What better way to maintain transparency in the complex UK business environment than to prepare a flawless audit report? Using an audit report, which offers an independent financial review, you can provide your clients with vital financial information, thus developing trust, facilitating decision-making, and strengthening corporate governance.

Using an audit report made by a third party will help your clients with independent financial analysis, thus offering their stakeholders reliability in the numbers. In this blog, we explore what an audit report entails, why it matters, and how professional audit services can make a tangible difference to your business.

What is an Audit Report? Definition and Purpose

An audit report is a formal independent review in which the auditor’s opinion is shared on your client’s financial position, internal controls, and regulatory compliance. In addition, it provides stakeholders with information to evaluate the organisation’s financial accuracy, transparency and adherence to UK accounting standards decided by the Financial Reporting Council. In the UK, audit reports are prepared based on International Standards on Auditing (UK) (ISAs (UK)) and International Standard on Quality Control (UK) (ISQC (UK)).

An audit report serves multiple critical purposes:

- Verification of Financial Statements: It verifies and gives opinions on the financial statements to ensure the accurate financial position of your clients is accurately reflected.

- Regulatory Compliance: Verifies that all the legal and accounting standards, such as IFRS or UK GAAP, are met.

- Assurance for Stakeholders: It gives confidence to stakeholders like investors and lenders of your clients that financial reports are verified, thus reliable.

- Decision-Making Support: Based on the audit data, your clients can make informed decisions.

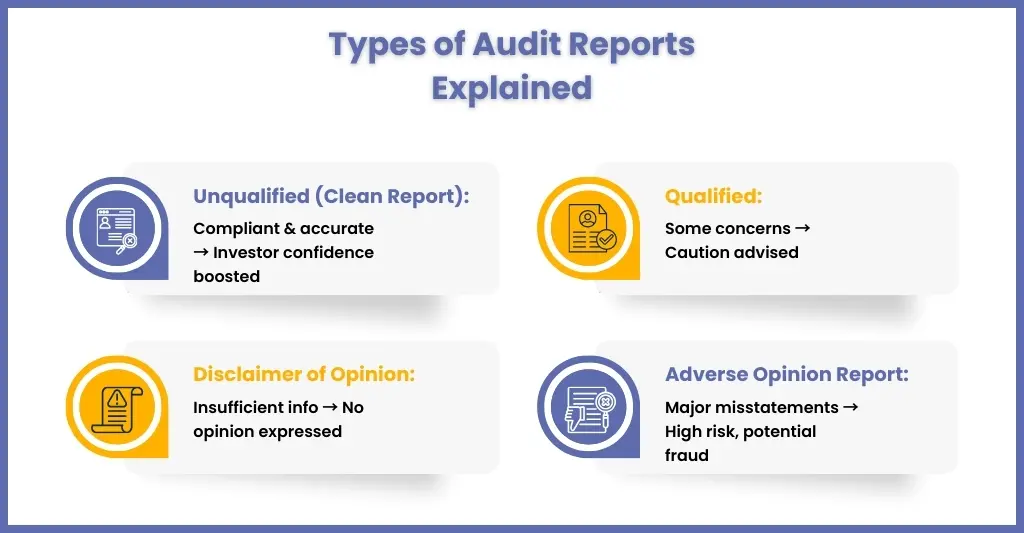

Types of Audit Reports and Their Significance

While doing audit planning, you must understand its types. Each of these audit report types provides a distinct level of assurance. The type of audit report includes :

Unqualified Audit Report

An unqualified report is also called a clean report, which all your clients would expect to receive. The issuance of this report indicates that the auditor is satisfied with the financial reporting and believes that it has followed all the UK accounting standards and regulations. As a result, such a statement suggests that your clients’ financial statements are free from material misstatements and comply fully with accounting standards, increasing confidence in their investors and stakeholders.

Qualified Audit Report

A qualified audit report is like a qualified opinion issued when the auditor is not confident about some process or transactions. Certainly, none of your client will want such a report because it casts a negative opinion in the area of financial position of your client.

Disclaimer of Opinion

Under the disclaimer of opinion, the auditor issues a report only when they choose to refrain from expressing any opinion on the financial statements. The auditor issues this type of report when the client obstructs a thorough audit or fails to provide satisfactory explanations for certain transactions.

Adverse Opinion Report

It is the final type of audit report and a big red flag. Getting such a document indicates that the financial reports contain gross misstatements and may indicate fraud. In addition, an adverse opinion report is also issued when financial reports are not by UK accounting standards. Consequently, an adverse opinion report will alert investors to stop doing business with the client and also push your clients to take corrective actions.

Why Accurate Audit Reports Matter for Your Clients

Audit reports play a vital role in the continuous improvement of your clients’ financial positions. Moreover, they give stakeholders independent assurance of the clients’ financial position. To understand in detail why audit reports matter to your clients, you have to take a look at the benefits they offer:

Regulatory Compliance

Through audit reports, you can ensure that your clients are adhering to statutory requirements, thus saving them from penalties and fines. Additionally, this prevents reputational damage to your practice.

Fraud Prevention

Audit reports also identified irregularities, mismanagement, or fraud in financial papers before they are discovered by the HMRC, helping you take corrective actions. As a result, it reduces potential legal and financial risks.

Investor Confidence

Transparent reporting creates confidence in the existing investors of your clients and attracts new investment and supports, thus promoting sustainable growth. Thus, it promotes sustainable growth.

Strengthen Internal Processes

Audit findings often reveal inadequacies or control issues, giving your clients a roadmap to improve operations and reduce risk.

Operational Insights

It also provides valuable insight which will help your clients become more efficient, especially in financial management.Therefore, they can optimise their operations for better profitability.

Enable Smart Decisions

Audits help ensure your clients meet financial reporting standards to make strategic moves from scaling to restructuring. Hence, they can make informed decisions.

Benefits of Choosing Professional Audit Services

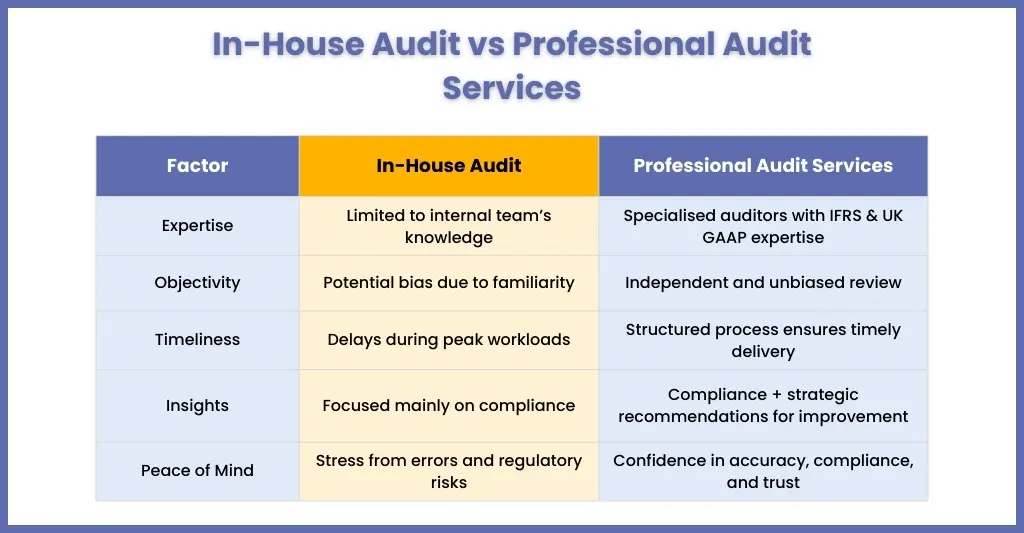

You might be having a capable audit team handling the internal audit work of your clients. However, using the professional audit outsourcing services is preferable because it brings in more transparency and independent analysis of your client’s financial standing.

Partnering with a professional audit firm delivers tangible benefits:

Expertise and Knowledge

Professional audit outsourcing firms employ certified and experienced auditors to navigate complex accounting standards like IFRS and UK GAAP. Their expertise helps in identifying potential issues easily before they become a significant risk, thus safeguarding you and your clients.

Objectivity and Independence

One of the benefits of audit outsourcing is that your clients get a pure independent perspective. Unlike your team, which may be too familiar with numbers, external auditors will do their work without any bias. For you, this independence also reinforces credibility and trustworthiness in client relationships.

Timely Reporting

Your auditing team might suffer from limited capacities, which makes it challenging to meet deadlines when the workload increases. On the other hand, professional audit firms can meet the deadlines without sacrificing quality. By leveraging proven methodologies, technology, and experienced teams, they can manage audits efficiently even during peak periods. With timely reporting, you can facilitate timely decision-making and strategic planning.

Strategic Insights Beyond Compliance

Instead of being stuck with numbers, professional audit outsourcing providers will help in identifying risks and opportunities for improvement. Therefore, they are turning into a strategic tool for your client’s growth.

Peace of Mind for Business Owners

Most importantly, professional audit services give your clients peace of mind. Knowing that their financial reporting is accurate, compliant, and independently verified allows them to focus on core operations, client services, and business expansion. As a result, it reduces the anxiety associated with regulatory scrutiny and potential errors, assuring that the company’s finances are in capable hands.

How Corient Delivers Reliable and Timely Audit Reports

Apart from providing multiple accounting services, Corient also offers audit services to countless accounting practices in the UK. We understood that there was a demand for independent audit report-making services among practices. Therefore, we have designed audit services that follow the following approach:

Comprehensive Planning

Tailored audit strategies based on your client’s business size, industry, and regulatory requirements.

Experienced Auditors

Our audit teams are proficient in IFRS, UK GAAP, and sector-specific reporting standards and will offer modified opinion and unmodified opinion based on your needs.

Real-Time Updates

We maintain transparent communication with clients throughout the audit process.

Actionable Insights

We offer simple and straightforward recommendations that will help you enhance your clients’ internal controls and financial efficiency.

With Corient, accounting practices can ensure that every audit report is accurate, compliant, and delivered on time.

Ready to Get Your Audit Report? Book a Free Consultation

People Also Ask

1. How long does it take to prepare an audit report?

Preparation time varies depending on the size and complexity of your client’s business, but our structured approach ensures timely delivery without compromising quality. Typically, mid-sized accounts are completed within 4–6 weeks.

2. Can an audit report uncover fraud or financial mismanagement?

Yes. While an audit mainly verifies the accuracy of financial statements, professional auditors are qualified to detect inconsistencies, anomalies, and potentially fraudulent activity.

3. Are your audit services compliant with IFRS or GAAP?

Absolutely. Corient auditors are fully experienced in IFRS, UK GAAP, and other relevant standards, ensuring compliance and credibility in all audit reports.

4. What is the role of auditing in financial transparency?

Auditors play a vital role in ensuring financial transparency by independently examining and verifying the accuracy, completeness, and fairness of financial statements.

5. Why is an audit report required?

Audit reports ensure financial accuracy and integrity by providing a picture of your client’s financial performance in a given fiscal year and how effectively it complies with regulations like the Generally Accepted Accounting Principles.

Conclusion

A well-prepared audit report is more than a regulatory requirement; it is a critical tool for ensuring transparency, financial accuracy, and stakeholder confidence. For accounting practices in the UK, partnering with experienced audit professionals can deliver unmatched expertise, independent assessments, and actionable insights that drive business success.

With Corient, you gain a trusted partner dedicated to providing reliable, timely, and high-quality audit reports, helping your practice and clients thrive in a compliant and transparent financial landscape. To know more about our services, contact us through our website and get a free trial and access to our experts.

Good luck, looking forward to seeing you soon.