AI in Payroll: How UK Accountants Can Leverage Technology for Growth

- Understanding AI in payroll

- Why UK Accountants Should Care About AI in Payroll

- Benefits of Using AI-Powered Payroll Systems for UK Accountants

- How to Implement AI in Payroll: A Step-by-Step Guide

- How Will This Impact Your Payroll Team?

- Common Mistakes to Avoid When Implementing AI Payroll Software

- Choosing the Right AI Payroll Software for UK Practices

- The Future of Payroll: How AI Is Shaping the Industry

- Frequently Asked Questions (FAQs)

- Conclusion

AI in payroll! Is that even happening? Yes, it is. Artificial intelligence has already started touching every aspect of accounting, and UK-based accountants know what we are talking about. The smart ones have already begun leveraging AI to reduce human errors in payroll because such errors cause 35% of employees to quit. From automation to fraud detection, AI in payroll is no longer optional, it’s essential.

Still, even after facing multiple challenges in executing payroll, we have found out that accounting practices are apprehensive in incorporating AI. There are many reasons, and most of them are misconceptions.

AI is here to stay, and to gain maximum benefits out of it, we have created this blog to break down the benefits of AI in payroll, its importance, and things to avoid.

Let’s check how AI will transform payroll processing.

Understanding AI in payroll

The key to your client’s employees’ happiness is the flawless functioning of payroll; this is why payroll is significant. Any mistakes and delays in payroll lead to resentment, and a considerable number (approximately 35%) of employees quit due to errors in their payroll. Hence, payroll cannot be taken lightly.

With time, expectations from clients and employees have also gone up, which has necessitated the incorporation of new tech such as real-time pay. Here’s where AI comes into the picture and we’ve seen it used in process automation, machine learning and natural language processing.

AI in payroll will focus on automated payroll processing (including data entry), fraud prevention, and predictive analysis.

Why UK Accountants Should Care About AI in Payroll

Gone are the days when clients will be satisfied with your payroll services handling just numbers. Due to the complex HMRC regulations or the competitive UK business environment, your clients need a streamlined payroll with more benefits to attract talent.

To fulfil your clients’ needs, you will need to execute their payroll in real-time, interact and resolve their employees’ queries in real-time, and much more. Your accountants cannot achieve this mammoth task alone and will need the help of AI in streamlining payroll.

By incorporating AI while doing payroll for your clients, you will be promoting:

- Automation and efficiency

- Allowing accountants to focus on strategic tasks

- Ensuring maximum compliance and accuracy to reduce human errors

- Enables the finding of patterns in data

- Satisfied clients and their employees due to accurate payroll processing

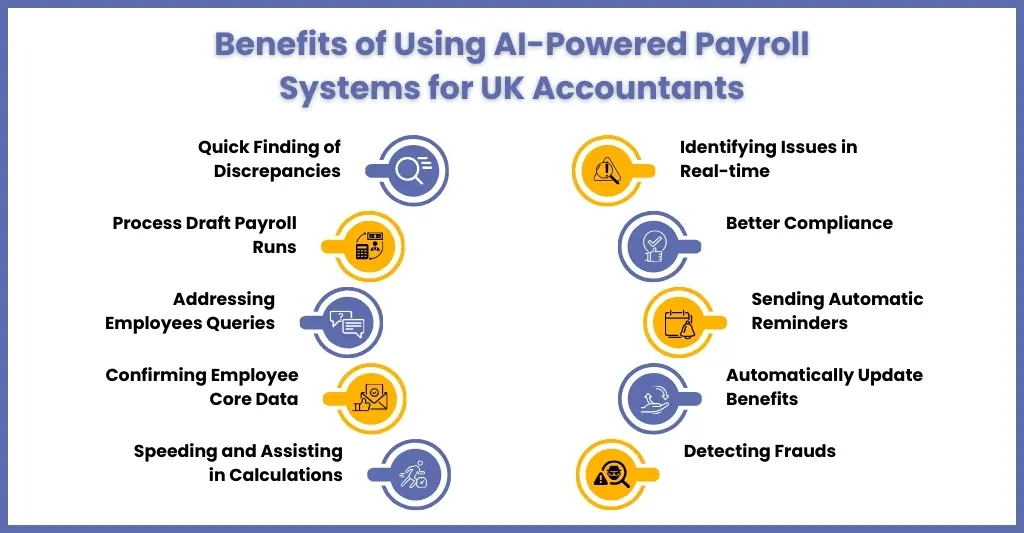

Benefits of Using AI-Powered Payroll Systems for UK Accountants

Incorporating AI in your payroll systems will bring in multiple benefits for your accountants and your clients. Whether it’s improving productivity or resolving payroll issues in real-time, AI can handle it. Let’s get to understand the benefits in detail:

Quick Finding of Discrepancies

Many employees have their working hours and pay fixed, but if there are any deviations, then catching them is difficult, especially when there are thousands of employees. However, AI will solve this problem by alerting your team about these deviations. This benefit will help you in identifying and resolving errors quickly before the payroll processing starts, thus avoiding a bigger problem.

Identifying Issues in Real-time

Thanks to AI, what seemed an impossible task of finding payroll errors among thousands manually is now achieved in a few minutes. Also, AI tools help in identifying and preventing mistakes when users are entering and submitting them, reducing the number of errors that make their way to payroll staff.

Process Draft Payroll Runs

An AI-enabled payroll system will automatically run draft payroll runs as data is entered and approved. This way, you will be able to catch potential issues early and alert your payroll team before the final payroll run. Doing draft payroll runs saves time, especially when your staff is trying to get payroll processed and finalised before the deadline.

Better Compliance

One of the biggest challenges for any accounting practice while running payroll for their clients is ensuring compliance with HMRC regulations, work hour regulations, and local laws. AI can easily flag any compliance issues and help your clients meet them.

Addressing Employees Queries

Payroll-related queries can come up anytime from your clients or their employees regarding new processes or regulations, and AI can answer them and suggest next steps. Such capability will save your time and that of your clients and their employees, enabling you to invest time in strategic decision making.

Sending Automatic Reminders

Sending reminders manually for completing, approving, or fulfilling timesheets and compliances is no longer necessary. The top payroll software these days has AI that will automatically send out reminders and flag non-compliance when required, thus saving your time and reducing the risk of penalties for your clients.

Confirming Employee Core Data

To conduct payroll processing, you will need information about employees, such as their address, hourly rate or salary, and government ID, such as a Social Security number. AI will let you know whether your payroll software has all the required information for hiring and rehiring. It will also help with updates when changes in employee profiles take place.

Automatically Update Benefits

Employees can experience changes in benefits, especially when they join a new company or if there are any benefit changes. AI will automatically adjust the benefits in the payroll systems.

Speeding and Assisting in Calculations

While doing payroll run for your clients, you will have to conduct multiple calculations such as a terminated employee’s final pay, employees’ overtime pay, vacation days taken versus earned, and company-specific items, such as investments or loan repayments. AI can perform these calculations in no time.

Detecting Frauds

There is always a possibility of unauthorised changes to timesheets, benefits or the cropping up of suspicious patterns like certain recurring expenses from an employee. An AI tool can easily identify such concerning changes or patterns by continuously reviewing data, thus alerting the concerned person.

How to Implement AI in Payroll: A Step-by-Step Guide

You might find incorporating payroll in your payroll system overwhelming, but by following the right steps, you can smoothly transition from manual processes to more brilliant, automated systems. Here’s how:

Assess Current Payroll Processes

Get started by taking stock of your existing payroll system. Check for the time spent by your accountants on tasks like data entry, handling compliance checks, or correcting errors. Also, look for issues and trouble spots; this will help you see where automation is needed for making improvements.

Fix Your Goals

Set what you want to achieve with AI in payroll; it can be speeding up the processing or improving compliance with HMRC rules. By having a set of goals, you can choose the right AI tools and measure success easily.

Choose the Right Software

Choosing the best payroll software is the stepping stone towards successful payroll processing. Hence, you must look for systems that:

- Integrate with your existing accounting tools like Xero, QuickBooks, or Sage.

- Stay updated with UK legislation to avoid compliance risks.

- Offer scalability so that they can grow with your client base.

- Provide data security features such as encryption and secure portals.

- Have user-friendly dashboards, so your team and clients can easily understand the outputs.

Compare each software option and request demos, which will help you make a confident choice.

Train Your Accounting Team

AI-enabled payroll systems can deliver only when your staff knows how to operate them. Hence, it is essential to give your staff training sessions both online and hands-on practice. During training, doubts will surface that must be shared and resolved. The goal is to build confidence so your team embraces the technology instead of resisting it.

Start Small

Instead of completely implementing AI in all payroll tasks, start taking baby steps. With a pilot payroll run, this will allow you to test the systems, identify issues, and streamline the process before it is implemented on a larger scale.

Monitor and Improve

AI is not a magic tool on which you can “set and forget”. Regular reviews are required for payroll runs, error reports, and client feedback. When you review, you will get an idea whether you are achieving your goals or not. Make adjustments as needed and continue to explore new features as the software evolves.

How Will This Impact Your Payroll Team?

One of the greatest misconceptions about AI is that it will take over jobs, which has created significant resistance to it. However, it is important to understand that AI will not replace human talent; instead, it will assist your accountants in streamlining trouble spots in payroll, so that they can focus on strategic initiatives.

Yes, AI is not error-proof, which is one of the reasons why it requires human oversight and human analysis of its results. You’ll also need to make sure it is compatible with your existing systems. In the long term, AI will become a natural and integrated part of your team. AI will help reduce talent gaps in your team and improve the employee experience.

Common Mistakes to Avoid When Implementing AI Payroll Software

While implementing AI in payroll, you will come across multiple pitfalls that must be avoided at all costs. These pitfalls are:

- Implementing AI in your payroll systems without proper training for your staff.

- Selecting the wrong payroll software that does not have AI features and cannot integrate with your systems.

- Complete disregard for data security, especially when you are handling your client’s sensitive payroll information.

- You are not updating your payroll processes, assuming that AI will handle everything.

- Lack of human oversight will create problems when tricky payroll issues come into the picture.

Choosing the Right AI Payroll Software for UK Practices

To enjoy the fruits of AI in payroll, you will have to crack the code of choosing the right payroll software for your accounting practice. There are two ways you can get that: buying the AI-enabled payroll software yourself or using the payroll outsourcing services offered by a service provider and gaining access to it. But more on that later, let’s focus on key considerations when choosing payroll software.

Compliance Features

Payroll regulations in the UK are strict and change frequently. Therefore, you will need payroll software that will automatically update itself to stay compliant with HMRC requirements. These changes include tax code changes, pension auto-enrolment, National Insurance rates, among others. By choosing software with good compliance features, your client faces less risk of penalties.

Scalability

As your clients’ demand for payroll services grows, your payroll software will need to handle those demands. An AI-enabled payroll can handle everything from a handful of employees to thousands of clients.

Ease of Use

AI-enabled payroll software is easy to operate, especially the best ones, which have simple dashboards, clear reporting tools, and step-by-step workflows. It becomes easy for your clients to understand who does not have extensive technical knowledge. An easy-to-use software will reduce your training time and help with smoother adoption.

Support and Training

Even with good payroll software, you will need reliable support. You will even realise the importance of getting payroll software services through an accounting outsourcing service provider. The best payroll outsourcing company will provide you with the required support, including training sessions to familiarise your staff with the tool. A provider that offers ongoing support will make the transition much smoother, that’s why multiple companies now prefer outsourcing payroll.

The Future of Payroll: How AI Is Shaping the Industry

AI in payroll is not just a fluke but a long-term trend. In the future, we can expect:

- Real-time payroll updates are accessible via mobile apps.

- AI-driven chatbots to answer client payroll queries instantly.

- Predictive analytics to forecast salary costs and tax liabilities.

- Greater integration with HR and compliance systems.

Only those practices that embrace AI early will be well-positioned to offer innovative payroll services and stay ahead of their competitors.

Frequently Asked Questions (FAQs)

Payroll automation uses software to calculate wages, tax, and National Insurance automatically. AI takes this further by learning from past data and predicting errors before they happen.

Machine learning is a type of AI that allows payroll systems to “learn” from data. For example, it can identify unusual patterns in employee hours or predict compliance risks before they become issues.

AI technology can streamline your payroll operations by automating it. Payroll professionals can finally wave goodbye to long hours spent on data entry, validation and reconciliation. This frees them time to take on a more strategic role.

By 2030, accountants will exceed their traditional role as number crunchers and become data-driven strategists who harness AI and automation to shift financial decision-making.

Conclusion

AI has changed or is changing the way UK accountants work, especially in the area of payroll. AI-enabled payroll software has been successful in reducing errors, quickening the payroll cycle, and ensuring full compliance with HMRC rules. It has helped practices in making time for value-adding advisory services. By leveraging this technology, you can scale up your services, improve your relationship with your clients, and future-proof your practice in a fast-changing accounting industry.

Thinking about getting an AI-enabled payroll software, it’s best not to, because buying and installing it will be your responsibility, which is not easy on your pocket, nor is it simple. The ideal way of getting payroll services within your budget is through an accounting outsourcing service provider, and Corient ticks all the boxes.

Since 2011, Corient has made its mark by being ahead of the curve by incorporating the latest tech, tools, and procedures to keep its accounting services compliant and future-proof. Results are there to see how we enhanced payroll processing accuracy and achieved significant cost savings (case study)—interested in our services? Get hold of our contact form and fill in your details, we will connect with you and address your challenges.