Breaking Down the Outsource Bookkeeping Services Cost in the UK

Have you faced a situation where clients suddenly come up with additional accounting work for which you will have to scale up and provide further services? The possibility of it is high and your competitors also face such situations. New hirings will aid in scaling up your capacity but also increase your cost. Only outsourcing can be your savior by scaling up your accounting services without straining your budget. Through outsourcing services, you will not only be able to scale up but also get additional services and improvements in workflow. All this can be achieved without exceeding your budget.

Many accountants and accounting practices are placing their trust in outsourcing because of the multiple benefits and capacity expansion it offers. Still, there will be one question that will keep coming, How Much Does It Cost to Outsource Bookkeeping? The outsource bookkeeping services cost will depend on your chosen outsourcing model and the services you want. So, to understand the cost of bookkeeping outsourcing you will first have to understand the models available.

Engagement Models for Bookkeeping Outsourcing

Every accounting practice has its unique accounting requirements for this reason bookkeeping outsourcing service provider offer customised pricing that will meet their exact requirements. However, certain models are highly preferred by your competitors, these models are:

Full-time Employee Model

Under this model, an outsourcing service provider will provide a dedicated employee to you at a fixed price.

Onshoring Model

Some practices prefer to meet the outsourcing representative onshore to resolve queries or for a quick discussion. To address this demand, many outsourcing service providers are offering onshore support.

Dedicated Personal Model

Under it, the outsourcing service provider will assign a dedicated accountant who will only work for you and will provide all the required technical and admin support. In this model, you will also get specialised services to handle complex accounting matters which will help you in scaling up your accounting practice.

Understanding Outsourced Bookkeeping Cost in the UK

Bookkeeping is vital for the smooth running of business operations for all your clients starting from a small sole trader right up to a large business corporation. For that, they can hire an in-house team or depend on your accounting practice to handle bookkeeping on a daily basis. However, UK accounting standards are high and HMRC regulations are implemented strictly. With so much pressure on your in-house teams, accounting firms in the UK have started to rely on outsourced bookkeeping service providers for additional support.

While outsourced bookkeeping is comparatively less costly than building an in-house team if not planned carefully it can be a burden on your finances. Hence, it is important to understand the bookkeeping outsourcing cost in the UK.

To understand the outsource bookkeeping services cost you will have to focus on pricing models and factors that influence the cost. Let’s elaborate more on it.

How Much Does It Cost to Outsource Bookkeeping?

Multiple factors influence the cost of bookkeeping outsourcing but none influence it more than the pricing models adopted by outsourcing service providers. These price models are as follows:

- Hourly Rates: Currently, the average cost of a bookkeeper’s service will be £13.33 per hour (subject to change). However, this will increase if the bookkeeper possesses specialised skills.

- Monthly Fees: Small-sized accounting practices are offered monthly package by service providers. Such a package may will cost between £200 to £600 per month (subject to change).

- Yearly Fees: Many would prefer only to pay for yearly bookkeeping services. The cost for annual bookkeeping services could range between £1,200 to £5,000 or more but that could change based on your requirements.

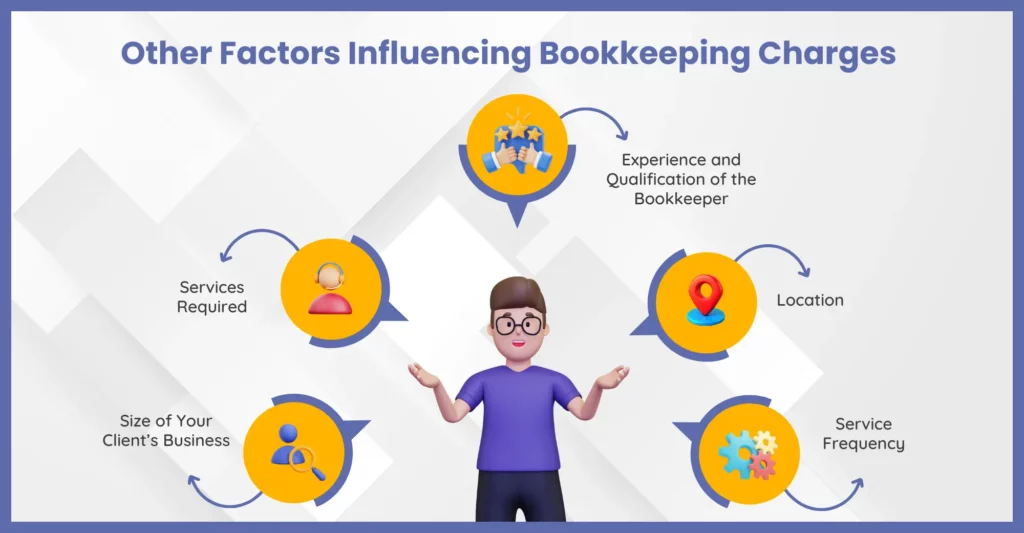

Other Factors Influencing Bookkeeping Charges

It must be noted first that every outsourcing service provider has its own bookkeeping charges. Plus, many other factors will affect the bookkeeping charges you will pay. Many of these factors also affect the overall accounting outsourcing cost but more on that latter. We are going to focus on some of those important factors that impact outsource bookkeeping services cost first.

Size of Your Client’s Business

One of the major factors that influence bookkeeping charges is the size of your client’s business. The larger the business size of your clients more will be its transactions. Also, there will be a considerable number of complex transactions that will require expertise and time, leading to added costs. For example, if your client is a small sole trader then there will be a smaller number of monthly transactions which will require only a few hours of bookkeeping support. However, if your client is a medium-sized business then it will have hundreds or thousands of transactions which will lead to a lot of work for your outsourcing partner and more costs.

Services Required

The services you require from your bookkeeping service provider will also influence the cost. If you require only basic bookkeeping services such as banking reconciliations and data entry then the outsource bookkeeping services cost will be minimal. But if you require advanced bookkeeping services along with payroll and VAT then expect the cost to go up.

Experience and Qualification of the Bookkeeper

A bookkeeper’s experience and qualifications matter when outsourcing your bookkeeping task to a service provider. The higher the experience or certification of the bookkeeper more will be its service charge. An experienced bookkeeper comes with multiple professional certifications from the Institute of Certified Bookkeepers (ICB) or the Association of Accounting Technicians (AAT) and professional bookkeeping service providers like Corient hire such bookkeepers. Only those who are willing to shell out more money can get access to their expertise and experience. For further research we would advise you to study the case studies and website of service providers and compare them, it will give you a clear picture of their experience and qualifications of their staff.

Location

Location matters when it comes to determining the bookkeeping rates. If the outsourcing service provider is located in London and hires bookkeepers only from London then your bookkeeping charges will be high. On the other hand, those service providers based in semi-urban or rural areas and recruiting from those areas will charge less for bookkeeping services. This price difference is due to the cost of living which is higher in expensive cities like London.

Service Frequency

Whether you need bookkeeping services from a service provider daily or only on certain occasions will affect the bookkeeping cost. Some of your clients will need bookkeeping services on a daily, monthly, or yearly basis, while some will require them only on some occasions like tax seasons. Outsourcing bookkeeping service providers will offer various pricing models and based on the service demand frequency the per-hour rates will be decided. More the frequency of bookkeeping service less will be the hourly rates.

Frequently Asked Questions (FAQ)

Once you outsource to a trusted partner you will be able to get access to their skilled accounting talent which will reduce your cost and scale up your capacity as and when required. The outsourcing team will work like a backup support functioning as per your preference.

Comparatively, outsourcing is more cost-effective than in-house hiring because it reduces or stops expenses related to salaries, benefits, pensions, training, and office-related infrastructure. On the other hand, you get access to experienced and certified bookkeepers.

Outsourcing is a common practice among accounting practices in the UK to outsource accounting tasks to third-party providers. The benefits of outsourcing can be substantial – from cost savings and efficiency gains to greater competitive advantage.

The United Kingdom is home to multiple top bookkeeping service providers who have gained the trust of numerous accounting firms by offering accurate, compliant, and scalable solutions. The best bookkeeping service providers offer to manage day-to-day transactions, bank reconciliations, VAT records, and real-time reporting, often integrating with cloud platforms like Xero, QuickBooks, and Sage.

Nowadays, top bookkeeping service providers in the UK are also entering the realm of providing financial insights. Among them is Corient, which possesses UK accounting knowledge and offers cost-effective delivery, robust internal controls, and ISO-certified processes.

Conclusion

You can help your clients in streamlining their bookkeeping services in multiple ways and outsourcing bookkeeping is surely one of the best ways. The only thing that will hold you back is the cost and we have taken the pain to elaborate in detail as to how the outsourced bookkeeping services are priced and what are the factors that influence it. Having a deeper understanding of how outsourced bookkeeping services are priced will help you in factoring your budget, thus allowing you to be in a better position to scale up and offer value-added services to your clients.

Now while focusing on bookkeeping outsourcing do not reduce your focus on the bookkeeping outsourcing service provider. To enjoy the full benefits of bookkeeping outsourcing you will have to choose a professional outsourcing service provider like Corient. We are a leading outsourcing service provider in giving tech-savvy and crucial accounting outsourcing services which include bookkeeping services. Our rich track record has made us the first choice for many accounting practices who are seeking an outsourcing partner. Take a look at our services and send your queries or doubts on our website contact form, our executive will contact you at the earliest.

Wishing you luck and looking forward to a long-term association.