The Real Advantages and Disadvantages of Outsourcing Internal Audit Services

- What Is Internal Audit Outsourcing?

- Understanding the Advantages and Disadvantages of Outsourcing Internal Audit

- In-House vs Outsourced Internal Audits: Which One Is Better?

- When Should a Company Consider Outsourcing Its Internal Audit?

- Real-World Example: How a Mid-Sized Accountants Benefited from Internal Audit Outsourcing

- People Also Ask

- Conclusion

No organisation can escape from internal audit, which is designed to evaluate an organisation’s internal control, risk management processes, and compliance with HMRC. In fact, it is accurate to say that internal control cannot be neglected, but implementation has been an issue.

Due to the fast-paced nature of the UK business and accounting world, clients expect their practices to conduct internal audits of their businesses on their behalf to maintain compliance and control. However, the issue is that internal audits of multiple clients require significant financial and human resources, making it costly, time-consuming, and complex.

For this reason, many accounting practices have started paying attention to outsourcing internal audit. Outsourcing internal audit has its share of pros and cons, which must be considered carefully.

In this blog, we will explore what internal audit outsourcing involves, and moreover, we will consider the pros and cons, compare in-house versus outsourced audits, and share real-world insights for accounting practices evaluating this approach.

Let’s get going!

What Is Internal Audit Outsourcing?

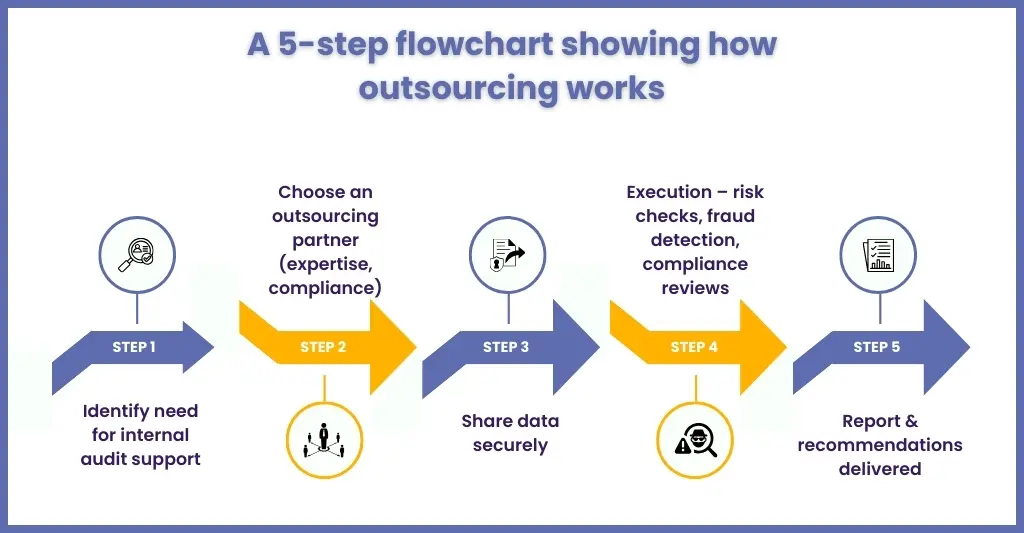

Under internal audit, your clients may ask you to perform internal audit functions on behalf of their in-house team. Moreover, you can outsource this task to an external service provider to manage it efficiently.

It’s a win-win situation for your practice and your clients because you won’t need to maintain a large in-house team to conduct audits of your clients. Also, your clients will get access to the expert auditors.

Outsourced internal audit services can cover a wide range of functions, including:

- Risk assessments and internal control evaluations

- Compliance audits and regulatory reporting

- Fraud detection and prevention

- Operational efficiency assessments

- Advisory services for process improvement

By using internal audit outsourcing services, you gain access to expert auditors and their specialised skills and knowledge. As a result, you can focus your internal resources on other core accounting activities.

Understanding the Advantages and Disadvantages of Outsourcing Internal Audit

Outsourcing internal audit has undoubtedly grabbed the attention of many accounting practices. After all, according to Jefferson Wells’ 2024 Internal Audit Priorities survey, nearly 74% of internal audit leaders use external support to meet demands. That does not mean that internal audit outsourcing is a path full of roses.

Therefore, let’s explore both sides:

Advantages

Access to Expertise

Professional outsourcing service providers have experienced auditors with deep on-ground knowledge of UK regulatory compliance and experience in risk management and process optimisation. As a result, such expertise helps enhance your audit quality and enables you to provide insights to your clients that your in-house team may not be able to.

Cost-Efficiency

Maintaining a large full-time audit team to handle all your clients’ auditing can be an expensive proposition for any mid-sized accounting practice. Consequently, many firms are exploring alternative solutions to manage costs effectively. Through outsourcing, you can reduce your expenses on an in-house audit team and provide services to your clients as and when they need them at a reasonable cost.

Enhanced Objectivity

A third-party auditors of outsourcing providers provide a new and critical perspective, thus reducing the risk of bias that arises to favour your clients.

Scalability and Flexibility

Outsourcing providers can scale up their internal audit outsourcing services as per your workload and client requirements. This makes it worthwhile during peak periods or for complex audits.

Focus on Core Activities

By outsourcing the audit function, accounting practices can focus on their core services, such as financial reporting, tax planning, and advisory, while leaving specialised audit tasks to experts. Hence, this improves overall service quality.

Disadvantages

Loss of Internal Knowledge

External auditors will not have the same understanding of your clients’ work culture, processes, or informal practices that you have. Consequently, this can impact audit context and decision-making.

Dependence on Third Parties

Relying entirely on external auditors of outsourcing providers can create problems, especially when there are delays, errors, or inconsistencies in their services. In turn, it will cause a potential decrease in your service quality and loss of trust of your clients.

Data Security Concerns

You will need to share your client’s sensitive data with an external auditor, which increases the risk of data breaches and confidentiality issues. However, this can be mitigated by selecting a provider with strong cybersecurity measures and signing a contract.

Potential Higher Costs for Complex Engagements

Yes, outsourcing internal audit is a cost-effective option for standard audits. But while doing audit planning, you might encounter more complex auditing requirements. As the complexity increases, accordingly, so will the charges.

Limited Control Over Audit Process

Outsourcing may reduce your control over the audit process that includes scheduling, methodology, and audit priorities, requiring careful oversight and clear communication.

In-House vs Outsourced Internal Audits: Which One Is Better?

Practices in the UK are confused as to whether internal audit is best or outsourced internal audits. That will depend on multiple factors:

| Factor | In-House Audit | Outsourced Audit |

| Cost | High fixed costs (salaries, training, tools) | Variable costs based on engagement scope |

| Expertise | Limited to internal team’s experience | Access to specialised auditors with diverse industry knowledge |

| Objectivity | Risk of internal bias | Independent and objective perspective |

| Scalability | Limited by team size | Easily scalable for complex or peak workloads |

| Control | High control over processes | Requires clear agreements and oversight |

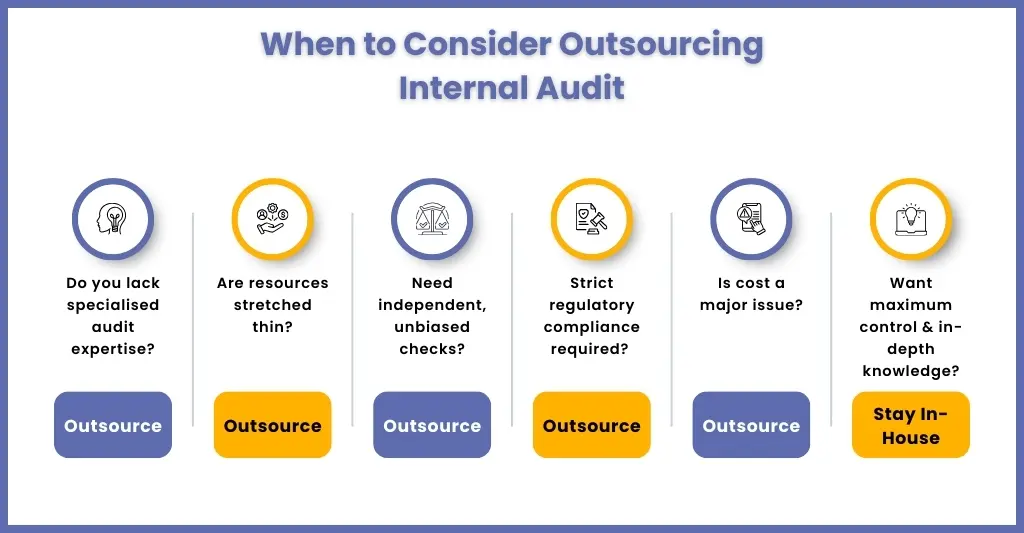

Generally, external or outsourced internal audits are attractive for practices that have to face strict regulations, have limited resources, and need specialisation. However, big accounting firms often prefer to manage it in-house to maintain complete control.

When Should a Company Consider Outsourcing Its Internal Audit?

Outsourcing internal audit services is mainly beneficial when:

- When you feel the need for specialised expertise that your current team lacks

- When your internal resources are thinly spread and hiring new auditors becomes unfeasible

- Need for an independent, objective assessment of internal controls

- Regulatory requirements demand specialised audit knowledge

- There is a desire to reduce costs while maintaining audit quality

- The firm is undergoing rapid growth or diversification that increases audit complexity

Real-World Example: How a Mid-Sized Accountants Benefited from Internal Audit Outsourcing

Fixing a Software Glitch in Directors Pay: A Real-World Case Study

In early 2025, a long-standing client approached us with a pressing issue: specifically, a payroll software error had caused miscalculations in their directors’ pay. While seemingly minor, the glitch affected year-to-date (YTD) payroll figures, resulting in incorrect data being submitted to HMRC. As a result, what followed was a complex but successful resolution led by a team of experts committed to restoring both compliance and confidence.

Problem

The issue came to light when the client noticed inconsistencies in the directors’ pay reports. Upon review, we identified a software glitch that had impacted YTD values across multiple payroll entries. As a result, the client’s internal records didn’t match the submitted reports, posing serious implications for tax reporting and employee accuracy.

Solutions

- Conducted a full audit of payroll entries

- Manually cross-checked YTD figures for all directors and employees

- Flagged every discrepancy for documentation and correction

- Contacted the software support team and coordinated a prompt resolution

Afterward, once the bug was resolved, we reprocessed payroll data and restored correct values internally, ensuring no errors remained in current reports.

People Also Ask

Internal audit outsourcing services typically include:

a. Audit planning and risk assessments

b. Evaluation of internal controls and compliance

c. Fraud detection and prevention audits

d. Operational efficiency reviews

e. Advisory reports and recommendations

f. Assistance with regulatory reporting

Outsourced auditors bring specialised knowledge, industry best practices, and independent perspectives. Moreover, they stay up-to-date with regulatory changes and provide objective assessments, reducing compliance risks and improving the overall quality of audits.

Hidden costs may include:

Additional fees for customised or complex audits

Costs related to onboarding and data sharing with external auditors

Potential delays if service-level agreements are not clearly defined

Security and compliance measures to protect sensitive data

Proper contract management and clear communication can mitigate these costs.

The main disadvantages of outsourcing internal auditors are:

Loss of Internal Knowledge

Dependence on Third Parties

Data Security Concerns

Potential Higher Costs for Complex Engagements

Limited Control Over Audit Process

The main disadvantages of outsourcing internal auditors are:

Access to Expertise

Cost-Efficiency

Enhanced Objectivity

Scalability and Flexibility

Focus on Core Activities

Conclusion

Outsourcing internal audit functions is becoming a lifesaver for accounting practices seeking specialised expertise. Moreover, it helps improve audit quality and reduce pressure on the audit team.

However, the path is not full of roses because it reduces your internal knowledge and creates dependence on third-party providers. Hence, assess the advantages and disadvantages of outsourcing internal audit and your clients’ requirements, UK regulatory requirements, and your internal capabilities thoroughly. Hence, you can make informed decisions and maximise the benefits of outsourcing the internal audit.

Speaking about maximum benefits, if you are running an accounting practice with a tremendous amount of auditing responsibilities, then approaching a professional service provider like Corient will be a wise decision.

Why should you choose us? Since 2011, we have gained high-level expertise in handling auditing requirements. Our services have reduced the likelihood of errors and missing deadlines, and our dedicated but flexible team of auditors will handle most of your audit requirements.

Consequently, the result of our audit services has been that our partner practices have become more efficient and confident in offering audit support to their clients. Interested in our internal audit outsourcing services? Please share your details and requirements on our contact form and get full access to our experts.

Overall, outsourcing internal audits isn’t perfect but for many UK accounting practices, it’s the smartest way to scale efficiently, stay compliant, and reduce costs. The key is choosing the right partner