End Reporting

When Corient is by your side, you will not have to worry about accuracy in payslips, Real-Time Information submissions, and year-end reporting. We handle P60s, P11Ds, RTI filings, and all year-end forms on your behalf so that your clients are audit-ready and fully compliant at the end of each tax year.

Scalable Services Tailored to Each Client’s Needs

It is difficult to be flexible and scale up your payroll services according to your client’s demands, but not for Corient. Our payroll solutions are flexible and can be scaled up to meet all your client’s unique requirements. No matter what your client’s business size is, we will adapt our services accordingly. Our services scale up as your client’s payroll requirements grow.

No Hiring, No Training, and No Hassle

By hiring Corient’s payroll services, you will not feel the need to expand and train your in-house payroll staff. We will be dedicating a team of payroll specialists who will take care of your payroll responsibilities, thus saving you time and resources. The resources expended on maintaining the in-house team can be diverted towards other essential tasks.

Business Continuity and Holiday/Sickness Cover

Expect disruptions in your payroll process due to employee sickness or holidays, but that will not be a worry with Corient. We will work as a backup in case of disruptions due to holidays or sick leaves in your in-house team, thus ensuring your client’s payroll process continues without any interruptions.

Expert Support and Consultancy

We have not limited ourselves to payroll processing services; instead, we have expanded to offering expert advice. Whether it’s tax planning, benefits analysis, or handling complex payroll issues, our payroll team will provide you with expert advice that will help you advise your clients on making better decisions.

Enhanced Employee Experience

The main aim of maintaining a smooth payroll process is to keep your client’s employees happy. Corient guarantees that by providing accurate payslips and timely payments, your client’s employee satisfaction will increase, and the employee retention rate will improve.

Start Your Payroll Planning Journey Today

We are already in April, and we think you would not like to start your tax year with the same old payroll headaches. So, this is your opportunity: whether it is selecting a payroll outsourcing partner or integrating an advanced payroll accounting software, get it done in April. Also, explore the option of our payroll outsourcing services and make your payroll services compliant and cost-effective.

Frequently Asked Questions(FAQ)

It’s not mandatory, but updating your payroll software in April is strongly recommended to stay compliant with the latest tax codes and thresholds.

Yes, you can choose to outsource payroll in the middle of the year, but it is not desirable. April will be the best month to switch to outsourcing with minimal disruptions.

Not matching the payroll with the new tax year will lead to a mismatch with the new tax codes and schemes applied by HMRC. Such a mismatch will result in employees paying too much or too little tax.

Handling payroll in-house is resource and cost-intensive, including software expenses, staff salaries, and ongoing training. However, outsourcing payroll will reduce all these expenses and quicken the whole process while maintaining quality.

Payroll deals with employee salaries, which are considered allowable expenses. This means they are deducted from your clients’ business profits, thus reducing their tax amount and corporation tax.

Conclusion

We understand that payroll planning cannot be done in haste. After all, it is a strategic decision that will have a long-term impact on compliance, cost, and client satisfaction. It is our opinion that April is the perfect month to make such an important decision. It is during this period that you can evaluate your payroll processes without any risks and take corrective measures. These corrective measures could be anything from automation to outsourcing based on your requirements.

However, automation can be achieved through outsourcing so outsourcing will be a better choice for your accounting practice. If you are looking for an outsourcing partner who will offer that option, then Corient has to be your first option. Not only will Corient automate your entire payroll process, but it will also deal with employee queries and corrections on your behalf, thus saving time. If you have any queries related to our payroll services, you can forward them to our website contact form, and our executive will contact you as soon as possible.

Looking forward to partnering with you and offering the best of outsourcing services.