A Comprehensive Guide for Accounts Payable Outsourcing

- Challenges of Internal Accounts Payable

- What is Accounts Payable Outsourcing

- Accounts Payable Outsourcing Procedure

- Benefits of Outsourcing Accounts Payable

- Challenges of Outsourcing Accounts Payable and How To Overcome Them

- Accounts Payable Automation vs Accounts Payable Outsourcing

- How to Choose the Right Service Provider for Your Practice

- Tips for a Smooth Transition and Ongoing Management

- Frequently Asked Questions (FAQ)

- Final Thoughts

With your growing accounting practice, your responsibilities also increase. You need to ensure that all your operations are optimised and cost-effective. You need to handle more and more complexities in your financial processes. To reduce some of your responsibility, one of the popular solutions several practices in the UK have been opting off lately is outsourcing their accounts receivable and account’s payable function. But is outsourcing your accounts payable process okay for and feasible for your practice?

This comprehensive guide on accounts payable outsourcing will therefore answer all your queries and concerns. So, staying with us till the end of the blog we will give you an in-depth idea of what is accounts payable process; what challenges one can face if the accounts payable are retained in-house. This blog will also run you through the accounts payable outsourcing procedure including the benefits and drawbacks of outsourcing and how you can overcome those drawbacks. It also includes a discussion over outsourcing or automating the accounts payable process, which is beneficial. Lastly, tips for selecting the outsourcing service provider are provided along with how you can seamlessly complete the entire transition process. Accounts Payable Overview

Accounts payable is the amount that a business owes to its vendors or suppliers towards the goods or services received. Hence, any delay or missed payments will impact the company’s brand image and the vendor’s or supplier’s trust. So, for fostering a healthy relationship with vendors, managing the accounts payable process efficiently is crucial. It will also help practices bring in financial stability and enhance your client’s cash flow management.

The accounts payable process involves four key elements:

- Invoice Processing

- Purchase Order (POs)

- Data Entry

- Payment Processing

Challenges of Internal Accounts Payable

Managing any process in-house is always considered safe and easy, but only if you are running a small accounting practice, where the transaction volume is less. But, once your client’s business starts growing, and the transaction volume keeps on increasing it becomes difficult to manage all the processes in-house, especially in the case of accounting and payment processes.

Since the accounts payable processes involve several steps from:

- Approval of invoices,

- Matching them with the receipts,

- Responding to the vendor’s inquiries or discrepancies

A significant amount of time is involved in all these processes. Thus, it becomes quite challenging to address them within the stipulated time for the smooth flow of the entire process. To avoid all these challenges, you can consider outsourcing the processes.

What is Accounts Payable Outsourcing

Outsourcing your accounts payable process implies, authorising a third party wherein they will be managing and handling your accounts payable process which comes under outsourced bookkeeping. Outsourcing companies are specialised professionals having vast experience in handling the entire accounts payable and various other processes efficiently. Hence, the outsourcing company will be undertaking complete responsibilities of:

- Processing your invoices

- Validating these invoices

- Recording your expenses

- Processing your vendor payments

- Managing your vendors on your behalf

- Reporting your accounts payable

Outsourcing your accounts payable process will also help you gain other benefits such as:

- Cost-effective

- All your compliance and other financial regulations are maintained effectively.

- The efficiency of the entire process increases with the help of specialised and expert knowledge possessed by outsourced professionals.

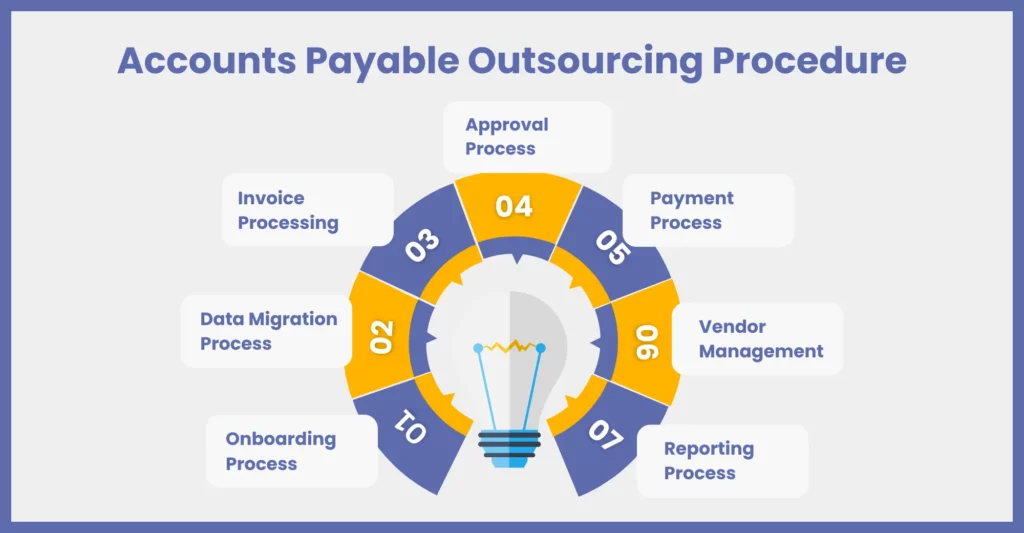

Accounts Payable Outsourcing Procedure

If you are keen on hiring an outsourcing service provider that will handle your accounts payable process on your behalf, it is necessary to have a complete understanding of the processes they will be offering you.

Generally, several of the third-party companies provide an extensive range of services which include, the use of the latest software technology, and additional consultancy services that can help with managing your accounts payable more efficiently. Maximum accounts payable outsourcing service providers provide the below-mentioned services and follow these procedures.

1. Onboarding Process:

Once you have finalised your accounts payable outsourcing service provider; an onboarding process takes place. In this process, a detailed discussion about your practice requirements, your expectations, and your entire accounts payable process happens.

2. Data Migration Process:

Once the discussion stage is complete, the next stage is migrating the data to the outsourcing provider’s systems so that it can start handling the accounts payable process. At times, many providers also provide services by using the client company software. Discuss with your outsourcing firm for the best suitable methods.

3. Invoice Processing:

One of the key aspects of the accounts payable process is “Invoice Processing”. In this process a complete verification of your purchase orders with the invoices sent by the vendors or suppliers (either electronically or hard copy) is essential. Therefore, it must be processed with complete accuracy. All the debit memos must also be processed with complete accuracy. If the invoice processing is done with complete accuracy it helps in facilitating cash flow management efficiently and streamlining your entire process.

4. Approval Process:

Once the invoices are processed, the outsourcing service provider will send them to your practice for review and approval. In case of any changes, the same is conveyed to the outsourcing service provider for making the necessary amendments to the invoices.

5. Payment Process:

Any payment processing is crucial for your clients. Hence, they must be efficiently handled. In the case of the accounts payable process, timely and accurate payments to the vendors or suppliers are necessary. Therefore, it helps in fostering a healthy relationship with your vendors. Your accounting practice will also get a real-time idea about your client’s financial stability and cash flow status.

Several accounts payable outsourcing service providers, provide services wherein they manage the vendor payment process. These payments are released once the invoices are approved by your practice.

Since the outsourcing service providers will be handling the vendor payments, it becomes extremely critical to conduct thorough checks before finalising the onboarding process.

6. Vendor Management:

Managing vendors is a critical component of the accounts payable process. It includes several activities, such as:

- Onboarding vendors

- Maintaining up-to-date records

- Constantly communicating with the vendors to foster a healthy relationship with them.

- Resolving any discrepancies

Failing to handle all these activities efficiently will hamper the relationship with the vendors and create several issues such as:

- Delayed deliveries of the goods or services.

- Problem with invoicing

- Missing all the offers and discounts

- Losing contracts with key vendors

Also, if the records are not maintained up to date it could lead to overpayment or underpayments to the vendors, wherein underpayments might even attract late fee charges.

Since several accounts payable outsourcing service providers also provide vendor management services, it is advisable to adopt those services. As a part of these services, they will be:

- Addressing all vendor inquiries

- Handling all the vendor issues relating to payments

- Ensuring that there is a smooth flow of communication with the vendors.

7. Reporting Process:

The accounts payable outsourcing service providers provide regular reporting of all the accounts payable activities. These reports include checking outstanding liabilities, payment status, and all other relevant financial data. So, all these data will be available to you on your dashboard of the accounts payable software provided by the outsourcing provider.

Benefits of Outsourcing Accounts Payable

1. Saving of Time and Money:

Accounts payable outsourcing can help your accounting practice in saving time and money. It will help in reducing your overhead costs that are associated with resource hiring, and purchasing of AP software in-house. The outsourcing provider already possesses skilled labour and the latest software that can help in streamlining your entire AP process. Yet another cost saving is receiving early payment discounts from the vendors or suppliers, and avoiding penalties, or overpayments. You can redirect these towards strategic planning and the growth of your business.

2. Improving Efficiency:

Adopting accounts payable outsourcing services will enhance the efficiencies of your practice. These outsourcing companies adopt the latest and new technologies and software which helps streamline your entire accounts payable process. Using the latest software will also help save time and reduce manual errors in invoice processing and payments.

It also contributes to maintaining a healthy relationship with vendors and suppliers, as it ensures that we complete the entire workflow according to accelerated turnaround times. It also contributes to maintaining a healthy relationship with vendors and suppliers, as we complete the entire workflow according to accelerated turnaround times.

3. Access to Better Tools:

By outsourcing the accounts payable process, you can have access to new and better tools and software systems for your process. Therefore, this will help in reducing the complexities of invoice and payment processing. All invoices and payments we process will be completely secure, thus preventing fraudulent and other security breach activities. The use of the latest tools and technologies will also help in reducing the paperwork related to manual invoicing and manual data entry. We can redirect the resources towards other strategic work where they can contribute more value to your accounting practice.

4. Constant Coverage:

Yet another benefit of accounts payable outsourcing service providers is that you will have real-time access to all the information on invoices, vendor payments, better accessibility of your client’s cash flow, and any other associated risks and issues. You can constantly track and monitor all the reports and have enhanced visibility and control over the financial transactions. It will also help your clients in making a better and more informed financial decision.

5. Improving Cash Flow:

Timely payments to the vendors or suppliers are the key benefits of accounts payable outsourcing payments. It will help your clients in improving cash flows, by following all the necessary compliances, avoiding late payment penalties, and missing any early trading discounts. By accurately maintaining the entire process, practices can avoid any overpayments to the vendors. Thus, all the timely payments will help you improve cash flows and provide necessary information to clients about their financial health.

6. Reducing Errors:

Any error can significantly lead to an increase in cost or HMRC compliance issues. In the case of the accounts payable process, most of these errors are related to manual data entry or during the approvals or deliveries of the process and purchase orders. Accounts payable outsourcing service providers have skilled and expert labourers; hence, you can benefit from avoiding these errors and ensuring seamless processing of the entire procedure right from the requisition of the purchase orders to the processing of the final payments.

Challenges of Outsourcing Accounts Payable and How To Overcome Them

While there are several benefits in outsourcing your accounts payable process, there are a few valid reasons why accounting practices in the United Kingdom refrain from opting for these services. Since there are payment processes and vendors involved in the accounts payable process selecting a third party requires careful consideration. Below are a few disadvantages of outsourcing the accounts payable process.

1. Less Process Control:

By outsourcing the accounts payable process, you may lose control over the management of your client’s financial transactions. Also, since the outsourcing service provider will be in direct contact with the vendors and resolve the issues, it means you lose personal touch with these vendors. Though your valuable time in dealing with the vendors and making payments will be free; however, lack of oversight from the entire process will also lead to increased dependency on the outsourcing provider, loss of communication with the vendors, and at times leading to transparency issues.

To resolve this issue, we advise maintaining constant communication and complete transparency with the outsourcing service provider and the vendors. Make sure to promptly address all vendor issues and concerns, while also meeting their expectations and requirements. In this way, you will also have control over the process by seeking regular updates and real-time reports from the outsourcing provider.

2. Privacy and Security Issues:

Yet another drawback or challenge can be related to privacy and security issues. Since your hired accounts payable outsourcing service provider will be handling all the vendor payments, security concerns about data handling can become one of the major concerns for you and your clients. Hence, always select a service provider once you have conducted through background check and observed necessary due diligence processes, indicating the security compliances adopted by the company.

Accounts Payable Automation vs Accounts Payable Outsourcing

Want to spend less time managing accounts payable? There are two best options available for you:

- Outsource the entire process or

- Use automation of the accounts payable process.

You might start wondering if the automation option is available, why choose third-party outsourcing?

Both these processes have their own benefit and drawbacks; therefore, it is always advisable to check the needs and requirements of your company before choosing between outsourcing or automation of the process.

It refers to implementing the accounts payable software. This software has been designed to assist you in streamlining your organisation’s entire accounts payable processes. The process includes:

- Invoice processing workflows, right from receipts of invoices.

- Matching them with the purchase orders and receipts.

- Obtaining payment approvals.

The simplification of the entire process helps with the ease of accessibility of invoices, traceability, and prompt payments. Therefore, automation can help avoid the entire manual data entry process, thereby reducing the risk of errors and enhancing efficiency. Furthermore, companies have observed nearly 49% cost savings in their invoice processing by choosing to implement an accounts payable automation process.

However, the drawback of this process is that the entire process relies on the third-party software that will be handling the process in-house, and it also requires training of the staff within the AP department. Therefore, this process is not suitable for several accounting practices, since it may not be capable of offering similar levels of results. Secondly, opting for this process entails a significant initial investment, including staff training fees, software purchases, and recurring fees from SaaS providers. Lastly, several practices also prefer having direct control over the operations rather than overseeing them.

Therefore, it is unlikely that this option will be as cost-efficient as compared to the outsourcing of the accounts payable process. By outsourcing your process, you can have access to a wide range of tools and technologies which might also include the Accounts Payable automation process. For example, if a certain outsourcing company is using the accounts payable automation process, you can benefit from this technology, without making any in-house investment. It will also provide you a competitive advantage of both outsourcing as well as automation.

Once, you have analysed all the key factors, you can select the best approach suitable for your organisation based on the terms:

- Cost

- Scalability

- Level of control

How to Choose the Right Service Provider for Your Practice

Choosing the best outsourcing company for your accounts payable process is critical. It requires an unbiased approach, because of the involvement of crucial vendor and financial data.

Below are a few tips that you must consider while choosing the best outsourcing service provider.

Assessing Capabilities:

You must ensure the evaluation of the expertise of your potential accounts payable outsourcing provider. The significant factors which you must evaluate here are:

- Years of experience within the AP outsourcing industry,

- Type of technology they are using.

- Which type of services they are providing

- How is their capacity to process different types of invoices?

- How is their track record – Ask for a case study or check for feedback from other clients.

- Their effectiveness in handling the entire accounts payable process – here also check from feedback.

- How will they integrate the process with your practice – must include a smooth and seamless transition of the entire process.

- How are their data privacy and security policies – check for certifications or audits.

- See how they are demonstrating their commitment towards safeguarding your company’s financial information and vendor’s data.

- Evaluate their anti-fraud measures and adherence to accounting principles.

- Gauge their commitment towards regulations and compliances.

- Check their capabilities to assess risk handling – evaluate their steps to mitigate risks.

Cost evaluation is essential when opting for AP outsourcing services. However, understanding that it’s not wise to solely prioritise the lowest prices is important. Decisions should also consider which service provider can offer a better return on investment along with high data security.

Tips for a Smooth Transition and Ongoing Management

Once you have finalised your service provider, careful consideration is essential for a smooth transition of the process from in-house to the outsourcing company. Below are a few essential tips that you must consider for the seamless process:

- Conduct adequate research by studying the transition phase and observing what challenges might arise during this process. Study the data of other companies on the challenges they faced and what steps they undertook to overcome them.

- Review whether the security policies of the service providers match with that of your company. If not, how can you ensure in align with them?

- Make sure you inform and involve all your key stakeholders in the transition process. Clearly define the change in the roles and responsibilities by addressing all their concerns.

- Monitor the productivity of the outsourcing company through the said KPIs and monitoring tools. Also, implement activity tracker, timesheet reporting, and project reports. All these will help you in keeping an adequate tab of the tasks along with a smooth transition process.

Frequently Asked Questions (FAQ)

While it is difficult to give you an exact cost of outsourcing accounts payable, it will depend on the size of your client’s business and will surely cost less than handling it in-house.

Multiple practices have chosen to outsource accounts payable tasks to avoid getting entangled in complicated regulatory requirements. Therefore, by delegating accounts payable tasks you will be saving time which can be invested towards other important matters.

Many businesses are preferring electronic payments over paper checks. The reason is that they are fast, secure, and transparent and are the way of the future.

Many outsourcing providers offer around-the-clock support, ensuring that your clients can get help whenever they need it. This improves their satisfaction and creates trust in your practice.

Final Thoughts

Accounts payable outsourcing can provide your practice with several benefits right from cost savings to improving efficiency and control over your financial health. Though off-lately several accounting practices in the UK are recognising the importance and benefits of choosing to outsource this process, several of them refrain from embracing this approach depending on the needs and goals of their companies.

Hence, it is always advisable to carefully weigh all the potential benefits and challenges before making the decision. By carefully evaluating the capability of the service providers and verifying all the compliance and security measures, therefore choosing the right partner will help you unlock all the potential benefits of the accounts payable outsourcing services and drive your company towards success.

With Corient UK, you can benefit from your complete accounts payable outsourcing process, by delegating all your accounts payable tasks to us which includes invoice processing, payment processing, and vendor management. We are one of the leading providers of accounting outsourcing services.

Our wide range of services includes complete accounts payable outsourcing services, bookkeeping and account services, audit services, tax outsourcing services, business tax support services, and advisory and consulting services. Our highest calibers ensure that we provide a valuable experience to all our clients, therefore allowing you to majorly focus on the growth of your business. If you would like to explore our services and discuss how we can help your business, you can contact us today!!